US Mergers and Acquisitions

Post on: 22 Июль, 2015 No Comment

More mergers and acquisitions take place in the USA than in any other country in the world. Real estate, finance and insurance are among the top sectors in terms of mergers and acquisitions in the USA. In the USA large firms are more likely to undergo mergers or acquisitions than smaller firms. US mergers and acquisitions have a major impact on jobs and employment.

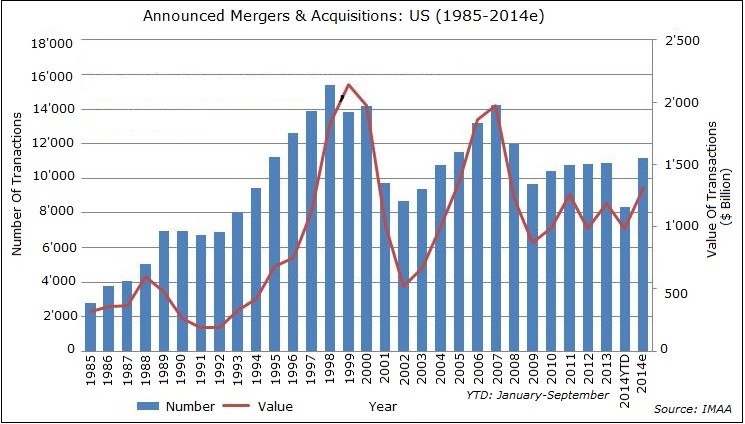

Mergers and acquisitions have been higher in USA than any other country in the world. In the 1990s mergers and acquisitions in the United States of America accelerated rapidly. The effects of mergers and acquisitions on the jobs and business and on the overall US economy have been substantial. Takeovers and mergers of record values, unmatched in any other country have taken place in various sectors United States of America. Mergers and acquisitions have not been uniform across all industries in the USA. In the 1990s majority of the mergers and acquisitions in took place in real estate, finance and insurance sectors. An average of 6.4% firms in these sectors were merged or acquired during the period 1990-1994. The industries with high employment that had undergone high rate of mergers and acquisitions included banks, hospitals, restaurants and grocery stores. Almost 25% of the employees in these sectors found themselves working under new employers during this period due to mergers and acquisitions. More than 4000 establishments in these sectors were acquired during this period.

A total of almost 100000 firms were merged or taken over in the first half of the 1990s. Large firms in the US are more likely to undergo mergers or acquisitions than smaller firms. The value of mergers and acquisitions in larger firms has expectedly been much higher. It has been observed that only 1.6% of small firm locations were merged or acquired between 1990 and 1994. Large firms preferred to merge with or acquire other large firms. Small firms also acquired other firms. Such acquisitions were restricted to single units of other small firms.

A major impact of mergers and acquisitions was in terms of employment. Downsizing took place in large firms that were taken over. On the other hand mergers and acquisitions in many sectors led to rapid creation of jobs thus leading to higher employment. Another positive impact was that many employees in small firms found themselves working for large companies as a result of mergers and acquisitions in the United States of America.