Understanding Your Time Horizon Risk Tolerance

Post on: 16 Март, 2015 No Comment

If you spend time reading and writing like I do, you know that there is an all too familiar phrase that is found in a large amount of investment articles: “depending on your risk tolerance and time horizon.”

Any time I read this I wonder why the investing community assumes that the relatively inexperienced investor has any idea what their risk tolerance or time horizon actually is. There are untold thousands of articles floating around with this phrase but very few telling you how to figure it out although it seems that it may be important to know.

In fact, it is important! Before you do anything you have to know both of these. You’ll find that what you believe your answer is to these two questions is rarely the real answer. Have you ever noticed that how you act and how you think don’t always line up?

Risk Tolerance

Your risk tolerance is simply the line where you go from cool, calm, and collected to anxious. Is there a point where maybe people don’t want to be around you because you’re so bent out of shape? For some, rattling their cage takes something pretty extraordinary while others become unglued when a traffic light takes too long to turn. Where on this spectrum do you fall? Remember, it’s not about what you think, it’s about how you act.

Second, how do you feel about money? Do you save every penny or do you fancy yourself a gambler? Most likely you’re somewhere in the middle but where would you put yourself? Gamblers have a higher risk tolerance than the more frugal minded people. Gamblers know that there will be big losses and big gains. Frugal people avoid losing or wasting money as much as possible.

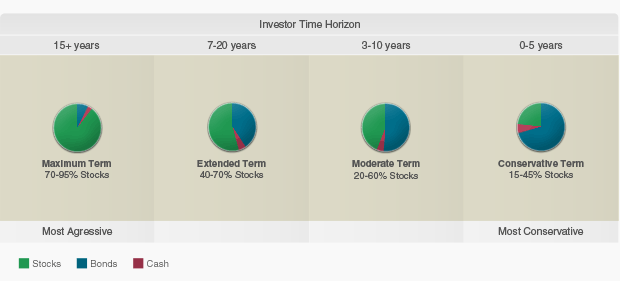

Finally, your risk tolerance is directly related to your time horizon. The older you get the lower your risk tolerance should be regardless of your attitudes. If you’re 55, your risk tolerance should be exceedingly low because your time horizon is short. You may only be a few years away from retirement and don’t have time to make up for losses that come from taking big risks. If you’re 35, your risk tolerance should be quite high because if something bad happens, you have plenty of years to recover.

Want to figure out your investing risk tolerance? Go to Yahoo! Finance and start a virtual stock portfolio and observe how you react to changes in the markets. It’s fake money so it won’t be a perfect representation but if you’re like me when I was first starting out as an investor, you’ll be surprised by your reactions.

Time Horizon

Your time horizon is related to your goals. If you’re 28 years old and want to save for your child’s college fund, your time horizon is 18 to 20 years, or if you started the fund later, possibly much less. If you’re saving for a down payment on a home, your time horizon may only be a few years. Retirement savings could be 30 or more years.

This is what those articles mean when they say, “depending on your time horizon”. A high yielding corporate bond that pays 2% interest isn’t going to be helpful for somebody who wants large scale capital appreciation over the long term. It is, however, appropriate for somebody who wants to protect their money for an upcoming purchase but doesn’t want it sitting in a nearly zero interest savings account.

Your time horizon is your goal and you shouldn’t do anything until you know your goal. (If your goal is to get rich quickly, change it. That’s not how investing works)

Bottom Line

Don’t blame all of those writers. Many financial professionals have to say that in order to meet compliance regulations but now that you know, take some time and figure out your risk tolerance and your time horizon. Once you do, you’ll read those articles with a much different mindset.