Understanding the role alternative investments play in a portfolio

Post on: 12 Апрель, 2015 No Comment

Alternatives: the basics

This is the second part of a series of posts dedicated to having a conversation with clients about the opportunities and risks associated with investing in alternative assets. Mike Smith kicked off the series by offering insights from Russell’s recent Alternative Investment Survey. He left advisors with three suggestions, the first of which we’ll explore in more detail: understanding the role alternatives play in a portfolio.

What is an Alternative investment?

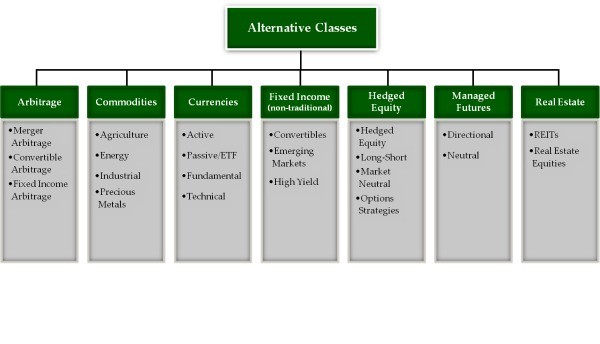

To start, I think we should step back and first define alternatives. You can ask five people in the investment community and it’s likely you will get five different answers to the question: What is an alternative investment? For some, alternative investments equate to hedge funds, for others it includes real assets, frontier markets and emerging market debt and equities.

Alternatives may be a category best defined in terms of what it doesn’t contain. rather than what it does. This asset class encompasses those investments typically found outside of traditional long-only global equities and global fixed income. At Russell, we group alternatives into liquid real assets, alpha-driven investments and private market/illiquid investments. For example, real assets include tangible assets like real estate. infrastructure and commodities. The table below highlights the alternatives market opportunity set as well as some of its unique characteristics.

Most individual investors access alternatives through public/liquid markets (which primarily include real assets and alpha-driven strategies). Individual investors general desire for higher liquidity, higher transparency, lower leverage and lower fees is what the public/liquid markets offer.

Understanding alternative investment market opportunity set, unique characteristics

The role of Alternatives in a portfolio: risk diversifier, return enhancer, or both?

According to Hedge Fund Research Inc. the hedge fund industry has grown from $500B in December 2000 1 to $2.1T in June 2012. 2 What has spurred such tremendous growth in this space and in the broader alternatives asset class? The answer: investors’ desire to diversify risk, manage volatility, and finally, potentially enhance returns. In short, the main driver to including alternatives in a portfolio has been risk diversification .

What makes alternatives attractive in a portfolio context is their their historic low correlation with traditional equities and fixed income. By combining strategies with imperfect correlations you have the potential to reduce risk (i.e. you spread your risk budget across assets that perform differently in a market environment).

Managing volatility has become ever more important to investors after the dramatic ups-and-downs the market has experienced since 2008. Having exposure to alternative strategies can help mitigate volatility because the investment strategies within alternatives are diverse. For example, real asset strategies can potentially help buffer against inflation and provide income. Alpha-driven strategies have historically depended less on systematic market factors and more on manager skill as their primary source of return. Performing thorough due diligence on these managers – not only their investment process but also their operational adequacy, transparency, business solvency has been critical. Diversifying the investment processes and sources of return can help to manage volatility in a portfolio.

Potential increases in return come from the characteristics of the alternatives market that distinguish it from traditional asset classes, namely inefficiency and illiquidity. Because alternatives tend to trade less frequently and with lower volumes, this offers skilled investors the potential to increase returns based on pricing inefficiencies. Inefficiency and illiquidity offer opportunity, but not without additional sources of risk. Understanding the risks inherent in the alternatives market is critical for any investor looking to participate. Each strategy in the alternatives space is subject to its own set of risks, some of which include credit risk, illiquidity risk, optionality, leverage, counterparty risk, and basis spread risk. This list is not exhaustive but offers a starting point to discuss Mikes second suggestion for advisors: educate your clients on the unique characteristics and additional risks in the alternatives space. This will be the focus of our next post.

1 Hedge Fund Research Inc. ; HFR Global Hedge Fund Industry Report – Year End 2011 ©, HFR, Inc.