Understanding the 2008 Housing Market Crisis Investment U

Post on: 23 Июль, 2015 No Comment

by Jason Jenkins Thursday, February 16, 2012

Yesterday, I wrote about securitization and how it revolutionized the mortgage market. Today, I’m going to explain how it ties into the financial crisis…

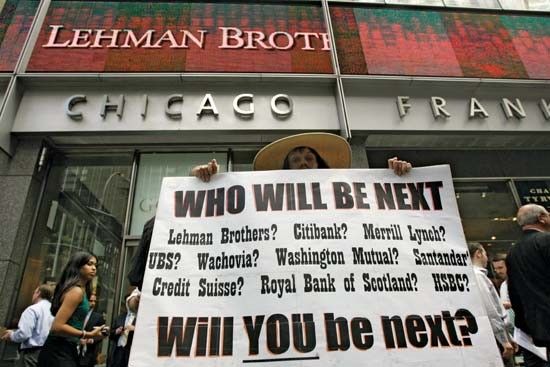

A perfect storm of events led to the meltdown in 2008.

According to the 2009 Congressional testimony by former Federal Reserve Chairman Alan Greenspan, it was the global proliferation of securitized U.S. subprime mortgages that triggered of the current crisis – and a few other things.

Let’s start in the early 1990s, when China created an economy based on exports that helped position it as the current second-largest economy in the world. The savings rate of the developing world soared and went beyond its investment rate. This created a fall in long-term interest rates and an increase in asset prices, in particular house prices.

In the middle of this evolving phenomena, we had September 11, 2001 and the burst of the dot-com bubble. These events left us in a great deal of economic pain with the need for solution.

So, the Federal Reserve cut interest rates to record lows. The real estate market reaped the benefits from the move and became the driving financial vehicle in the economy.

And Then There Was Deregulation

The passage of the Financial Services Modernization Act of 1999, also known as the Gramm-Leach-Bliley Act, removed sections of the Banking Act of 1933, also known as the Glass-Steagall Act. Glass-Steagall had separated banks, insurance companies and securities firms.

It required bankers to decide either to be commercial banks or investment banks. Now that banks didn’t have to decide and could function as both, the general argument is that it opened up the market to an increased amount of risk and conflict of interest because it created giant financial supermarkets.

All of the sudden, you had a decade of global prosperity, low inflation, and low long-term interest rates reduced global risk premiums to historically unsustainably low levels. As asset prices began to rise dramatically, subprime lending became lucrative. The increased investment in subprime mortgage backed securities by government sponsored entities (GSE), such as Fannie Mae and Freddie Mac added to the investment frenzy.

Everybody Needs a Home

Included in this mix of events was the warm and fuzzy feeling of the American dream – everybody needs a home. There was increased pressure for minority homeownership. Legislation and subsequent changes to the Community Reinvestment Act of 1977 encouraged commercial banks to lend to low-income households.

Other programs, such as NeighborWorks America, established by President G.W. Bush, set goals of increasing minority home ownership by at least 5.5 million by 2010. Although this push for greater homeownership wasn’t directly meant to create more loans specifically for securitized investment, it did encourage under-writing standards to decrease.

The System Becomes Broken

To keep this economic momentum. loans were being pooled together and securitized that were derived from products that would ensure loans approval – what the industry called alternative mortgage products (AMPs)

These alternative mortgage products produced loans that are characterized as bad or toxic assets because they created a scenario where the borrower maintained very little, if any, equity in the property. These AMPs include “Interest-Only” loans, “Optional Adjustable Rate Mortgage” loans or Option ARMs, and NINA (No Income No Asset) loans, or loans that were approved with limited information from the borrower and whole lot more creative agreements.

Borrowers could defer repayment of principal, and sometimes part of the interest, for several years, some may eventually face payment increases large enough to be described as payment shock. The payment shock felt by borrowers created an increased risk of loan defaults and risks to creditors.

The real estate market was to never have a downturn, but it did. In 2007, the system broke where too many people walked away from responsibilities and financial institutions were left with a balance sheet of assets they could not even value.

And this is how something good for the economy can all of the sudden become the worst thing for it.