Understanding Investment Diversification

Post on: 4 Июнь, 2015 No Comment

Understanding Investment Diversification

“Diversification is a time-honored investment principle” (Gibson, 2004). Early documentation of diversification may be traced back as far as 1200 BC, where the Jewish Talmud preached that “every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve” (Gibson, 2004). People have recognized, from an early stage, the benefits of risk spreading brought upon by diversification; even if that was at an intuitive level. And as the world continues to take on varying forms, as a result of changes brought upon by one generation inheriting it from the next, part of what remains constant across time, is that “investors want high returns, [all the while not incurring] risk in securing those returns” (Gibson, 2004).

But why do investors want returns in the first place? And what risks are they trying to avoid? In answering these questions, we must first establish that when investing in any asset, an investor is taking on a certain level of risk. This degree of risk, may be divided into two parts: systematic and non-systematic. The systematic portion is association with market risk, and is ingrained in each asset; meaning it cannot be diversified away. As for the unsystematic risk portion, this type of risk is asset specific. Unsystematic risk is the amount of possible deviation between the expected and actual return on an asset. The higher the possible deviation, the higher the unsystematic risk. As a result of the risk investors take when giving up their capital to invest in a given asset, they expect to be compensated. Naturally, the higher the associated risk, the higher the compensation; or in other words, the expected returns.

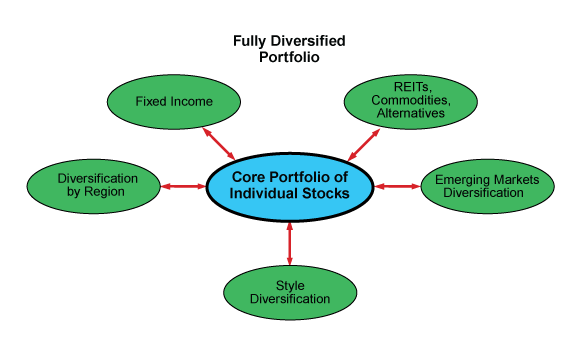

Diversification, refers to the selection and investing in various assets, so as to spread the risks associated with investing in each asset. Since each asset inherently contains the same market risks, that is systematic risk, then diversification “could be conceptualized as a reduction in unsystematic risk” (Hight, 2010). The selection criteria for the assets when achieving diversification, includes [but not limited to]:

Geographic location [i.e. different international markets]

Industry [i.e different industry types]

Asset type [i.e. Bonds, stocks, treasury bills, etc].

The relationship between the returns of the different assets [also known as correlation]

So up until this point, we have determined that:

> Any type of asset bares some form of risk [systematic and non-systematic]

> Investors, whom are giving up their capital to invest in assets, want returns to be compensated for the risk they are baring. Preferably, the investors want as high a return as possible; and as low a risk as possible.

> What diversification does effectively is spread an investor’s capital across a portfolio of assets, reducing the “risks that bear no compensation” (Wagner and Lau, 1971). Generally, the “more securities in a portfolio, the greater the likelihood that sufficient good fortune will appear to balance off the bad fortune” (Sharpe, 1995). This gives the investor the benefit of higher predictability when if comes to the expected return on investment. Diversification facilities for less investment volatility.

But so far, this discussion has only tackled diversification from a very theoretical point of view. In the real world, certain impediments exist, as to lessen the benefits gained from diversification. Such hurdles include:

> Markets are not as uniform as mathematical formulas make them to be. the diversification process relies on formulas and probabilities [such as the quadratic formula and normal distribution] that provide good approximations of the expected asset returns. Also, these formulas rely on data input that is based on sample historical data; as it would be too costly and difficult to take into account all of the historical data. Thus, given that formulas are not exact, and the underlying data is only a partial set, a lot of estimation error is introduced.

> Returns are not symmetric. what diversification aims to achieve, is to create a portfolio of assets, where the correlation between the different assets is low; as when one asset goes down, the other goes up. But “paradoxically, [the correlations of] well-diversified portfolios tend to increase during crisis situations, reducing the effectiveness of diversification when it is needed most” (Levy and Post, p.237, 2005).

> The diversification effect has become less due to globalization. lower costs in information and capital accessibility, has had the effect of increasing the correlation between the various markets. This dampened the diversification effect, as “economic events in one part of the world affect markets on the other side of the globe” (Gibson, 2004)

> Limited possibility sets due to regulations. investors may have to adhere to certain rules and regulations when it comes to investing; for example: a set percentage limit in investing in a given asset type, or investing in only environmentally friendly companies. Such restrictions, whether enforced or voluntary, end up reducing the diversification effect as the number of investment options [the possibility set] shrinks.

> Market timing. a lot of underlying variables in the diversification formulas must be ‘tweaked’ to reflect the best diversification strategy. But such tweaking is highly dependent on the market conditions, and thus timing is crucial. Yet, since we still do not have a way to tell how future events may unfold, market timing is at best a guess-timate!

> The human factor. steering away from all the mathematics and number crunching, there are some human elements that cannot be capturing by formulas, such as: what defines an acceptable risk level? what defines an acceptable return for a given risk level? etc. Each person may answer these questions different, and as such, a given diversification strategy/formula may not apply to everyone.

Warren Buffett once said, diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing. But then again, diversification does have some merits, so as long as its effectiveness is not over estimated. It has been proven that as more assets are included in the diversified portfolio, the marginal benefits diminish quickly. Thus wide-diversification is essentially harmful to the investor. This theme extends to all types of investments, regardless of the underlying asset. For example, in the real estate business, “marginal risk reduction from expanding into more cities diminishes quickly, making the choice of staying geographically concentrated a sensible portfolio strategy” (Ping and Roulac, 2007). Effectively, it might be best if one utilizes a more focus-diversified strategy.

Youssef Aboul-Naja