Understanding Cost In Real Estate Investment

Post on: 14 Июнь, 2015 No Comment

I have been talking quite a bit to real estate investors who are anxious to start working their way back into real estate investments but want to make sure they go about it in a safe manner. Many have read my blog on How To Invest In Real Estate Safely and have wanted more examples. Quite often, they are in the buy and flip mentality, so I have to work with them to understand that buy and flip is a business, not just a real estate investment .

Most of my clients who invest in real estate want to do so in a passive manner. They are doctors, lawyers, business people, school teachers, retirees, police officers, etc. They do not want to be actively working in the Tallahassee real estate market. It is for this reason that I encourage a long-term hold mentality, where market cycles come, and market cycles go, and it has no real impact on the long-term focus, which is maximizing ROI (return on investment).

Supply And Demand Matter In Real Estate

The first thing a real estate investor needs to understand is that supply and demand rule this market, just as it does in any other commodities market. When demand is high and supply is low, prices go up. When the converse is true, prices go down. Not rocket science, but we do to remember these simple rules of market theory do apply.

Understanding Cost In Real Estate Investment

One way to evaluate real estate is called the cost approach. All this method looks at is how much money one would require to rebuild the property (or to produce another one) if it were needed. [IMPORTANT NOTE. Cost approach has no bearing on market value if supply and demand are in an imbalance.]

Cost is important to know because over the long haul, the market is always seeking cost as the normalized value level. When supply drops and prices rise to and above cost, producers bring more homes to the market to sell at a profit. When supply rises and homes cannot be built and sold at a profit, produces quit building homes. Simple. Just like other markets with a supply and demand dynamic.

So, understanding cost, real estate investors know when to buy real estate and when to sell real estate. When properties are selling below what it costs to replace them, there is great upside potential if one considers the local market viable for the long-term. Investors can grow their portfolio carefully, selecting properties below the cost to replace and ones that have the highest probability of long-term positive cash flows.

When properties are selling at or near cost, it is a great time to hold real estate and enjoy the benefit of growing cash flows. This is the reason that real estate is a long-term investment, because properties appreciate at a rate that usually beats inflation, thus a position in real estate provides not only cash flow benefits, but also the potential for long-term equity growth.

When properties are selling well above cost (which happens very rarely), the market goes into a production frenzy such as we saw in 2004 through 2006. People couldnt build homes quick enough for the misunderstood demand in the market. This is a good time to sell, should it ever happen again.

Real Estate Investment Example

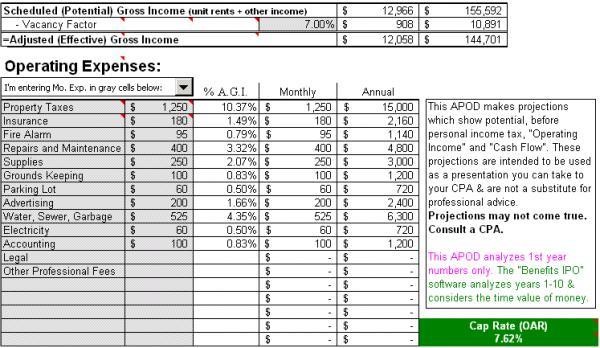

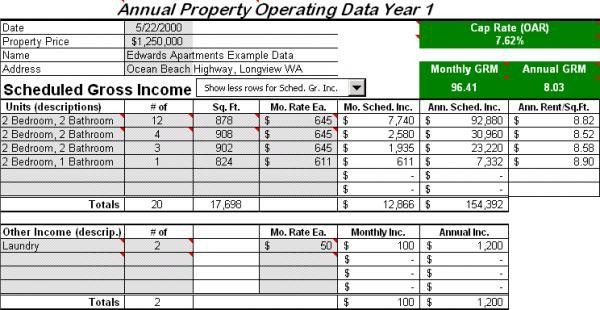

In order to estimate the ROI (return on investment) one would receive in an investment in todays real estate market. we have to create an investment proforma that is based on some long-term assumptions. I will list the assumptions that I used for this example so if the reader disagrees with any assumptions, please comment below and we will revise the model if needed.

My thinking is that our market is currently in a glut situation with supply, and that glut is going to be growing before it begins shrinking. Property values are dropping and will continue to drop until we see supply levels low enough to require future production. In a nutshell, we know that property values will not return to an appreciation mode until the population in Tallahassee grows large enough to consume the current supply of homes for sale in Tallahassee. as well as the current shadow inventory of homes in Tallahassee.

Ultimately, that means to do a fairly accurate job in our proforma, we must estimate the future population growth in Tallahassee. In the past this has always been easy, because Tallahassee has historically grown at a rate between 1 and 2% each year. But last year, Floridas population fell, and Tallahassee stayed basically the same (dropped by 68 people or so). The Capital Region grew by several thousand people, which I believe means that people who might normally have moved to Tallahassee were drawn to value opportunities in our surrounding counties (Wakulla County specifically).

Real Estate Investment Assumptions :

- Population growth will be minimal for the next few years

- Housing supply will be enhanced by distressed properties that must be flushed through the market

- Home construction levels will remain at historically low levels for the next five years

- Home values will fall for the next 3 to 5 years at the following rates

- Supply and demand will achieve a healthy balance in 7 yo 10 years

- Home values will race towards cost after 7 years

- Home values will appreciate at 4% after 10 years (historic rate of growth)

- Cost of materials is going up (sticks, bricks, labor)

- Cost of land is going down (supply and demand)

When you take all the above into consideration, you get a simple table as you see on the right.

So, if you agree with my assumptions, then we conclude with the following rationale. There are many properties that can be purchased today and over the next few years that can be acquired below the cost of reproducing them. But once supply and demand get back in balance. values will race toward the cost of replacement (see 2017 in the table above right). So what does that mean for an investor

Lets say we find a home that was selling in the $90K range a few years ago and buy it for $40K. Why is it selling for so low? For sellers who have to leave the market due to larger financial problems, they have to drop their price so low as to pull investors into the market. Investors have left our market due to the gross oversupply of homes, but can be enticed when homes are selling at less than 1/2 the cost of replacement.

So, lets say we purchase a 1,000 square foot home for $40K. in an area with way too much supply. We rent it out for very little (or even negative cash flow) until the market regains its balance (through population growth and the reduction of supply of homes for sale and rent). Using the table above, you can see how the snap back to cost basis has a huge affect on our compounded appreciation rate.

Wise Real Estate Investment

Understanding the huge impact that our return to growth will have, a wise investor can acquire holdings of properties that have low trade value right now. They will hold these properties which will not seem to make sense during the the market recovery, but once Tallahassee needs more homes, it is inevitable that their values will return to what it would cost to replace them.

This analysis is incomplete, as it does not consider the holding costs and the potential benefits and downfalls of bringing leverage into the equation. In order to do so in this analysis, my morning blog would have become my all day blog and I suspect most readers had a hard enough time making it this far (testare you still reading :)).

But a full analysis is what we do for our investor clients, and potential investors should require a full analysis from their real estate professional. After one is done, you should pick apart the entire assumptions set to make sure that you believe the analysis is conservative enough for your risk posture. If you would like to know more about investing in real estate, please let us know and we would be happy to work with you.