Types of Investments Risk Returns

Post on: 25 Апрель, 2015 No Comment

Stock Investments

Investing in the stock market involves considerable risk. An investor has no assurance of making money. Stocks are therefore high risk investments. In exchange for assuming a higher level of risk an investor has higher potential to make money. Risk can be defined as volatility. Stocks are volatile, prices increase or decrease in the market on a daily basis. Investors can mitigate the risk of stock investment through diversification. Diversification involves investing in multiple investments, reducing the risk of a single investment’s loss. Stocks are long term investments; their volatility reduces the likelihood of gain in the short term.

Government Bonds

Government bonds are bonds issued by the United States government or by states or municipalities. Bonds issued by the U.S. government are considered to be very safe investments. The risk factors are the same for government and corporate bonds; however, credit risk is lower for government bonds than for corporate bonds. Government bonds generally pay lower rates of interest than corporate bonds. The likelihood of default is also lower due to lower credit risk.

Money Market Investments

References

Resources

More Like This

How to Measure Return on Investment

Long-term Debt Instruments

What Are 403(b) Retirement Plans?

You May Also Like

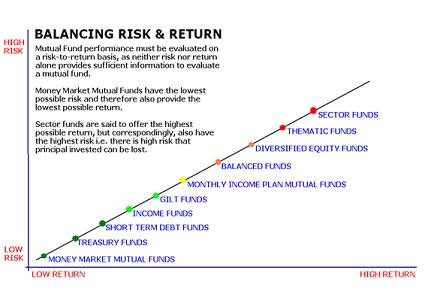

A basic investment philosophy is that you generally must take more risk to achieve higher returns. However, that doesn't guarantee that your.

There are various types of investments. Investments are, essentially, items or assets that have values that are bought for either capital or.

The best types of investment depend on a number of variables, including an investor's age, time horizon, goals, risk tolerance and investment.

The best type of investment will depend on on the risk profile of the person and the increased cash flow of the.

Types of Personal Investments. The term investment refers to many different things. For some, personal investments refer to retirement accounts while others.

Mutual funds that hold stocks, bonds or both carry some degree of risk, which means that you can lose money in any.

Types of Risk Premium. It is commonly accepted that when an individual takes on risks in investing he expects a financial return.

The concept of financial risk and return is an important aspect of a financial manager's core responsibilities within a business. Generally, the.

Types of Investment Returns. In the world of investing, there are many methods for collecting investment returns. Labeled and organized by the.

The number of types of investments there are varies, depending on which website you go to and on whom you talk to.

There are many types of investments for individuals, including real estate, stocks, bonds, certificates of deposit, options and futures. Know your risk.

Investing can result in significant profits. In today's economy, investments protect your money from inflation and other such maladies. Before investing, do.

Investment Objectives & Risks of a Unit Trust. Unit investment trusts represent an interesting opportunity for investors to grow their money. A.

A smart business person knows the importance of doing regular return on investment (ROI) calculations. It is a way to measure the.