Traditional Intangible Assets Valuation Techniques

Post on: 13 Май, 2015 No Comment

An excerpt from Chapter 4 of The Intangible Assets Handbook

By Weston Anson

Traditionally, the methods used to value intangibles have some elements in common with those used to value tangible assets such as real estate. An important difference in most cases, though, is in the availability of the necessary data, such as finding comparable transactions or relevant historical financial information. Often, comparable transactions or benchmark information needed to establish a logical and intellectually sound basis for the valuation conclusions of intangible assets are unavailable.

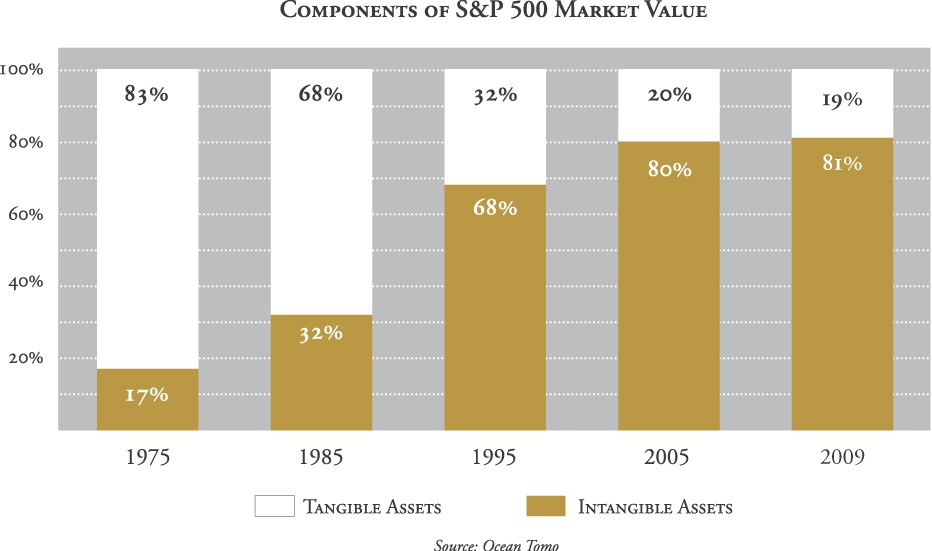

In the last two decades, the intangible asset valuation practice field has grown dramatically. Traditionally, four different methodologies have been used to value assets, whether for transaction, tax or litigation purposes; in a going-concern valuation or in liquidation. We also present herein a fifth method that is frequently used for technology valuation.

The Cost Approach

The Cost Approach is based on the economic principle of substitution. Essentially, the premise is that potential buyers will pay no more for an asset than it would cost them to develop or obtain that same asset or an asset with similar utility in other cases. The Cost Approach seeks to determine the value of intangible assets by aggregating the costs involved in their development. On the face of it, this may seem fairly straightforward. However, there is more involved in the process than simply adding up the receipts for expenditures associated with the intangibles. Indeed, there are two distinct Cost Approach methods: Reproduction Cost and Replacement Cost.

“Reproduction Cost” measures the level of expenditures necessary to reproduce the exact same asset. It is appropriate in situations such as litigation involving specific patents or when return on investment needs to be measured. Alternatively, the “Replacement Cost” method measures the expenditures necessary to develop an asset with similar utility and is appropriate in situations such as determining a target price prior to negotiations or calculating a basis for suitable royalty rates or transfer pricing.

An important requirement for both methods is that the costs not be determined in accordance with the historical expenditures that actually took place. Instead, the necessary expenditures and costs to replace or reproduce the asset should be determined as of the valuation date. For example, many factors relevant to the asset’s development may have once been proprietary, but are now in the public domain, and could therefore be acquired at a much lower cost than was actually included initially. Also, research methods may have improved in the interim, to the point where only half of the historical research time is needed to accomplish the same achievements, and this also would affect the value of the asset

The costs included when calculating value with this approach must be considered within the appropriate economic environment. Only the expenditures necessary in relation to the environment in existence on the valuation date should be included. Remember that the appropriate valuation date may be current or it may be a historical date, and costs would be estimated as of that date. When using an historical date, it is crucial to utilize the necessary expenditures related to that date, and not rely on the actual levels of any expenditures made prior to that date.

The impact of this requirement is twofold. If the cost of any of the relevant components has changed since the initial expenditure, the current cost needs to be utilized in the calculations. This will account for any inflation or deflation that has occurred. Also, any developments during the interim that would materially impact the development process need to be factored in as well. For example, an invention that took a team of ten researchers to develop may only take a team of four now.

All costs encountered during development of an intangible should not be included, only those necessary to duplicate the asset or produce an asset of similar utility. Typically, these consist of both direct expenditures and opportunity costs. The direct expenditures will include items such as materials needed in the development process, labor costs, and some overhead items. One must ensure that the salaries, benefits, and other employment costs being attributed to researchers associated with the development effort are based on current practices, not on expenditures from historical efforts.

Overhead and management costs, such as project supervision, utilities, and administrative costs, should be pro-rated to reflect their true level of involvement with the development process. Also, when projecting the timetable needed to develop the assets in question, consideration must be given to the probability of success. Another aspect to remember is the fact that not all expenditures contribute equal value to an intangible asset. For example, it is doubtful that expenditures on Super Bowl ads increased the value of the trademarks and other marketing assets of the brands being advertised anywhere close to the tens of millions of dollars that are spent each year.

Opportunity costs consist of value of the other courses of action and investment opportunities that have been passed on, to pursue the development of the subject assets. Essentially, this analysis should measure the impact of a delayed market entry. In other words, what could be earned during the period of development if the assets were licensed today? Also, whether utilizing the reproduction method or the replacement method in a current or historical environment, the risk of obsolescence needs to be incorporated into the analysis.

The Cost Approach is most useful in cases where there is no economic activity to review, such as early-stage technology that is not yet producing revenue. It also is effective at establishing a maximum price for the asset if the context is a proposed transaction. This situation exists when there are many candidates for substitution available. The main drawback associated with the cost approach is that it does not recognize any economic benefits associated with marketplace activity. For example, there is no mechanism to incorporate revenue or profit data, and it therefore ignores important data by which the value of assets is typically measured. Costs that should be quantified in this analysis include:

- Legal fees

- Application/registration and other fees

- Personnel costs

- Development costs

- Production costs

- Marketing and advertising costs

In any event, the Cost Approach can often (but not always) be looked upon as providing a floor or minimum value for the intangible assets in question. Exhibit IV-1 illustrates how reproduction costs can often be different from historical costs:

REPRODUCTION COST APPROACH