TPA 401(k) recordkeeping platform

Post on: 26 Май, 2015 No Comment

401(k) Recordkeeping Platform for TPAs

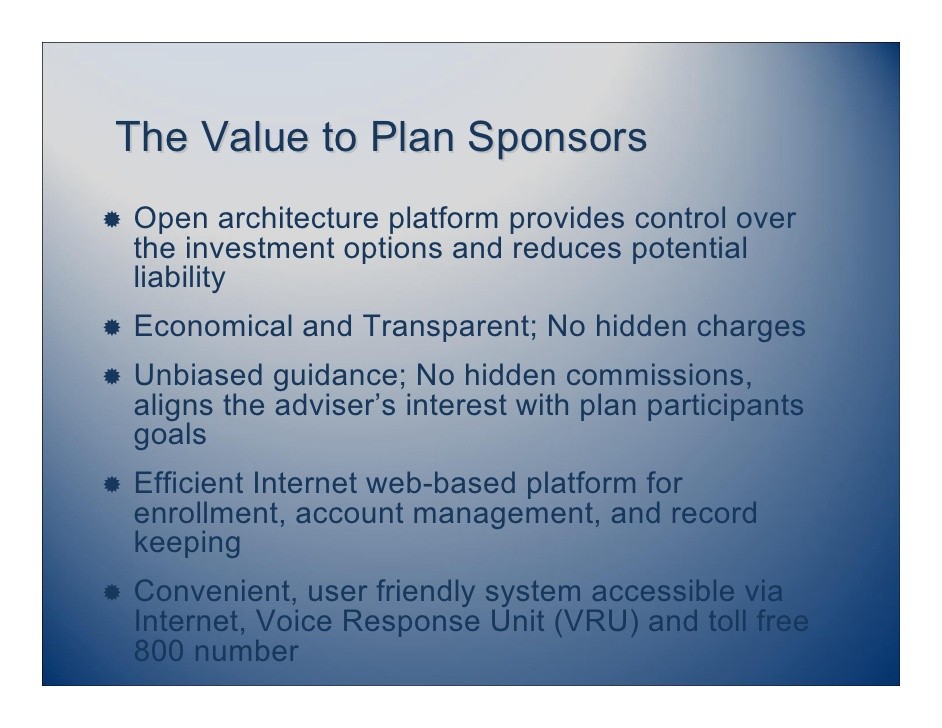

The TPA Direct product is a recordkeeping solution designed for retirement plan third party administrators (TPAs) who are looking for a true open architecture 401(k) platform. Whether you are searching for a new service provider for an existing retirement plan or helping a company build their first 401(k) plan, Lincoln Trust offers services you can rely on to establish and maintain your professional relationships. Our dedication to retirement plan recordkeeping allows you to focus on the continued development of your administration business.

- When comparing retirement plan recordkeepers, the following offerings will likely be high on your “must have” list:

- Investment flexibility

- Full fee transparency

- One-to-one service model

- Participant education

- Managed model capability

Investment flexibility

Lincoln Trust provides you with access to a 401(k) solution with either a pre-selected investment menu that is continually monitored by a third-party investment consultant (the Advantage Plan ), or a unique open architecture 401(k) platform (the Custom Plan ). Our trust and custodial platform features include:

- Availability of institutional share class funds

- Up to 30 investment options in each plan’s lineup

- No proprietary product requirements

- Access to an extensive web-based fund research and reporting tool

The TPA Direct Advantage Plan includes:

- Access to 20+ investment companies

- Pre-selected investment menu of 150 mutual fund options to select for the plan’s lineup, including QDIA eligible investments

- Enhanced diversification, including the availability of such mutual fund asset classes as international fixed income and real estate

- Mutual funds with or without Rule 12b-1 fees

- Investment fiduciary support provided by a third-party investment consultant

The TPA Direct Custom Plan includes:

- A menu of over 24,000 mutual funds from 470+ fund families and over 900 ETFs

- The flexibility to include alternative investments such as private stock

- Managed models that allow plan designated investment advisors to create their own asset allocation portfolios tailored specifically for each plan

- Unitized managed accounts and collective investment funds available through a third-party platform provider

- Third-party self-directed brokerage accounts

Full fee transparency

Beware of the “free” plan! Fee transparency is the way of the future for the retirement plan market because it is the right thing to do for plans and participants. The time has come to be open about administration and recordkeeping costs and let the plan sponsor choose how plan fees should be paid. Lincoln Trust provides full disclosure and fee transparency with our explicit per-participant and asset-based fees. Furthermore, our fee schedule is independent of the investments selected for the plan. Lincoln Trust does not retain Rule 12(b)-1, sub-transfer agency or shareholder servicing fees that are attributable to the plan’s selected mutual fund investments. To the extent applicable, such fees, less a 5% fee charged by the platform provider for collection and processing, will be utilized to offset the plan’s quarterly invoice due to Lincoln Trust.

One-to-one service model

We assign a dedicated relationship manager to you and your plan sponsors. Oftentimes in the small and mid size plan market, both the TPA and plan sponsor are required to call a generic 800 number and speak to a customer service representative. Lincoln Trust provides an experienced relationship manager to you and your clients, regardless of plan or book of business size. Your time is valuable and we recognize that by offering a personalized service experience.

Participant education

Lincoln Trust has participant education services available if your plans need them. For a fee specified in the Fee Schedule, we offer on-site participant education delivered by experienced financial professionals. Along with basic investing information, this service utilizes customized participant enrollment kits including fund fact sheets, plan highlights and performance information. If a plan chooses to perform the education, Lincoln Trust can supply the plan with enrollment materials at no additional charge.

Managed models

Managed models allow an investment advisor that is appointed by the plan sponsor to generate customized risk-based or age-based portfolios for a plan. One of the primary benefits of Lincoln Trust’s managed model solution is the investment advisor’s ability to include funds in a managed model that are not included in the plan’s core fund lineup. Managed models may differentiate producing TPAs from their competition with this highly customized investment feature.

A comprehensive solution

Contact Lincoln Trust for more information on how we can work together to cover the key components of every 401k plan:

Administration

Recordkeeping

Investment fiduciary services (offered by a third-party investment consultant for the TPA Direct Advantage Plan)

Participant education

Contact us

We would love to talk with you about your recordkeeping needs. Contact us at 855.719.5796 or Sales@LincolnTrustCo.com to start a conversation!