Top 5 Most Reliable Candlestick Patterns

Post on: 16 Март, 2015 No Comment

The Five Most Reliable Candlestick Patterns

There is a bewildering array of opinions on the best approaches to candlestick analysis, but not much in the way of objectivity. The field is so arcane and expert opinion so varied, that it might not be surprising if the average trader gave up and went in search of more straightforward trading systems.

In reality, candlestick analysis need not be overwhelming. While there are well over sixty named candlestick patterns, we can make some intelligent guesses about which patterns are likely to be the most reliable. Candlestick analysis generates some of its power from the fact it is widely believed and used by traders. If a certain pattern is commonly believed to be bullish, then traders utilizing candlestick analysis are more likely to buy upon spotting it, thereby increasing the likelihood that the price will increase. For this reason, it is reasonable to assume that the most widely recognized and unambiguous patterns are likely to be the most reliable.

Based on an investigation of the popular literature, the following five patterns appear most likely to be recognized and acted on by the technical trading community.

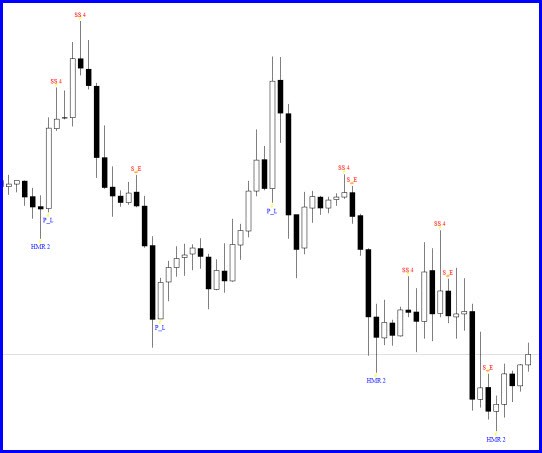

Engulfing Patterns

The Bullish Engulfing pattern consists of a short black bodied candlestick (indicating a moderate decline) followed by a taller white candlestick, where the body starts below and ends above that of the black candlestick. In financial terms, prices on the second day open lower than the first day’s close and end higher than the first days open. As the name suggests, a Bullish Engulfing Pattern is a strongly bullish signal which suggests that it is time to buy.

The Bearish Engulfing pattern is simply the opposite the Bullish engulfing pattern. It features a modest price gain followed by and engulfing price drop. Unsurprisingly, this is a bearish signal, which suggests that it is time to establish a short position.

Hammer/Shooting Star Patterns

The Hammer and Shooting Star patterns comprise short candles with one long wick. The usual interpretation of the Hammer pattern, which is a short white candlestick on top of a long wick, is that sellers held sway during part of the day and pushed the price low, but buying pressure predominated at the end leading to a close that was also the day’s high. This is generally a very bullish signal. The Shooting Star pattern is simply the mirror image of the Hammer and is considered to be extremely bearish for similar reasons.

Harami Patterns

Superficially similar to the Engulfing patterns, Harami patterns are in fact opposite combinations with very different interpretations. A Bullish Harami pattern consists of a long black candlestick with a close near the daily low, followed by a short white candlestick. The interpretation is that while the bears were in clear control of the market on the first day, selling momentum halted on the second day, which in turn suggests that rally may be in the offing. A Bearish Harami is again the mirror image configuration and has the exact opposite interpretation.