Think you can’t access frontier markets Try these ETFs and funds

Post on: 16 Март, 2015 No Comment

Investors who heeded the call of Jim O’Neill, now chairman of Goldman Sachs Asset Management, to move into the BRIC markets (frontier markets weren’t even a twinkle in an anlysts’ eye then) during the last decade were richly rewarded.

Santiago,

The combined MSCI index for Brazil, Russia, India and China returned an impressive 15.39% annually in the 10 years to May 2010.

Brazil was the most profitable market with an 18.24% yearly return, China the relative laggard at 11.70%. That still swamped the MSCI USA index, which offered a paltry 0.86% increase per year, and the MSCI EAFE benchmark of developed foreign markets, which maintained a 2.48% growth pace.

The BRICs have cooled off substantially since 2010 of course. Now O’Neill suggests looking further afield into so-called frontier markets, which may be starting the period of steep growth that the emerging market giants experienced after 2000.

Mark Mobius, manager from mutual fund provider Franklin Templeton who was an early emerging markets guru, also talks up frontier markets investing in his recent book, Passport to Profits.

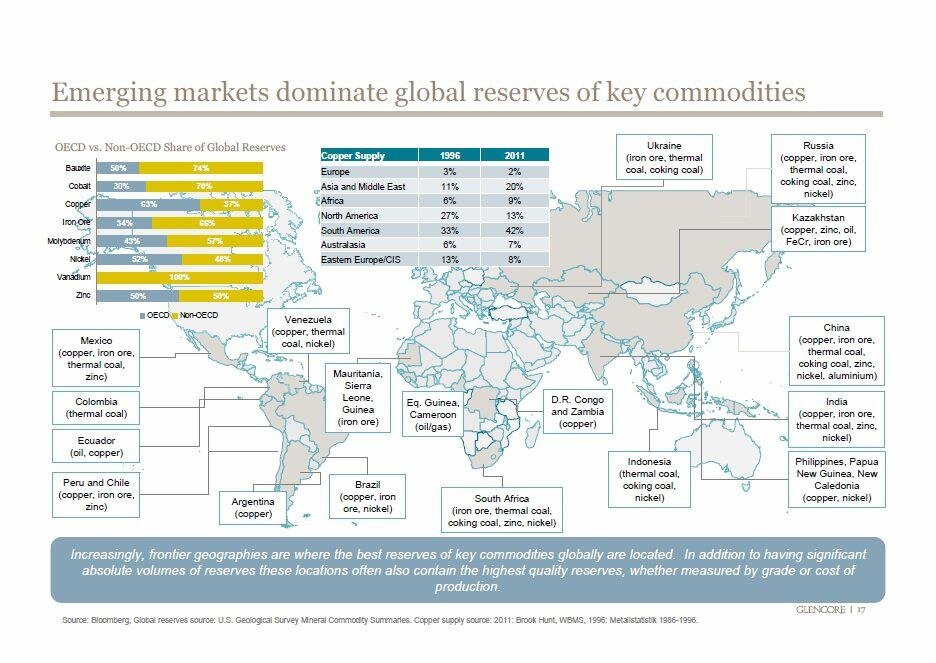

It’s fine to theorize that markets like Jamaica, Kazakhstan, or Oman are ready to come into their own as drivers of global economic growth. But the armchair investor needs to know how to get a piece of them that they can also get out of when the time comes to sell. A growing number of ETFs and funds offer a liquid way in.

The Claymore/BNY Mellon Frontier Markets ETF ( FRN. quote ) provides exposure to, among others, Egypt, Colombia, Kazakhstan, Chile, Poland, Lebanon, Peru, and Oman. It slightly outperformed the iShares MSCI Emerging Markets Index ( EEM. quote ) over the past year, losing a mere 16.1% instead of 16.9%

The Market Vectors Africa ETF ( AFK. quote ) offers access to markets across the continent including Nigeria, Morocco and Egypt. Twelve-month performance is 15.5%

The PowerShares MENA Frontier Countries ETF ( PMNA. quote ) holdings focus on the Middle East, including Kuwait, Jordan, the United Arab Emirates, Morocco, and Oman. It lost 15.4% over the past year.

The Morgan Stanley Frontier Emerging Markets Fund ( FFD. quote ) is a closed-end mutual fund that invests in exotic markets globally. The Middle East and Asia, but also Jamaica, Trinidad & Tobago, Bulgaria, and the Ukraine. It is a relative star, having declined by a mere 12.8% over the past year.

Many country specific ETFs are also springing up for frontier markets, for example the Market Vectors Vietnam fund ( VNM. quote ).

A prominent traditional mutual fund investing in frontier markets is Templeton Frontier Markets A ( TFMAX. quote ). This is managed by the celebrated Mobius, but beware of fees.

TFMAX has a 5.75% sales charge when you buy it. This compares quite unfavorably with the nominal commission you’ll pay to buy ETFs through a discount broker. TFMAX also has annual expenses of 2.08%, which also compares unfavorably with the ETFs, whose maximum expense ratio is .83%. The extra cost may be worth it. It currently doesn’t look like it though, judging by the past year. Mobius’ performance — off 12.9%, is similar to that of Morgan Stanley’s closed-end fund, though far better than any of the passively managed ETFs’.