These May Be The Best Of Times for Individual Traders

Post on: 23 Август, 2015 No Comment

23. Jun, 2014 Comments Off

The raging debate on high frequency trading generated by Michael Lewis’ controversial bestseller “Flash Boys: A Wall Street Revolt” may lead the average retail investor to think that he/she continues to get a raw deal in a stock market increasingly dominated by institutions and hedge funds. Coming as it does on the heels of scandals like the ones surrounding the fixing of benchmark rates for LIBOR and foreign exchange, the controversy may reinforce the impression that financial markets are rigged and unfair. Though there will doubtless always be areas of the market that are relatively inefficient or not the fairest of forums for individual investors, the reality is that these are probably the best of times for them. Here are five reasons why:

1.Transaction costs are the lowest ever:

Transaction costs have two major components – commission costs and trading spreads. The surging popularity of online brokerages from the late-1990s onwards has driven commission costs relentlessly lower, to the point where it has become routine to trade hundreds of shares for a dollar commission in the single digits. As for trading spreads, the advent of “decimalization” since April 2001 for U.S. equities has resulted in one-cent spreads for the most liquid stocks, rather than 1/16th of a dollar ($.0.625) which was the minimum spread prior to 2001. The dramatic decline in transaction costs since the 1990s generates significant savings for investors and enables them to retain a bigger proportion of their trading gains. It also allows them to manage their portfolios more actively, since high trading costs are no longer a deterrent.

2.Plethora of investment choices:

Investors currently have no shortage of investment choices, thanks to the pace of innovation in financial products in recent years. Investors can now invest in most categories of financial assets, even obscure ones and investments that were formerly not available to them – currencies, commodities, foreign markets, real estate, options, hedge funds and so on. Most of these investment choices are available through exchange-traded funds (ETFs), the market for which has grown tremendously in this millennium. Global ETF assets as of October 2013 amounted to $2.3 trillion, of which over 70% comprised U.S. ETF assets. On the derivatives side, the introduction of special options such as mini-options and weekly options gives investors more tools for hedging and speculation. Overall, investors now have a much wider range of investment choices than they did even a few years ago, and the sheer number of these choices continues to expand.

3.The Information Age:

With investors now having access to a vast repository of market information, the days when the only sources of information were brokers and other market professionals are long gone. Most companies now promptly upload on their websites a wealth of valuable information such as their quarterly results, financial statements, corporate presentations, and even transcripts or recordings of conference calls with analysts. Online portals like EDGAR in the U.S. and SEDAR in Canada give investors access to other information such as prospectuses and corporate filings. Then there are blogs and micro-blog services like Twitter that often beat newswires to the punch in terms of breaking news. Plus the thousands of websites on stocks and markets that can be accessed by investors at no charge with a mere mouse-click. Lack of timely information is no longer a handicap for the individual investor.

4.Better regulation:

One consequence of the two savage bear markets in this millennium has been better regulation to protect the small investor. Widespread accounting irregularities and “tainted research” – whereby analysts published glowing reports on dot-com companies that they privately disparaged – were two features of the 2000-02 “tech wreck.” In its aftermath, Sarbanes-Oxley legislation was enacted to improve corporate governance, while new regulations were also introduced to preserve the independence of investment research. Similarly, the LIBOR and forex rate-fixing scandals erupted as a result of financial institutions excessive risk-taking coming under the spotlight after the 2008-09 bear market.

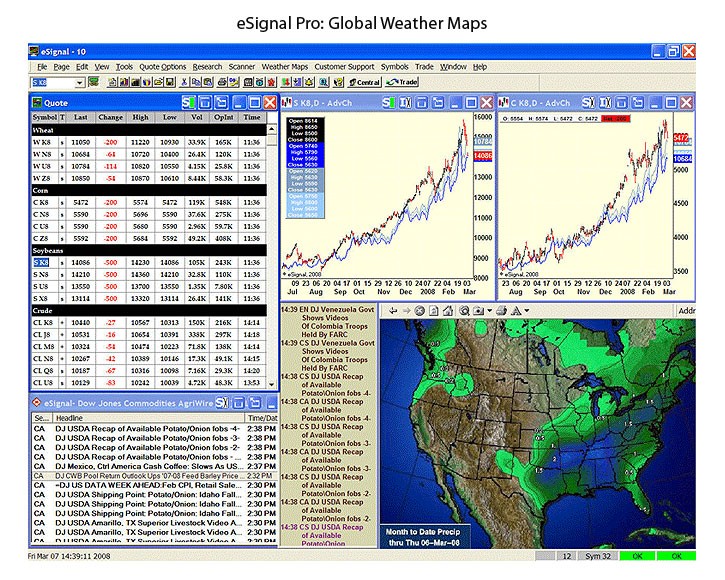

5.More tools for the DIY investor:

Plenty of tools exist for the do-it-yourself investor, ranging from trading simulators and technical analysis charting services to free educational sites (like this one) and portfolio management software. These tools can range from free basic ones to sophisticated suites that can cost a packet, depending on one’s requirements. The availability of these tools can greatly enhance learning of investment concepts and help one become a better investor.

The Bottom Line

Record low transaction costs, a wide range of investment choices, access to timely information, better regulation, and more DIY tools – for individual investors, these are the best of times, despite the debate on high frequency trading and recent price-fixing scandals.