The Woodlands TX Real Estate Advisor Oil Prices Jobs and Real Estate

Post on: 10 Август, 2015 No Comment

October 30, 2014

Its been an interesting four days. On Sunday I picked up the Houston Chronicle to see a front page story that asked the question How Long can Houstons Boom Hold Out? with obvious reference to the oil bust of the 1980s that was so devastating to Houston and its economy. This was followed by another front page story Tuesday entitled Report Warns $70 Oil Likely. And finally, yesterday Chris Tomlinson ran a story entitled Theres a Silver Lining for the Oil Industry in Lower Crude Prices.

Clearly, oil and energy have been major drivers of the Houston/Woodlands economies in recent years; and jobs that this industry has provided have both attracted people to our communities and allowed employees to buy homes, thereby driving the real estate markets. So today I thought it would be interesting to examine more closely the real effect of oil prices on real estate in the Greater Houston Area.

Before we get started, its necessary to understand that there are actually two prices of oil that are quoted by news organizations; and we need to be sure we understand which one is being referred to in any given discussion. The two prices are tied to what are called benchmark crudes, which are Brent and West Texas Intermediate (WTI) .

Brent crude is a major trading classification of sweet (i.e. low sulfur) light crude oil that is produced in the North Sea and serves as a major benchmark price for purchases of oil worldwide. West Texas Intermediate, as the name implies, is produced in Texas and is also a light sweet crude.

So there is no obvious difference between the two in terms of properties; and up through 2010, there was essentially no difference in terms of price. However, in 2011 the price differential began to diverge as shown in the graph above, differing by as much as $27/barrel in late 2011 and vacillating wildly in subsequent years. Click on the graph for a larger view. What caused this difference; and why is it important?

The answer is very positive and supports the concept that the Houston economy is in good shape. It turns out that the point of settlement (delivery point for contracts) for WTI is Cushing, OK; and in late 2011 production of U. S. crude from shale formations had risen to the point that the Cushing pipelines were essentially full, providing what was in effect an oversupply (glut) and driving down the price. While this might on the surface seem to be a bad thing, the fact that the production of crude oil in the U.S. had reversed a decline that had begun in 1970 was viewed as a major positive. Today the United States produces over 8.5 million barrels per day (MMBBL/D) and in 2014 overtook Saudi Arabia as the worlds leading producer of oil.

The Effect of Crude Prices on Jobs

High crude oil prices have fueled innovation and economic growth during the past four to five years; and companies in Houston large and small are actively engaged in ramping up exploration and production. This, in turn, has fueled the need to expand refineries and chemical plants on the Gulf Coast as exemplified by the fact that ExxonMobil, Lyondellbasell and Dow Chemical are all increasing capacities in their ethane cracking units to produce more ethylene from the ethane being supplied from the Eagle Ford Shale. The ExxonMobil plant expansion alone was touted as creating 4,000 permanent jobs.

Amid all of this exuberation, Goldman-Sachs came out with a report on Sunday slashing its forecast for crude prices in 2015 and raising the question about an oil bust in Houston. Heres why I dont believe that will happen:

- Houston is much more diversified than it was in the 1980s. While very important, the oil and gas sector is but one part of the Houston economy; and other areas such as healthcare and commercial real estate account for a large percentage of Houstons half trillion dollar economy, which grew at a rate of 5.2% (net of inflation) in 2013 and was the fastest growing of the nations 50 largest metropolitan areas according to a report by the Greater Houston Partnership earlier this month. Remember that I mentioned on Tuesday that healthcare in The Woodlands ranked second only to oil and gas in jobs produced.

- Costs of producing oil and gas from shale plays are going down. According to the Chronicles Chris Tomlinson, Long-term operators, in the Eagle Ford especially, are reducing incremental costs with every new piece of infrastructure. Both well density and production are going up.

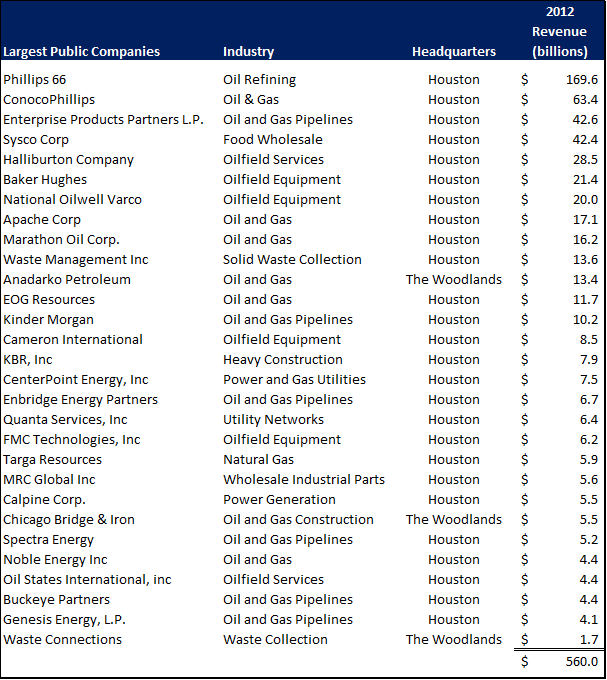

- Houston oil and gas companies can weather a brief oil price reduction. Houston is headquarters to some of the largest oil and gas firms in the world as shown in the table below. These companies had $560 billion dollars in revenue worldwide in 2013 according to their annual reports. Their plans are made for long-term operation and do not change on a monthly or daily basis.