The US Follows Japan Into A Balance Sheet Recession What Do Investors Know and Why Is It That

Post on: 4 Июль, 2015 No Comment

BoomBustBlogger and Director of Research at Paisley Financial. Mario Ricchio, writes on the abject futility of QE during a balance sheet recession. That is where I, and he, believe the US and Japan are right now. See my video take on this from a real estate perspective here. You can download Mr. Ricchio’s report via this link. but in the mean time I would like to highlight some of the not so common sense remarks that I came across in such.

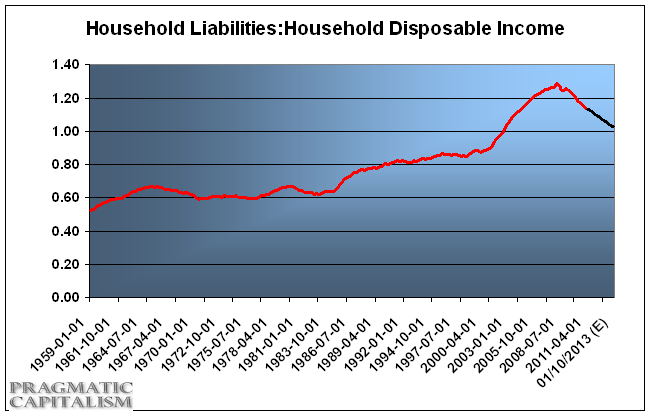

When the U.S housing bubble burst, the effects reached far beyond the decline in home prices and in construction-related employment. The nature of the economic landscape changed. As home values began their descent in 2006 against a backdrop of record mortgage debt, household net worth plunged primarily through a loss of home equity (see exhibit 1). Consumer attitudes shifted from conspicuous consumption to frugality. After several decades of leveraging up the balance sheet and living beyond their means, households started the process of deleveraging characterized by: debt minimization and reduction, increased personal savings, and lower consumption (see exhibit 2). The balance sheet recession commenced and how we look at the economic cycle must change.

THE PRECURSOR TO A BALANCE SHEET RECESSION

A debt-financed asset bubble precedes a balance sheet recession. Consequently, we begin by paraphrasing the thoughts of legendary hedge fund manager, Ray Dalio, on the cycle leading up to the collapse. A healthy economic expansion starts with a private sector (corporate or household) agent holding minimal debt. The private sector begins to see income rise at the pace of GDP. At this stage of the economic expansion, the majority of aggregate demand comes from cash-based income.

For example, let’s assume the private sector spends $1,000 of cash income (which contributes to the economy); now someone else has $1,000 of income. As the economy expands, the private sector feels more optimistic and decides to leverage up the balance sheet by going to the bank and borrowing $100 per year against $1,000 of income.

FEATURES OF A BALANCE SHEET RECESSION

Since asset prices decline (eg. house prices) well below the value of corresponding liabilities (eg. mortgages), balance sheets become impaired (eg. negative equity or negative net worth). In order to repair balance sheets, the private sector moves away from profit maximization to debt minimization2. The deleveraging cycle ends up reducing funding needs. Unfortunately, with no borrowers, the economy loses aggregate demand equivalent to the sum of un-borrowed savings and debt repayment3. Even in a zero interest rate environment, the private sector refrains from taking on added liabilities (see exhibit 3). This outcome renders monetary policy ineffective by creating a liquidity trap.

On this very salient point, I must chime in with my own analysis and opinion.