The Ups and Downs for Prospect Capital Corp (NASDAQ PSEC) in 2015

Post on: 14 Июнь, 2015 No Comment

2014 was a rough year for Prospect Capital Corp. (NASDAQ:PSEC). The share prices went down by 27%, and investors lost about 15% due to reinvested dividend for adjustment. With a new year starting, let’s see what is in store for Prospect Capital Corp. (NASDAQ:PSEC)

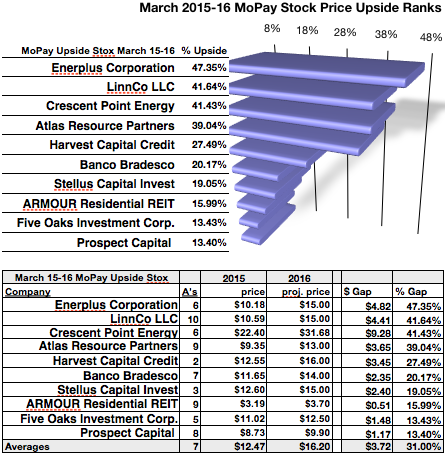

The upside for a deeply depressed stock price is that a simple reversion of mean can bring huge returns. Currently, the shares are trading around 22% discount compared to its $10.47 per share value of net asset which was reported previously. If stocks trade on the book value, it would give investors a net return of 28%. On top of that, the reduction in dividend done recently is now sustainable.

The dividends are now reduced to $0.0833 each share per month for Prospect Capital Corp. (NASDAQ: PSEC), and it is the belief of the company that it can keep up with income from net investment, with an assumption that it can generate $0.01 for other income every quarter.

Prospect Capital Corp. (NASDAQ:PSEC) has a few moves in its bag for creating new incomes and making higher share prices. As far as the income is concerned, company plans to rotate its investment which is low yielding and reinvesting it to higher yields. The company calculated 600 million dollars in assets which yielded less than 8 percent on balance sheet. If investments are swapped, assets would yield 4% more and that would seal the gap of 0.01 dollars. Moreover, the company believes that spinoffs are a source of value creation. The company’s portfolio consists of small-business load and peer-to-peer consumers, collateralized debt and assets of real estate, all these can spun off into separate different businesses.

As Prospect Capital Corp. (NASDAQ:PSEC) is managed externally, the managers takes more fee from its shareholders as the base of assets grows. The incentive is growth encouragement; even when the growth is not for the best interest of its shareholders. It has the highest fee than any other company that is externally managed. Looking at this in long term plans, this fee will have an impact on its performance which is one reason for its discount trading for its peers.

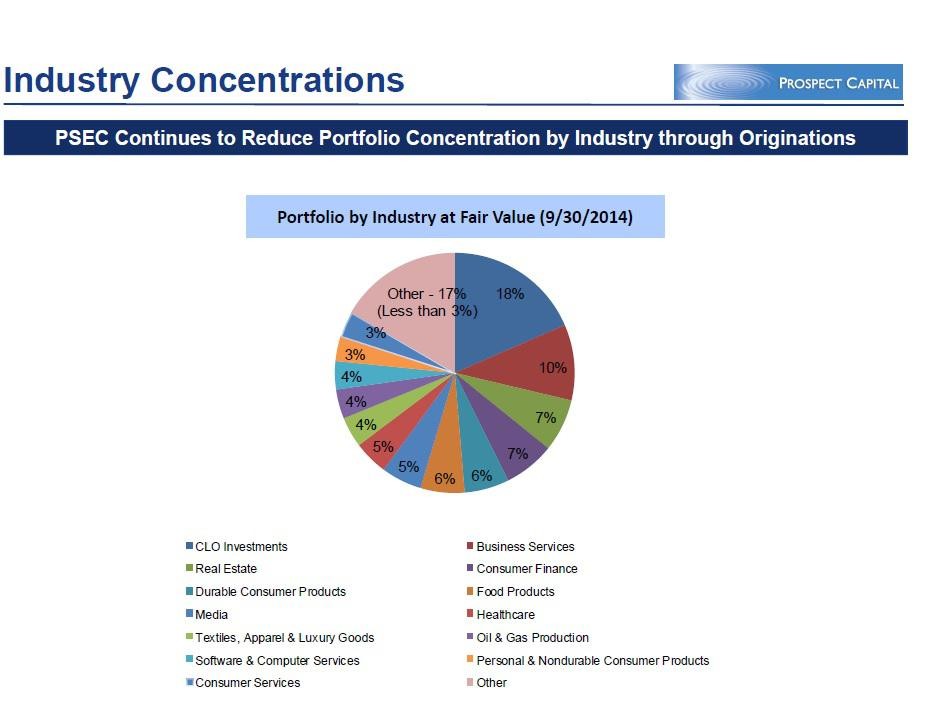

The recent markdowns of the company suggest that more losses are yet to come to its asset value. Prospect Capital Corp. (NASDAQ:PSEC) sold some of its investment of loan obligation on loss even despite the fact that they were being carried out at a premium towards the end of the last quarter. CLO equity makes 18 percent of the company’s portfolio on September 30 th. 2014. Recent quarterly results show that there are markdowns on some controlled investments, even with sizable movements.

It also made high markdowns on United State Environmental Services which is one its portfolio companies. More markdown could be witnessed as the price cuts in gas and oil sector making the spending cut. It is believed that the right time to buy the stocks of this company is when it is trading on discount for its net assets, and Prospect Capital Corp. (NASDAQ:PSEC) trades on substantial discount.