The Types Of Mortgage Backed Securities Finance Essay

Post on: 13 Август, 2015 No Comment

Mortgage-backed securities also called as MBS is a type of asset-backed security which is secured by collection of mortgages or a mortgage. These securities must be grouped in one of the top 2 ratings as determined by an accredited credit rating agency and usually pay periodic payments that are similar to coupon payments. MBS allows small regional bank to lend mortgages to its customers without having to worry about whether the customer have the assets to cover the loan. Bank here acts as a middleman between the home buyer and the investment markets. An MBS is a derivative, because its value is derived from the underlying asset.

This document talks about MBSs market in United States. The USA MBSs provides a large pool of liquid, high-credit fixed-income securities with attractive yield spreads over US Treasuries.

In USA, majority of MBSs are issued by the Government National Mortgage Association ( will be referred as Ginnie Mae from now on), a U.S. government agency, or the Federal National Mortgage Association (will be referred as Fannie Mae from now on) and the Federal Home Loan Mortgage Corporation (will be referred as Freddie Mac from now on), U.S. government-sponsored enterprises. Ginnie Mae, backed by the full faith and credit of the U.S. government, guarantees that investors receive timely payments. Fannie Mae and Freddie Mac also provide certain guarantees and, while not backed by the full faith and credit of the U.S. government, have special authority to borrow from the U.S. Treasury. Some private institutions, such as brokerage firms, banks, and homebuilders, also securitize mortgages, known as private-label mortgage securities.

Mechanics of Mortgage-backed Securities

As a first mechanic, a bank or mortgage company makes a home loan. The bank or mortgage company then sells that loan to a quasi-governmental agency like Fannie Mae, Freddie Mac or Ginnie Mae or an investment bank. They in turn bundle a lot of loans with similar interest rates. They then sell a security that delivers the same payments that the bundle of loans do. That’s the MBS, which is a security backed by the mortgage. The MBS is sold to institutional, corporate or individual investors on the secondary market.

The MBSs sold by the governmental agencies were particularly attractive, because the returns were guaranteed by these agencies, which were themselves backed by the Federal government. Therefore, those who bought a Fannie Mae or Freddie Mac MBS knew they would get something in return for their investment. Ginnie Mae absolutely guaranteed that investors would receive their payments.

Types of Mortgage-backed securities:

These investments can be very complicated. The most basic are called pass-through participation certificates. They simply pay the holder their fair share of both principal and interest payments made on the mortgage bundle.

As banks tried to create more investment products, they came up with the more complicated collaterized mortgage obligations or mortgage derivatives. These sliced up the bundles into similar risk categories, known as tranches. The least risky tranche would only contain the first 1-3 years of payments, since borrowers are most likely to pay the first three years. However, for adjustable-rate mortgages, these years also have the lowest interest rates. Therefore, some investors may prefer a tranche that contains the next 5-7 years of payments. They’re willing to take the higher risk of non-payment for the higher interest rate reward.

The greatest risk with MBSs is that the borrowers may not pay. If the borrower prepays the mortgage because they refinance, then the investor gets the initial investment back. However, people usually refinance when interest rates are low, so the investor doesn’t have many attractive alternatives. The worse risk is when the borrower defaults altogether. Then the investor takes a loss.

Mortgage-backed security sub-types include:

Pass-through securities are issued by a trust and allocate the cash flows from the underlying pool to the securities holders on a pro rata basis. A trust that issues pass-through certificates are taxed under the grantor trust rules of the Internal Revenue Code. In order for the issuer to be recognized as a trust for tax purposes, there can be no significant power under the trust agreement to change the composition of the asset pool or otherwise to reinvest payments received, and the trust must have, with limited exceptions, only a single class of ownership interests.

A RMBS (residential mortgage-backed security) is a pass-through MBS backed by mortgages on residential property.

A CMBS (commercial mortgage-backed security) is a pass-through MBS backed by mortgages on commercial property.

A Pay-through bond” or collateralized mortgage obligation are debt obligations of a legal entity that is collateralized by the assets it owns. Pay-through bonds are typically divided into classes that have different maturities and different priorities for the receipt of principal and in some case of interest.

A SMBS (stripped mortgage-backed security) where each mortgage payment is partly used to pay down the loan’s principal and partly used to pay the interest on it. These two components can be separated to create SMBS’s.

There are two types of classifications based on the issuer of the security:

Government or Agency, issued securities, by government-sponsored enterprise issuers such as Fannie Mae, Freddie Mac, and Ginnie Mae.

Private-label, Non-agency, securities, by non-governmental issuers such as trusts and other special purpose entities like Real Estate Mortgage Investment Conduits.

Role of Mortgage-backed Securities in US Economy

The key to the development of MBSs was the realization that individual loans, hammered out by a banker and a homebuyer, could be transformed into what were in effect financial commodities.

The model was the bonds issued by large companies and governments. Investors who put up money to buy bonds are promised repayment at specified times; that amounts to being promised a share of a stream of revenue delivered by the borrower. When many mortgages are pooled together, the monthly payments from homeowners add up to a comparable revenue stream.

The banks and other lenders who originate mortgages are generally happy to sell them because they can use the proceeds to make more loans right away, rather than waiting for payments to dribble in each month. The companies that pool the mortgages together then sell pieces of the revenue stream to investors eager for a predictable return.

The invention of mortgage-backed securities completely revolutionized the housing, banking and mortgage business in US. At first, mortgage-backed securities allowed more people to buy homes. Many less careful banks and mortgage companies made loans with no money down during the real estate boom, thus allowing people to get into mortgages they really couldn’t afford. The lenders didn’t care as much, because they knew they could sell the loans, and not pay the consequences when and if the borrowers defaulted. This has created an asset bubble, which then burst in 2006 with the subprime mortgage crisis. Since so many investors, pension funds and financial institutions owned mortgage-backed securities; everyone took losses, and this lead to 2008 financial crisis.

Discussion of players, their profiles and objectives in the Market

Growth in the MBS markets has been significant over the past 20 years. For example, single-family MBS grew from less than $367 billion outstanding in 1981 to more than $3.3 trillion outstanding at the end of 2001, an 800% increase. During this period, MBS have evolved, as have the standard disclosures made to investors. In order to understand the reasons for evaluating disclosure practices in the MBS markets, it is helpful to understand the development and operation of the MBS markets.

The MBS markets consist primarily of the MBS issued or guaranteed by two government-sponsored enterprises, Fannie Mae and Freddie Mac, and one United States-owned corporation, Ginnie Mae. MBS are also issued by private-label issuers, which are private institutions. The GSEs and Ginnie Mae guarantee payments on their respective MBS, whereas private-label issuers use various forms of credit enhancement.

Government sponsored enterprises (GSEs) — Fannie Mae and Freddie Mac — as well as a wholly-owned federal government corporation — the Government National Mortgage Association (Ginnie Mae) — played a major role in creating the MBS markets and today remain the largest issuers. Privately owned financial institutions have become increasingly important as issuers in the so-called private-label market. The MBS markets are estimated to have grown by more than 800% in the past two decades. During this time, the structure of MBS vehicles or products — whether issued by the GSEs, by Ginnie Mae, or by private-label issuers — has evolved and become significantly more complex. MBS investors continue to be almost exclusively institutional, but their expressed needs have changed with the evolving market and economic conditions. In recent years, investors have focused much more time, attention and resources on the evaluation of prepayment risk and, in the case of private label MBS, credit risk.

The most commonly issued MBS are pass-through securities, which consist almost entirely of GSE and Ginnie Mae MBS, and REMICs, which are the primary security issued by private-label issuers. The MBS investor base has evolved, but remains largely institutional. The most important risks in the MBS market are prepayment risk and credit risk. Investors perceive these risks differently depending on whether the issuer (or guarantor) is a GSE, Ginnie Mae, or private-label issuer, due to the different underlying mortgage loans and credit structures. This section includes a discussion of how these players drive disclosures in the MBS markets.

A. Issuers

Fannie Mae, Freddie Mac, and Ginnie Mae were all created by federal law to address perceived deficiencies in the U.S. housing finance market. The statutory purposes of the GSEs and Ginnie Mae are to facilitate a secondary market for residential mortgage loans and to enhance liquidity in such loans. The GSEs and Ginnie Mae enhance liquidity by enabling lenders and originators to sell their mortgage loans and use the proceeds from the sales to make new mortgage loans.

Fannie Mae was originally authorized only to buy FHA insured loans. After being split into two entities in 1968, Fannie Mae and Ginnie Mae, Fannie Mae was authorized to buy a broader range of loans. Freddie Mac was initially authorized to purchase conventional mortgages from federally insured financial institutions. Both Fannie Mae and Freddie Mac are now investor owned companies, and the common stock of both companies is traded on the New York Stock Exchange.

OFHEO was established in 1992 as an independent entity within the United States Department of Housing and Urban Development by the Federal Housing Enterprises Financial Safety and Soundness Act of 1992. OFHEO’s primary mission is ensuring the capital adequacy and financial safety and soundness of Fannie Mae and Freddie Mac.

Ginnie Mae does not buy or sell loans or issue MBS; instead, it guarantees payment on MBS that are backed by federally insured or guaranteed loans, mostly loans insured by the FHA and guaranteed by the Department of Veterans Affairs (the VA). Other guarantors or insurers of loans eligible as collateral for Ginnie Mae MBS include other offices in the Department of Housing and Urban Development (HUD), and the Department of Agriculture’s Rural Housing Service. Ginnie Mae is a wholly-owned government corporation under the auspices of HUD.

Private-label issuers include commercial banks, savings associations, mortgage companies, investment banking firms and other entities that acquire and package mortgage loans for resale as MBS.

B. MBS Investors

The types of investors in MBS have changed over time. Initially the primary purchasers of MBS were thrift institutions, insurance companies, commercial banks, pension funds, and mutual funds. More recently Fannie Mae, Freddie Mac, and international institutions have also become much more active market participants.8 The investor base remains overwhelmingly institutional. Investments in MBS are made for a variety of reasons. Some investors purchase MBS to hold long-term in portfolios while others purchase for short term trading purposes. MBS are also widely used for hedging purposes. Much of the development of GSE, Ginnie Mae, and private-label MBS markets has been in direct response to investor interests and demands

Recent Trends in the Market

The ability to create mortgage-backed securities was authorized by the 1968 Charter Act which created Fannie Mae. The intent was to allow banks to sell off mortgages, thus freeing up funds to lend to many homeowners. The founders of this didn’t anticipate that this would also remove an important discipline for good lending practices. Banks then realized that they wouldn’t be around to take the loss if the borrower didn’t pay off the loan. The banks got paid for making the loan, but didn’t get hurt if the loan went bad. Therefore, they weren’t as careful about the credit-worthiness of the borrower.

MBSs allowed financial institutions other than banks to enter the mortgage business. Before MBSs, only banks had large enough deposits to make long-term loans. They had the deep pockets to wait patiently until these loans were repaid 15 or 30 years later. The invention of MBSs meant that lenders got their cash back right away from investors on the secondary market. Mortgage lenders sprang up everywhere, and they also were not too careful about who they lent to. This created additional competition for traditional banks, who had to lower their standards to keep the loan volume up.

MBSs were not regulated. Traditionally, banks had been highly regulated by governmental agencies to make sure their borrowers were protected. MBSs, and mortgage brokers, were not.

In 2008, the United States tottered on the brink of financial disaster. Unemployment looked to reach its highest levels in two decades. Homeowners defaulted on their loans in record numbers. Enormous investment banks that had been in business for more than a century and had endured the Great Depression faced collapse. The economy, in other words, was circling the drain. And all of it, every last part of this looming economic disaster, was due to a unique financial instrument called the mortgage-backed security.

Mortgage-backed securities have played a prominent role in the wave of financial litigation emanating from the economic downtown. As the number of lawsuits continues to drastically increase, so do the complicated legal questions regarding the viability of claims that investors and insurers can bring against those who structured and sold these derivative instruments

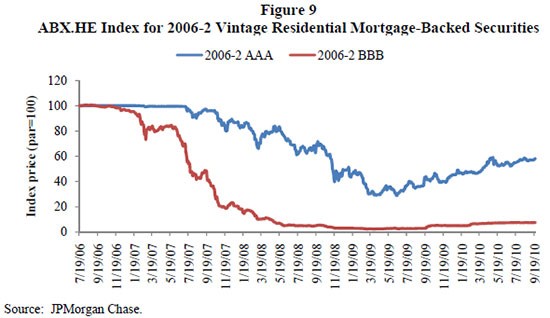

Two governmental reports released this past year confirmed that the issuance and securitization of risky residential mortgage loans were critical factors in causing and fueling the financial crisis. The risks associated with these toxic loans were passed on to investors worldwide when they purchased the resulting “RMBS” (residential mortgage-backed securities) in reliance on misleading offering materials and inflated credit ratings.

Investors lost billions when the loans defaulted in massive quantities.

To recover their losses, investors began filing lawsuits in 2008 against the banks that sold RMBS or originated, acquired, and securitized the underlying mortgage loans. As more evidence of underwriting violations emerged, lawsuits increased. This past year saw a surge in RMBS lawsuits by large, well-known investors, such as Allstate Insurance Co. American International Group, Massachusetts Mutual Life Insurance Company, the National Credit Union Administration Board, and the Federal Housing Finance Agency, as receiver for Fannie Mae and Freddie Mac. These lawsuits and others have resulted in the issuance of a number of opinions by courts that have defined the parameters for RMBS litigation.

Conclusions

While the recently high degree of uncertainty remains very much intact, the Fed’s decision to specifically target Mortgage-Backed-Securities in a third round of Quantitative easing provides a supportive undertone for mortgage rates. It is still advocate not trying to get too far ahead markets. In other words, we would not guess how low or how high rates might go before changing course. Rates remain near all time lows and risks of volatility remain high. Those factors suggest that we stay vigilant regarding the day-to-day swings in mortgage rates. If you’re floating, set a limit as to how high rates would have to go before you cut your losses and locked. Similarly, set a target of how low rates would have to get before you lock