The top 35 MBAs for getting a job in hedge funds private equity and asset management

Post on: 16 Март, 2015 No Comment

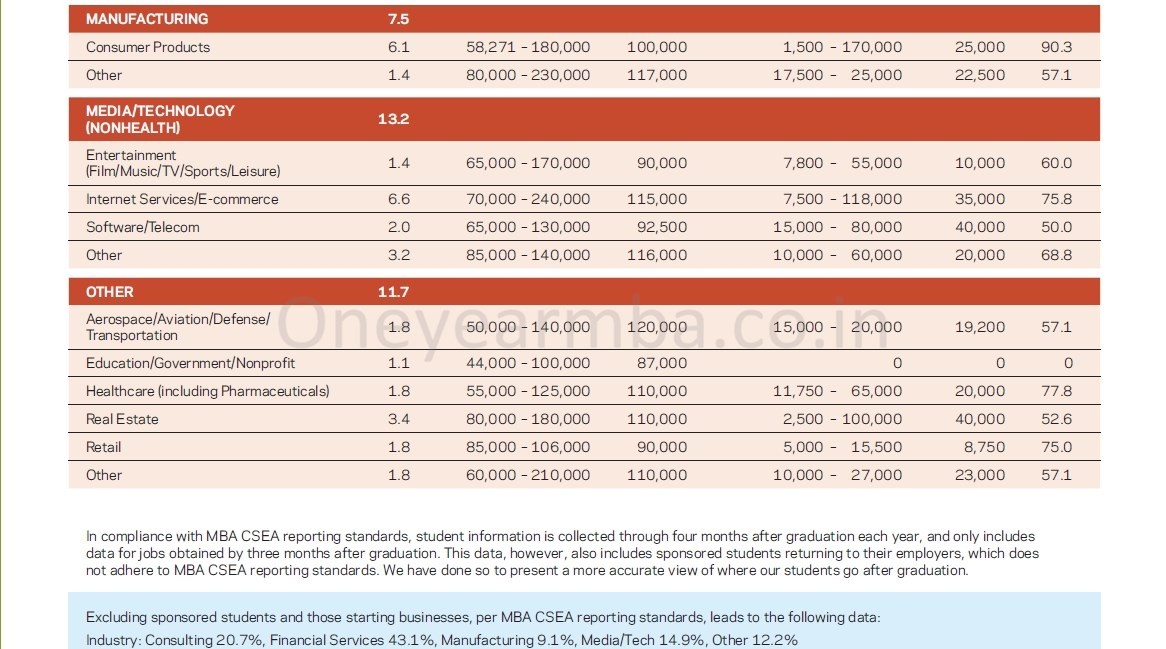

MBAs with ambitions to work in the financial sector still have more opportunities available to them in investment banking than elsewhere. However, it’s private equity and hedge funds where the biggest packages are dangled in front of business school graduates, while asset managers recruiting MBAs offer much greater job security .

Our research into the best MBAs for breaking into investment banking showed a dominance of the large U.S. business schools. This is not surprising – while banks in EMEA and Asia have focused more on recruiting at a graduate level and training in-house, banks in the U.S. have maintained their traditional focus on hiring from Ivy League business schools.

However, taking a look at the best business schools for getting a job in private equity, hedge funds and asset management paints a decidedly more mixed picture. Across all three sectors, our research suggests that London Business School graduates have the best chance of securing a role, while the University of Oxford: Saïd, INSEAD and Bocconi are all in the top ten.

U.S. financial services stalwarts Columbia, New York Stern, Harvard and Wharton also feature in the top ten, although their dominance on the buy-side does not match that in the investment banking sector.

The figures used for our rankings are taken directly from the people listed on the eFinancialCareers CV database, which comprises 1.2m resumes globally, who have MBAs from these particular schools and have gone on to work in either hedge funds, private equity firms or asset managers.

Hedge funds, our research suggests, do not recruit many MBAs, with only a small percentage of graduates from any school making it into a role in the sector. Only last week Citi CEO Michael Corbat told a classful of MBAs that there weren’t enough seats in either private equity or hedge funds to hire all of those with ambitions to work in the sector.

Our rankings reflect the relative difficulty of securing a hedge fund and private equity job – a greater weighting is given to the percentage of graduates working in hedge funds, followed by those who have gained a job in private equity and finally asset management, which are more active recruiters of MBAs directly from school.

We’ve ranked the schools on this weighting for getting a job in each sector, combined this figure with the overall proportion of people working across asset management, hedge funds and private equity and given each school a score based on their MBAs’ employability.

Again, like our MSc in Finance rankings. we don’t claim that these are perfect – as they don’t include earning potential, career progression or the total number of students finding jobs immediately after graduation – but they do show the number of people graduating from these schools and going on to get a job in private equity, hedge funds and asset management.

Related articles: