The Tax Advantages of Municipal Bonds

Post on: 19 Июль, 2015 No Comment

Municipal bonds offer some of the best tax advantages of any kind of investment. If you’re looking for tax-free growth or consistent income, municipal bonds are a one stop shop!

What are Municipal Bonds?

Municipal bonds are essentially pieces of municipal debt that are bought and sold by investors. A city, township, county, or state may issue a municipal bond as a way to finance a large purchase today against future revenue.

A municipal bond may be issued for virtually any kind of large project. This may include a new public swimming pool, a new stadium, or maybe just new roads and sewers. Sometimes, municipal debt may even be issued to replace older, higher interest municipal debt issues.

Municipal Bonds and Taxation

Municipal bonds offer taxation benefits that are unmatched by any other bond. As a standard, all income from municipal bonds or municipal bond funds. is tax-free at the federal level, and it may also be tax free at the state level as well.

A few states allow tax-free municipal bond income, regardless of where the bond was purchased. Several other states offer tax-free earnings on municipal bonds if the municipal bonds or municipal bond funds are being used to finance a project in a state in which you reside. For example, an investor who resides in Albany, New York may purchase a New York City municipal bond and collect disbursements that are tax-free at the state and federal level.

Gaming the System

The type of municipal debt you purchase, as well as the method you use to invest (straight municipal bonds or municipal bond funds), can have a dramatic impact on your year-end tax burden.

Many investors who live in states that offer tax-free gains on locally purchased bonds would be best to buy municipal bonds directly with the help of a broker from the city or locality that is currently issuing bonds. This process, though requiring a larger out of pocket investment than municipal bond funds, ensures every bit of the annual income is entirely tax-free at the state and local level.

In other areas where municipal bonds are tax-exempt, regardless of issuing locality, municipal bond funds may prove to be a better and more diversified way to gain exposure to municipal debt.

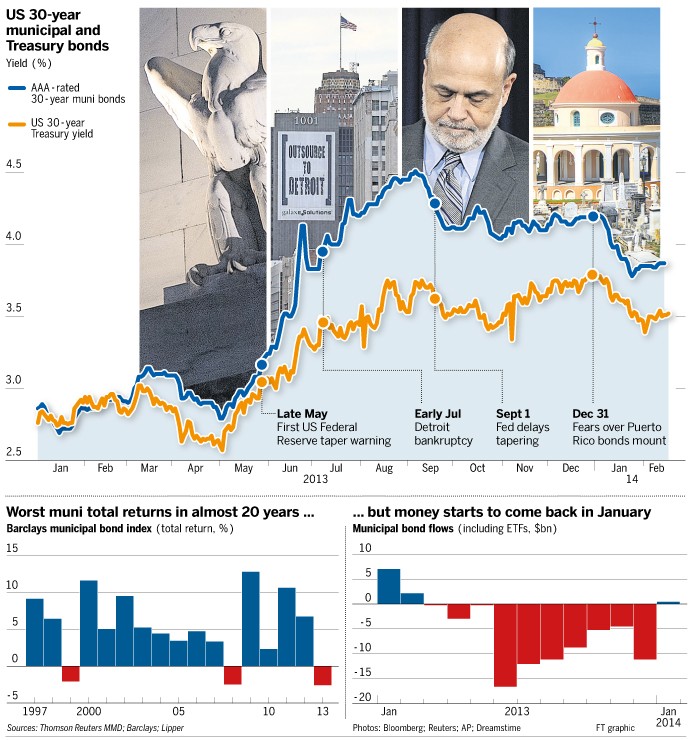

Keep in mind that municipal debt is backed by the full faith and credit of the city and its ability to tax its citizenry to pay for the future burden. Cities that are already plagued by high taxes may make for a bad investment, since there is little opportunity for future municipal revenue growth to cover the interest expense.

Likewise, when buying municipal bonds. it is important to know exactly where local revenue is derived. For example, most recently in California, a number of small cities ran into financial issues when local real estate prices plummeted and property tax revenue followed.

Go Municipal

There is a reason why most fixed income investors choose municipal debt over other debt obligations. The simplicity, tax-exempt status, and generally rewarding yields make them the perfect investment for any portfolio. In addition, since only a few municipalities have ever failed to make good on their obligations, investors know their money is safe.