The Short Sale Process

Post on: 11 Июль, 2015 No Comment

Short Sale

In a short sale, the lender allows the owner to sell the property that secures the mortgage for less than the amount owed. Once the new owners are approved to purchase the property, the lender releases the borrower from any outstanding debt on the loan above and beyond the agreed-upon purchase price of the property, as well as all associated costs, such as late fees, legal charges, and past due interest payments. This debt release is important because in many states, the lender has the right to collect on these amounts after the foreclosure is complete. Time spent collecting these amounts can drag out the uncertainty and delay a fresh start

Benefits

- You can sell your home at market value, even if you owe more than that amount.

- You no longer owe the large debt to the mortgage company. Any remaining unpaid principal balance will be forgiven.

- You receive cash to assist you with expenses in relocating to a new home upon completion of the short sale.

- You avoid the costs and stress of public foreclosure. You have the ability to work out a mutually convenient move-out date.

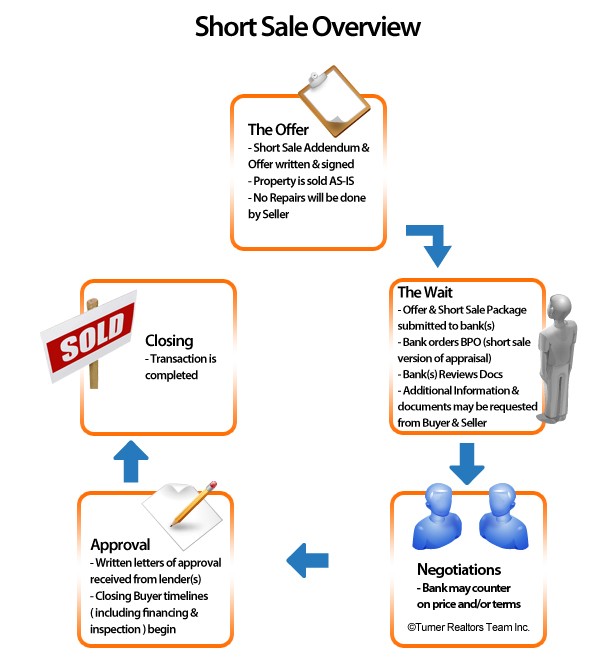

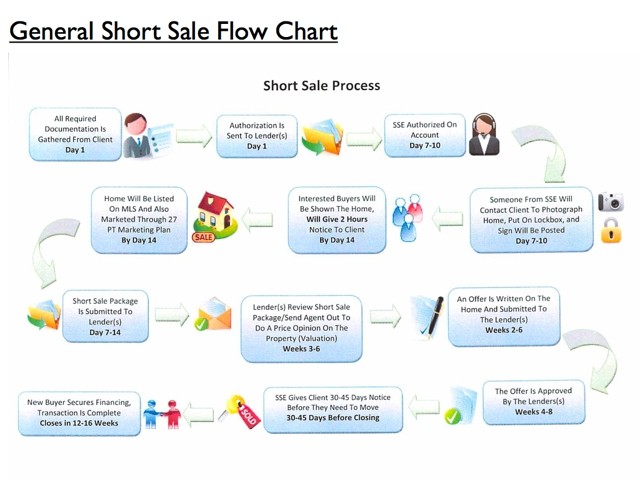

The Short Sale Process

A short sale is similar to a traditional home sale in many ways. You’ll work with a real estate agent to market and sell your home. Unlike a traditional real estate transaction, however, you and the agent will work with PennyMac throughout the process to help ensure its success.

Pre-Sale: PennyMac approves a listing price based on the fair market value of your home. This may be an amount less than what you actually owe. We take into consideration all sale-related costs, such as broker fees and closing costs.

Listing: You list your property either with a real estate broker or agent of your choice or, if you are interested, we can refer you to a local PennyMac-approved agent. PennyMac must approve the list price for your home based on the fair market value of the property.

Offer: When you receive an offer on your home, your agent submits required paperwork to us. PennyMac will approve the sale if the purchase price is in line with what we agreed to.

Closing: Once the sale closes, PennyMac releases you from all responsibilities for repaying your mortgage.

Relocation Assistance: Because a short sale requires you to move to a new home, PennyMac offers a one-time cash incentive to help with your relocation expenses. You will receive this amount at the closing, provided you have met all of the requirements above. The amount of the incentive depends on the state where your property is located and how long your mortgage has been delinquent. In addition, the amount of money available to you decreases with time as the costs of foreclosure increases, so delaying the process isn’t to your advantage.