The REIT way to diversify with ETFs

Post on: 11 Август, 2015 No Comment

JohnSpence

BOSTON (CBS.MW) — Adding real estate to a portfolio of stocks and bonds can smooth out the performance bumps, provide a steady revenue stream and perhaps even the prospect of higher returns.

Buying and selling private real estate is time-consuming and costly, but one way to easily invest in the sector is through real estate investment trusts, or REITs, companies that own and operate commercial real estate. Several exchange-traded funds are tied to REIT indexes such as the Cohen & Steers REIT Index RMP, +2.15%

If you have a market-like stock portfolio, then REITs are going to definitely add to your diversification in a good way, said financial adviser Jeff Troutner, head of TAM Asset Management.

What are REITs?

Created by Congress in 1960, REITs are an efficient and convenient tool for small investors to establish a position in a broad basket of real estate holdings in various geographical areas of the country. REITs provide professional management and are more liquid than owning private real estate investments because REITs can be easily bought and sold.

REITs can be broken down into three main categories: equity REITs, mortgage REITs and hybrid REITs.

A large majority of REITs are equity REITs, which generate earnings from rental payments and capital gains on property sales. Mortgage REITs lend money to real estate owners and operators, while hybrid REITS both own properties and finance owners and operators.

There are over 300 REITs in the U.S. with about 180 trading on public markets.

REITs usually concentrate on specific real estate markets and geographic areas. For example, Equity Office Properties EOP is the largest owner of office properties in the U.S. with real estate in several major cities, while Equity Residential Properties EQR, -0.14% is the biggest owner of apartment buildings.

Why invest in REITs?

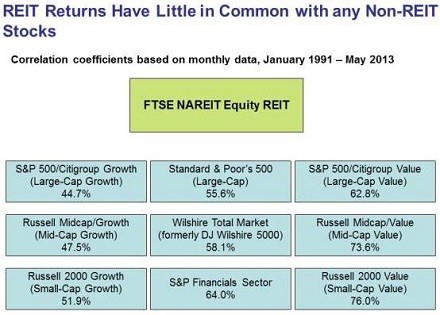

Aside from their diversification benefits and low correlation to stocks and bonds, REITs offer income and inflation protection. They have also provided a significant performance pop in recent years.

To qualify as a REIT, a company must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends. Most of the return from REITs has come in the form of dividend yields, with the rest resulting from a rise in stock price.

REIT dividend yields have averaged between roughly 5 and 7 percent over the past decade, which stacks up favorably against stock and bond yields. The current dividend yield on the streetTRACKS Wilshire REIT RWR, -0.07% is 4.8 percent, compared with 1.7 percent for S&P 500 SPDRs SPY, -0.61%

REITs also provide some protection against inflation because dividend growth rates have outpaced the Consumer Price Index; most commercial leases are indexed to the CPI, so rental rates rise along with inflation.

REITs also tend to move in the opposite direction of stocks, which can smooth out portfolio bumps when equities fall. The five-year correlation of the S&P REIT Composite index vs. the S&P 500 is a low 0.20.

For example, the S&P 500 was down all three years between 2000 and 2002, while the S&P REIT Composite provided a positive return every year during the period. The S&P 500 fell heavily the most in 2002 with a 22.1 percent drop vs. a gain of 4.2 percent for the REIT index.