The REIT Health Care Play HCP Investing Daily

Post on: 14 Май, 2015 No Comment

While Congressional Republicans continued to put up at least a symbolic fight against the Affordable Care Act (ACA) last year, it did little to dent the health care sectors performance. Health care was the only traditionally defensive sector to outperform the broader market in 2013.

We strongly suspect that health cares outperformance was due to the market perception that Republicans were tilting at windmills. Investors tuned out the political noise and priced in the effect of more than 50 million new patients accessing the health care system. That also likely means that much of the potential positive impact of the ACA is already being priced into most health care stocks.

This dynamic makes stock picking in the sector much more difficult, because rising valuations have made slam-dunk opportunities tougher to find.

Nonetheless, at least one terrificif somewhat contrarianincome play is still available in health care.

Real estate investment trusts (REIT) have enjoyed a once-in-a-life opportunity, as the Federal Reserves zero interest rate policy (ZIRP) has made capital cheap and relatively abundant for solid companies. At the same time, ZIRP left investors reaching for yield and created a stampede into REITs, which are required to distribute at least 90 percent of their income to unit holders, driving a huge run up in REIT valuations over the past few years.

Unfortunately for REITs, though, the Fed has begun its much anticipated taper and now the main speculation is when exactly it will begin bumping up its benchmark interest rates. That could spell trouble for REITs. At a bare minimum, rising rates will eat into their margins, as financing becomes more expensive and drives up the cost of debt service.

But not all REITs are created equal, even if they are based in the US.

HCP (NYSE: HCP) is one of the largest health care REITs in the nation and the first to become an S&P 500 component. HCPs portfolio of properties includes nearly 450 senior housing developments, more than 300 skilled nursing facilities, 274 medical office buildings, 17 hospitals and more than 100 facilities used by other life sciences companies.

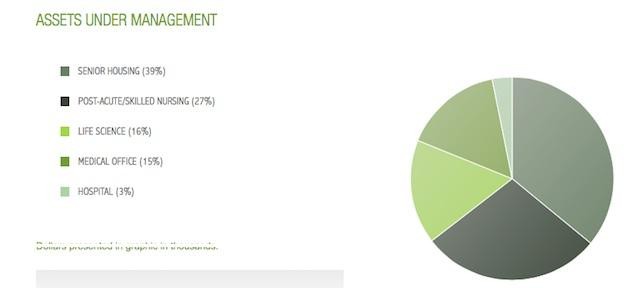

Over the years, HCP has carefully built its portfolio of properties, investing only when a solid opportunity presents itself, buying real estate and developing properties, forming joint ventures or investing in debt. It currently holds $21.8 billion in assets under management and its portfolio is throwing off about $1.6 billion in net operating income.

To minimize its own costs and ensure a stable tenant base, HCP uses a long-term, triple-net lease structure that leaves tenants responsible for paying operating expenses such as upkeep and taxes typically for terms of at least 10 years. Thanks to those long-term commitments from tenants, less than half of HCPs existing leases will expire between this year and 2021. On top of that, the leases usually stipulate that rents will increase by at least the rate of annual inflation which, in the health care industry, is currently running around 2.5 percent.

With 35 percent of its assets allocated to senior housing and another 29 percent in post-acute/skilled nursing facilities, HCP has demographics on its side. About 13 percent of the American population is currently over 65 years of age. That percentage will continue to rise as 10,000 people turn 65 every day for the next two decades, reaching 15 percent of the population by the end of the decade and gradually rising to nearly a quarter by 2050.

Largely as a result of that aging population, health care spending is expected to increase by 6 percent annually over the next two decades.

At the same time, the ACAs deepening of the Medicaid pool means that more patients will be entering senior living and nursing facilities in the coming years. Increased demand for health care of all types will also benefit medical practices and hospitals, helping to ensure strong demand for health care-related properties.

That stable tenant base and growing demand for health care properties has helped the REIT fund 28 straight years of dividend increases.

Thanks to the sell-off that the Feds first hint at tapering sparked in REITs, HCPs shares have declined by nearly 30 percent since May. But HCP seems to be getting lumped in with REITs as a whole. Many will indeed suffer, but health care REITs tend to be less susceptible to rate increases because of the inelastic nature of health care demand, which allows them to command more favorable contract terms.

Despite HCPs strong operating track record, it currently has one of the most favorable valuations in the health care REIT sector, trading at just over 17 times its funds from operations.

Another added advantage is that HCP has been publicly traded since 1985 and has shown that it can successfully navigate a rising rate environment over the years. Since the Fed rocked the boat in the second quarter, HCPs cost of capital has fallen by nearly 55 basis points.

HCP also has ample acquisition opportunities in the coming years, allowing it to further bolster its growth. In fact, the REIT averages about $500 million in purchases annually. But even without additional acquisitions, HCP should experience same-store growth of at least 3 percent this year, largely from annual rent increases.

Given shifting American demographics and its long, profitable operating history, HCP should continue generating healthy returns for years to come. REITs will be volatile as Fed speculation heats up, but HCP is well positioned to ride that out. HCP rates a buy up to 45.

Stock Talk

We encourage you to engage with our analysts and your fellow subscribers on our website. To ask a question or post a comment related to a particular article, please do so in the Stock Talk field at the bottom of that article.

Or, to ask a general question, please go to the main Stock Talk page found under the Resources menu for each publication.