The REIT ETFs Beating The Market

Post on: 5 Апрель, 2015 No Comment

- Article Comments (0)

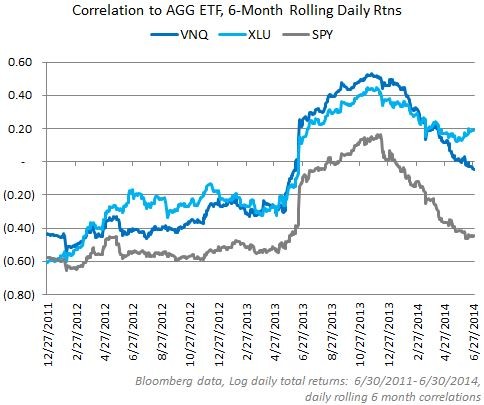

REIT ETFs that limped into the end of 2013 are looking as though the sector will finish out 2014 in a much different state, as investors look for high-yield options that perform well in low interest rate environments. REITs are one of the few investment choices that investors can turn to when looking for above-average income. Falling rates allow REITs to refinance existing investments at lower rates, in turn increasing their margins.

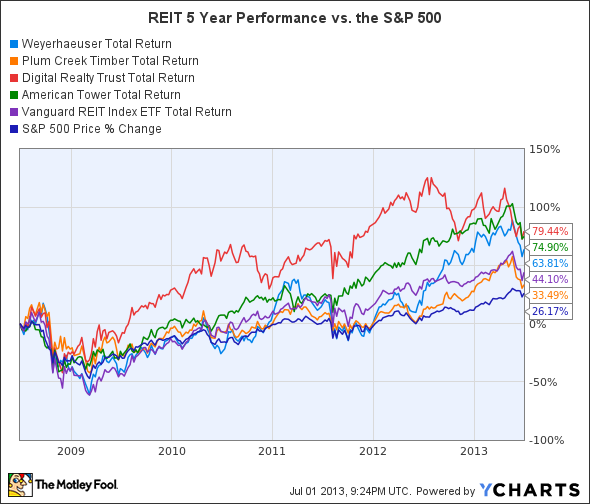

Year to date, the Vanguard REIT Index ETF (NYSEARCA:VNQ ), the largest REIT ETF, is up 23 percent. Its fellow ETF, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY ), is up 10 percent. However, for 2013, VNQ was down 3 percent versus SPY, which was up 26 percent.

Highlighted below are three REIT ETFs and one mortgage REIT ETF that are leading the charge in the sector this year.

The iShares Cohen & Steers Realty Maj. (NYSEARCA:ICF )

ICF provides exposure to large real estate companies that are fixtures within their sector. The ETF is comprised of 31 stocks with its top holdings being:

- Simon Property Group Inc (NYSE:SPG ) at 7.9 percent

- Public Storage (NYSE:PSA ) at 6.9 percent

- Equity Residential (NYSE:EQR ) making up 6.1 percent of the portfolio.

The top five holdings account for 27 percent of the total allocation, taking away from some of the diversification that an ETF offers. The ETF is up 18 percent over the last 12 months and up 10 percent over the last six months. An expense ratio of 0.35 percent puts ICF in the middle of the road in comparison with its competitors.

The Vanguard REIT Index ETF

VNQ consists of 138 large real estate investment trusts. In terms of sector diversification, retail REITs account for 26 percent, and residential REITs come in at 16 percent.

The individual top three holdings are identical to ICF with different weightings:

- Simon Property Group has an 8.7 percent holding

- Public Storage is at 4.1 percent

- Equity Residential accounts for 3.6 percent.

VNQ is up 14 percent over the last 12 months and 9 percent over the last six months. The REIT ETF boasts a low expense ratio of 0.10 percent.

The IQ U.S. Real Estate Small Cap ETF (NYSEARCA:ROOF )

ROOF provides investors the means to track the overall performance of the small capitalization real estate market. ROOF tracks 61 securities and is a well-distributed ETF with its top 30 holdings ranging from 3.7 percent to 1.7 percent.

The top three holdings of the ETF include:

- Sunstone Hotel Investors Inc (NYSE:SHO ) with a 3.7 percent holding

- CubeSmart (NYSE:CUBE ) at 3.3 percent

- DCT Industrial Trust Inc (NYSE:DCT ) at 3.3 percent

ROOF is up 11 percent over the last 12 months and 7 percent over the last six months. The expense ratio comes in at 0.69 percent, making it one of the more expensive REIT ETFs on the market.

The iShares Mortgage Real Estate Capped ETF (NYSEARCA:REM )

REM provides exposure to the residential and commercial mortgage real estate sector. It is made up of 36 stocks.

Top holdings for REM:

- Annaly Capital Management, Inc. (NYSE:NLY ) making up 15.6 percent

- American Capital Agency Corp (NASDAQ:AGNC ) with a 11.7 percent holding

- Starwood Property Trust, Inc. (NYSE:STWD ) coming in at 7.2 percent.

REM has performed the worst out of the highlighted ETFs; it is up 3 percent over the last 12 months and down 1 percent over the last six months. The mortgage ETF has en expense ratio of 0.48 percent.

The current low rates make the REIT sector very attractive for investors looking to add income to a portfolio or simply diversify. It is worth noting, however, that this sector is interest-rate sensitive and a rising interest rate environment could put pressure on the stocks.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Neither Benzinga nor its staff recommend that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation.

Read more articles from Seeking Alpha:

- The Bank Of Japan Nukes The Yen, DXJ Wins

- What A Rising Dollar Means For Your Stock Portfolio

- Building A Portfolio That Is S.M.A.R.T.

- Gold Still Has Luster: Why You Should Consider Holding GLD In Your Portfolio

- Using Screens To Focus Investment Research