The Proforma Income Statement

Post on: 5 Ноябрь, 2015 No Comment

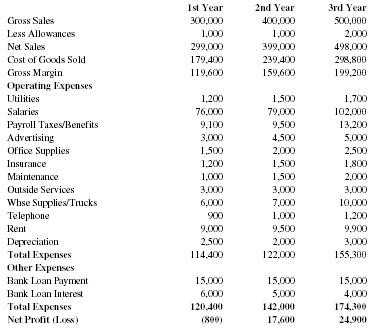

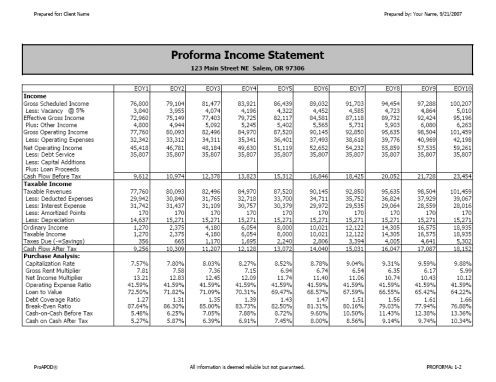

The Proforma Income Statement. sometimes also referred to simply as a proforma, or in some circles as a pro forma income statement (notice the spacing), is a report real estate investors, agents and other analysts create in order to evaluate rental income property financial performance over time.

The key phrase here is financial performance over time.

For unlike the highly popular APOD, which merely gives a snap shot of a property’s first year cash flow, proforma income statements look at revenue and expense projections typically for up to ten years. Moreover, they have the added benefit of including rates of return, tax benefit (or loss), and even sales proceeds projections for each of those years.

How it Works

The proforma income statement is generated by applying a user-designated variable to the property’s financial data such as gross rental income, vacancy and credit allowance, operating expenses, and projected future resale price.

In other words, if you want to make your evaluation based upon an annual increase in rental income of (say) five percent, the proforma will increase the income by that percent every year as well as adjust all the other data accordingly.

Example

Let’s say that you’re looking at a building currently generating a gross scheduled income of $30,000, operating expenses of $12,000, and likewise a net operating income of $18,000 ($30,000 — 12,000). Look what happens to next year’s net operating income in the event rental income increases 5% and operating expenses 4%.

Revenue = $30,000 + (30,000 x .05) = $31,500

Operating expenses = $12,000 + (12,000 x .04) = $12,480

Net operating income = $31,500 — 12,480 = $19,020

It’s a simple example, but you get the idea.

The property’s financial data is inflated by some variable of your choosing which in turn recalculates next year’s data starting in any given year through to the end of whatever year provided by your statement. As a result, you have the benefit of taking a peek at future cash flows, rates of return, sale proceeds due to a sale, and so forth.

How to Create

- Manually — You can use an Excel spreadsheet. In this case, it helps to have some knowledge of Excel, and you should allot yourself plenty of time to do it correctly.

- Software — You can invest in a third-party investment software solution. This will automatically create a pro forma for you, and may even include computations for tax shelter and time value of money.

Which ever method you choose to create the Proforma, though, here are a couple of important considerations to keep in mind.

- Your objective is to determine future cash flows, rates of return, and profitability primarily due to anticipated changes in rental income, vacancy, and operating expenses.

- Use realistic numbers. Start with the current income and expenses and inflate them by a reasonable amount that best reflects the trend in your market area.

- Limit your projection to ten years or less. After all, it’s all highly speculative (a guess) so it doesn’t make prudent sense to project out further.

- Do not rely solely upon a proforma income statement to make your investment decision. Be sure to carefully consider all aspects of the property, including it’s location, condition, price, tenant appeal, and so on.

So You Know

All three of my software solutions create a proforma income statement. And both, Investor 8 and Executive 10 do include the computations for tax shelter and time value of money. Sample reports are available for preview.

Here’s to your real estate investing success.

James Kobzeff has over thirty years experience as a realtor and real estate investment property specialist who freely shares his knowledge to help others understand the nuances. He is the developer of ProAPOD investment real estate software solutions.