The PE Ratio A Good MarketTiming Indicator

Post on: 4 Август, 2015 No Comment

The P/E ratio (price-to-earnings ratio ) of a stock (also called its earnings multiple, or simply multiple, P/E, or PEen.wikipedia.org/wiki/T-Model ]. mbox=frac

The price per share ( numerator ) is the market price of a single share of the stock. The earnings per share ( denominator ) is the net income of the company for the most recent 12 month period (for Trailing P/E or P/E ttm, which is most common), divided by number of shares outstanding. The P/E ratio can also be calculated by dividing the company’s market capitalization by its total annual earnings.

For example, if stock A is trading at $24 and the earnings per share for the most recent 12 month period is $3, then stock A has a P/E ratio of 24/3 or 8. Put another way, the purchaser of stock A is paying $8 for every dollar of earnings. Companies with losses (negative earnings) or no profit have an undefined P/E ratio (usually shown as Not applicable or N/A); sometimes, however, a negative P/E ratio may be shown.

Most stocks today trade between a 15-25 P/E ratio [The average P/E of the market has varied in the past, the variation depends on yields of competing fixed-income securities and expectations of earnings growth ]. Stocks with higher earnings growth will have a higher P/E, and those with lower earnings growth will have a lower P/E. A ratio higher than 25 must have really good earnings growth or risk a drop in the stock price.

By comparing price and earnings per share for a company, one can analyze the market’s stock valuation of a company and its shares relative to the income the company is actually generating.Fact|date=December 2007 Investors can use the P/E ratio to compare the value of stocks: if one stock has a P/E twice that of another stock, all things being equal (especially the earnings growth rate), it is a less attractive investment. Companies are rarely equal, however, and comparisons between industries, companies, and time periods may be misleading.

Determining share prices

Share prices in a publicly traded company are determined by market supply and demand. and thus depend upon the expectations of buyers and sellers. Among these are:

* The company’s future and recent performance, including potential growth;

* Perceived risk, including risk due to high leverage ;

* Prospects for companies of this type, the market sector .By dividing the price of one share in a company by the profits earned by the company per share, you arrive at the P/E ratio. If earnings move up proportionally with share prices (or vice versa) the ratio stays the same. But if stock prices gain in value and earnings remain the same or go down, the P/E rises.

The earnings figure used is the most recently available, although this figure may be out of date and may not necessarily reflect the current position of the company. This is often referred to as a ‘trailing P/E’, because it involves taking earnings from the last four quarters

The price earning multiple is sometimes called the price earnings ratio .

Other related measures

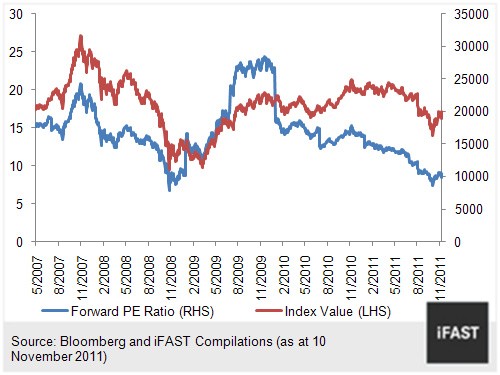

The forward P/E uses the estimated earnings going forward twelve months.

P/E10www.generationaldynamics.com/cgi-bin/D.PL?d=ww2010.i.050711eleven 11% Solution — Overvalued Stock Market — Adam Barth in Barron’s — Generational Dynamics ] ]. thus using P/E10 will reduce the noise in the data.

The P/E ratio relates to the equity value. A similar measure can be defined for real estate, see Case-Shiller index .

PEG ratio is obtained by dividing the P/E ratio by the annual earnings growth rate. It is considered a form of normalization because higher growth rate should cause higher P/E.

The similar ratio on the enterprise value level is EV/EBITDA Enterprise value divided by the EBITDA .

Present Value of Growth Opportunities (PVGO) is another alternative method for stock valuation. Present value of growth opportunities is calculated by finding the difference between price of equity with constant growth and price of equity with no growth.

PVGO = P(Growth) — P(No growth) = [D1/(r-g)] — E/rwhere P = Price of equity D1 = Dividend for next period r = Cost of Capital E = Earning on equitySince the Price/Earnings (P/E) Multiple is ‘Price per share / Earnings per share’ it can be written as

P0 / E1 = 1/r [ 1+ (PVGO/(E1/r))] Thus, as PVGO rises, the P/E ratio rises.

Dividend Yield

Publicly traded companies often make periodic quarterly or yearly cash payments to their owners, the shareholders, in direct proportion to the number of shares held. According to US law, such payments can only be made out of current earnings or out of reserves (earnings retained from previous years). The company decides on the total payment and this is divided by the number of shares. The resulting dividend is an amount of cash per share. The dividend yield is the dividend paid in the last accounting year divided by the current share price.

If a stock paid out $5 per share in cash dividends to its shareholders last year, and its price is currently $50, then it has a dividend yield of 10%.

Historically, at severely high P/E ratios (such as over 100x), a stock has NO (0.0%) or negligible dividend yield. With a P/E ratio over 100x, and supposing a portion of earnings is paid as dividend, it would take over a century to earn back the purchase price. Such stocks are extremely overvalued, unless a huge growth of earnings in the next years is expected.

Earnings yield

The reverse (or reciprocal) of the P/E is the E/P, also known as the earnings yield. The earnings yield is quoted as a percentage, and is useful in comparing a stock. sector, or the market’s valuation relative to bonds .

The earnings yield is also the cost to a publicly traded company of raising expansion capital through the issuance of stock.

Interpretation

The average U.S. equity P/E ratio from 1900 to 2005 is 14 (or 16, depending on whether the geometric mean or the arithmetic mean. respectively, is used to average). An oversimplified interpretation would conclude that it takes about 14 years to recoup the price paid for a stock [not including any income from the reinvestment of dividends] .

Normally, stocks with high earning growth are traded at higher P/E values. From the previous example, stock A, trading at $24 per share, may be expected to earn $6 per share the next year. Then the forward P/E ratio is $24/6 = 4. So, you are paying $4 for every one dollar of earnings, which makes the stock more attractive than it was the previous year.

The P/E ratio implicitly incorporates the perceived riskiness of a given company’s future earnings. For a stock purchaser, this risk includes the possibility of bankruptcy. For companies with high leverage (that is, high levels of debt), the risk of bankruptcy will be higher than for other companies. Assuming the effect of leverage is positive, the earnings for a highly-leveraged company will also be higher. In principle, the P/E ratio incorporates this information, and different P/E ratios may reflect the structure of the balance sheet .

Variations on the standard trailing and forward P/E ratios are common. Generally, alternative P/E measures substitute different measures of earnings, such as rolling averages over longer periods of time (to smooth volatile earnings, for example), or corrected earnings figures that exclude certain extraordinary events or one-off gains or losses. The definitions may not be standardized.

Various interpretations of a particular P/E ratio are possible, and the historical table below is just indicative and cannot be a guide, as current P/E ratios should be compared to current real interest rate s (see Fed model ):

www.reuters.com/finance/stocks/ratios?symbol=RHT.N Example of RHT ] Often, comparisons will also be made between quarterly and annual data. Only after a comparison with the industry, sector, and market can an analyst determine whether a P/E ratio is high or low with the above mentioned distinctions (i.e. undervaluation, over valuation, fair valuation, etc).

www.moneychimp.com/articles/valuation/pe_ratio.htm P/E: Price to Earnings Ratio ] ] allows one to evaluate the fair P/E ratio. Using constant historical earnings growth rate of 3.8 and post-war S&P 500 returns of 11% (including 4% inflation) as the discount rate, the fair P/E is obtained as 14.42. A stock growing at 10% for next 5 years would have a fair P/E of 18.65.

The Market P/E

To calculate the P/E ratio of a market index such as the S&P 500, it is not accurate to take the simple average of the P/Es of all stock constituents. The preferred and accurate method is to calculate the weighted average. In this case, each stock’s underlying market cap (price multiplied by number of shares in issue) is summed to give the total value in terms of market capitalization for the whole market index. The same method is computed for each stock’s underlying net earnings (earnings per share multiplied by number of shares in issue). In this case, the total of all net earnings is computed and this gives the total earnings for the whole market index. The final stage is to divide the total market capitalization by the total earnings to give the market P/E ratio. The reason for using the weighted average method rather than ‘simple’ average can best be described by the fact that the smaller constituents have less of an impact on the overall market index. For example, if a market index is composed of companies X and Y, both of which have the same P/E ratio (which causes the market index to have the same ratio as well) but X has a 9 times greater market cap than Y, then a percentage drop in earnings per share in Y should yield a much smaller effect in the market index than the same percentage drop in earnings per share in X.

A variation that is often used is to exclude companies with negative earnings from the sample — especially when looking at sub-indices with a lower number of stocks where companies with negative earnings will distort the figures.

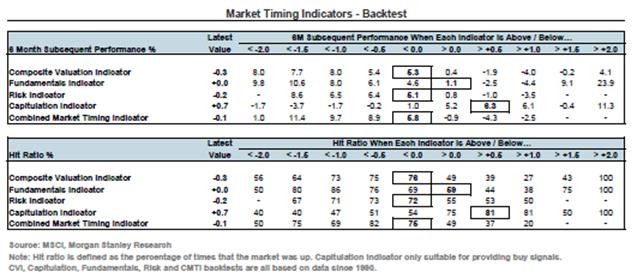

www.investopedia.com/articles/technical/04/020404.asp Is the P/E Ratio a Good Market-Timing Indicator? ]. Matt Blackman has examined a trading strategy using P/E ratio involving staying out of the market when P/E’s 2 year SMA falls below 5 year SMA. It resulted in capturing 91% of the gain by staying in the market for only 42% of the time.

Accuracy and context

In practice, decisions must be made as to how to exactly specify the inputs used in the calculations.

* Does the current market price accurately value the organization?

* How is income to be calculated and for what periods? How do we calculate total capitalization?

* Can these values be trusted?

* What are the revenue and earnings growth prospects over the time frame one is investing in?

* Was there special one-time charges which artificially lowered (or artificially raised) the earnings used in the calculation, and did those charges cause a drop in stock price or were they ignored?

* Were these charges truly one-time, or is the company trying to manipulate us into thinking so?

* What kind of P/E ratios is the market giving to similar companies, and also the P/E ratio of the entire market?

*Are P/E ratios an accurate measure?

Historical vs. Projected Earnings

A distinction has to be made between the fundamental (or intrinsic) P/E and the way we actually compute P/Es. The fundamental or intrinsic P/E examines earnings forecasts. That is what was done in the analogy above. In reality, we actually compute P/Es using the latest 12 month corporate earnings. Using past earnings introduces a temporal mismatch, but it is felt that having this mismatch is better than using future earnings, since future earnings estimates are notoriously inaccurate and susceptible to deliberate manipulation.

On the other hand, just because a stock is trading at a low fundamental P/E is not an indicator that the stock is undervalued. A stock may be trading at a low P/E because the investors are less optimistic about the future earnings from the stock. Thus, one way to get a fair comparison between stocks is to use their primary P/E. This primary P/E is based on the earnings projections made for the next years to which a discount calculation is applied.

The P/E Concept in Business Culture

The P/E ratio of a company is a significant focus for management in many companies and industries. This is because management is primarily paid with their company’s stock (a form of payment that is supposed to align the interests of management with the interests of other stock holders), in order to increase the stock price. The stock price can increase in one of two ways: either through improved earnings or through an improved multiple that the market assigns to those earnings. As mentioned earlier, a higher P/E ratio is the result of a sustainable advantage that allows a company to grow earnings over time (i.e. investors are paying for their peace of mind). Efforts by management to convince investors that their companies do have a sustainable advantage have had profound effects on business:

*The primary motivation for building conglomerates is to diversify earnings so that they go up steadily over timeFact|date=June 2007 .

*The choice of businesses which are enhanced or closed down or sold within these conglomerates is often made based on their perceived volatility, regardless of the absolute level of profits or profit marginsFact|date=June 2007 .

*One of the main genres of financial fraud, slush fund accounting (hiding excess earnings in good years to cover for losses in lean years), is designed to create the image that the company always slowly but steadily increases profits, with the goal to increase the P/E ratio.

These and many other actions used by companies to structure themselves to be perceived as commanding a higher P/E ratio can seem counterintuitive to some, because while they may decrease the absolute level of profits they are designed to increase the stock price. Thus, in this situation, maximizing the stock price acts as a perverse incentive .

Recent historic values

www.nber.org/cycles.html US Business Cycle Expansions and Contractions ] .

Note that at the height of the Dot-com bubble P/E had risen to 32. The collapse in earnings caused P/E to rise to 46.50 in 2001. It has declined to a more sustainable region of 17. Its decline in recent years has been due to higher earnings growth .

www.investopedia.com/articles/technical/04/020404.asp Is the P/E Ratio a Good Market-Timing Indicator? ] ] Jeremy Siegel has suggested that the average P/E ratio of about 15 (or earnings yield of about 6.6%) arises due to the long term returns for stocks of about 6.8%.

Jeremy Siegel in Stocks for the Long Run. (2002 edition) had argued that with the favorable developments like the lower capital gains tax rates and transaction costs, P/E ratio in low twentieswww.nareit.com/portfoliomag/04julaug/capital.shtml NAREIT — Capital Markets ] ] .

* Fundamental analysis

* Stock valuation

* Dividend yield

* Stock market

* Stock market bubble

* Stock market crash

* Value investing

* List of finance topics

External links

www.hussmanfunds.com/popup/pricepeak.htm Hussman Funds — Popup: Why We Use Price to Peak Earnings ]

www.crestmontresearch.com/pdfs/Stock%20Inflation%20&%20PE.pdf Crestmont Research — Relationship of Inflation & Price/Earnings Ratios (1900—2005) ]

beginnersinvest.about.com/cs/valueinvesting1/a/011101a.htm P/E Ratio: A Quick and Dirty Way to Determine Relative Value ]

www.fool.com/investing/value/2005/08/19/how-to-use-the-pe.aspx How to Use the P/E ]

screen.yahoo.com/b?pe=0/&pb=0/&ps=0/&peg=0/&b=1&s=pe&db=stocks&vw=1 Yahoo! Stock screener — Sorted by P/E ]