The Payout Ratio Learn I I I WIN LINE Investing Daily

Post on: 16 Март, 2015 No Comment

By Roger Conrad on October 29, 2010

Certainly not every North American industry is thriving here in late 2010. And high unemployment across the country promises more upheaval for the US political system when voters go to the polls next week.

Nonetheless, if youve got a healthy helping of Utility Forecaster companies in your portfolio, its pretty hard not to be just a little bit sanguine, at least if you look at third-quarter numbers. To be sure, there are areas of weakness, mainly for companies operating in unregulated areas like natural gas production and wholesale power generation. But even those companies with substantial exposure still put up overall numbers supporting dividends and financial health as well as plans for growth.

Its become quite fashionable in the financial media to question the safety of almost anything paying a dividend. Thats not surprising. Many investors have proven themselves all too willing to pay good money for such so-called advice, just as they would to enter a haunted house this Halloween. Whether or not its justified to scare is wholly irrelevant.

The good news is the numbers weve seeing should smooth even the most ruffled feathers. Thats takeaway No. 1 from third-quarter earnings season so far for Utility Forecaster Portfolio recommendations.

Of course, one can put a negative spin on practically anything. And as investors keep proving to unscrupulous marketers, many are all too willing to believe the bad news and ignore the good, particularly if they watch the latest cable new infotainment. But if youre willing to take the time to check out just one earnings number for the companies you own, you can easily set your concerns to rest and at the same time gain some insight on the source pushing the negative view.

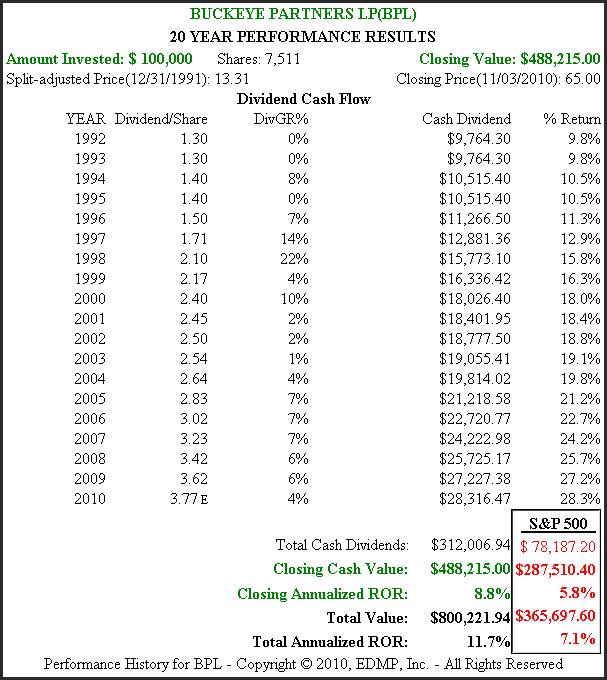

The number Im talking about will be no surprise to subscribers to Utility Forecaster . Canadian Edge . MLP Profits . Personal Finance or any other advisory Ive contributed to over the years. Its the payout ratio, which compares dividends to the profits that make them possible.

Generally speaking, the higher profits are relative to the dividend, the better protected that dividend is from setbacks at companies. A low payout ratiowhich is the dividend as a percentage of earningsis consequently the best possible sign that the dividend is indeed safe, and that the media doubters are full of hot air.

A lot of people track payout ratios. Whats appalling is how few actually report them correctly, including many people apparently paid to do so.

Simply, if you use the wrong measure of profits, the number youre going to come up with will be worse than worthless. In fact, its guaranteed to do one of two things: give you a false sense of security about your companies, or convince you solid ground is really quicksand. Either way, youre headed for some really bad investment decisions.

Ignore the Headlines

For most corporations the best measure of profits is earnings per sharebut usually not the number reported in headlines, which are more often than not generated by computer algorithms rather than actual sentient beings. Rather, to get an accurate measure of earnings power youve got to strip out any one-time items, be they gains or losses from asset sales, accounting items, one-time factors affecting operations or anything else.

Whats left is what many companies call adjusted earnings, and its the account from which all dividends are paid. As its not an official GAAP (generally accepted accounting principles) number, adjusted earnings can vary from company to company. That can make it unreliable for analyzing some sectors. Fortunately, as long as were talking about regulated essential-services like electricity, gas and water, variation is generally low and we can count on the numbers.

If youve ever looked at a stock and wondered why its rising on a day when headline earnings are down, more often than not its because adjusted earnings were right in line or better than what Wall Street expected. The headline number got the computers attention. But anyone familiar with the situation knew to ignore it.

I generally like to see payout ratios of less than 70 percent for my picks, though Im willing to tolerate higher if the trend is moving in our favori.e. earnings are rising. Payout ratios based on even adjusted earnings per share, however, are useless when it comes to measuring dividend safety at companies that are able to pay dividends from cash flow.

These include master limited partnerships (MLP) and real estate investment trusts (REIT), which are enabled by the tax code to minimize taxable earnings per share. They also include a growing number of ordinary corporations that have figured out how to avoid taxes by the nature of their businesses, and are willing to share the proceeds out in dividends.

These include many of the former Canadian income trusts, virtually all of which will have converted to corporations by Jan. 1, 2011. They also include communications that have traditional phone system assets on their books, particularly rural providers like Frontier Communications (NYSE: FTR) and Windstream Corp (NYSE: WIN) .

For these companies distributable cash flow (DCF) is the essential measurement of profits. Thats basically cash flow excluding any one-time items and after taking out debt service and maintenance capital costs. Whats left is the cash generated by the business that it can use to pay dividends, cut debt, invest in growth or buy back stock.

Its not uncommon for an MLP, for example, to post wild variations in earnings per share. Energy producers like Linn Energy LLC (NSDQ: LINE). for example, have such reliable cash flows precisely because they hedge their future output. Yet mark-to-market accounting requires them to declare gains and losses on that hedge book every time they report earnings per share.

The number reported is absolutely useless when it comes to gauging Linns dividend safety. Certainly management didnt base its decision this week to bump up distributions 5 percent on reported earnings per share of 38 cents. And judging from the solid bump in the shares this week, neither did anyone pay attention to the fact that EPS was well below so-called analyst projections.

Rather, the key number was 75 cents per share in third quarter DCF, supported by a 30 percent boost in year-over-year energy production and continued aggressive hedging of future output. That DCF covered the distribution by a 1.18-to-1 margin, topping managements internal guidance of 1.15 times.

Anyone looking at earnings per share of 38 cents as a basis for Linns dividend safety would no doubt have headed for the exits, as it didnt come close to covering the quarterly dividend of 66 cents. The fact that Linn actually raised its payout for the first time since early 2008 was no doubt even less understandable. But then again, thats the risk people run when they dont take the time to understand just what it is theyve boughtor when they listen to people who really dont have any idea what it is theyre writing about.

Unfortunately, I have little doubt that as earnings season progresses this kind of misunderstanding will be repeated over and over again. The next batch of companies likely to get the scare treatment: Rural communications companies slated to announce third-quarter results next week.

Once again, well see and hear the usual blather that these companies dont earn their dividends, with payout ratios based on earnings per share front and center. But theres absolutely no excuse for falling for it.

Thats because these days anyone can go right to the source and read the companys earnings report themselves. And management will put its DCF front and center for all to read, along with coverage ratios. Frontier and Windstream will call it free cash flow. And thanks to both companies ability to avoid taxes, it will be much higher than whatever headline number is spit out for earnings per share.

Ill have full commentary for Utility Forecaster readers next week. Note that the November issue will be up on the site starting tomorrow morning.

Question of the Week

Here I address a frequent query from readers over the past week. Send your question to utilityandincome@kci-com.com .

- Atlantic Power Corp (TSX: ATP, NYSE: AT) took a dive last week after it issued stock and convertible bonds that boosted capital by 10 percent. Isnt this a bad sign?

No. The key when a company issues capital is always whether it can invest the money to grow profitably. Is the expected rate of return sufficiently greater than the cost of capital to justify the risk, i.e. the potential dilution if the investment doesnt work out? The good news for companies like Atlantic now is theyre able to raise capital at their lowest cost in history.

Atlantic issued shares, for example, at a price more than three times higher than where it was in late 2008, and a good 30 percent above where its shares have traded for most of its history. Meanwhile, the convertibles will only have exchange value if the stock rises 35 percent from current levels. That makes them basically seven-year debt maturing June 30, 2017, and yielding 5.6 percentby far the cheapest debt Atlantic has ever issued.

As for the investment side of the equation, the company has already announced two big deals that will start adding to cash flow almost immediately. One is the now fully financed (partly by Uncle Sam) Piedmont Green Power, a 53.5 megawatt biomass power plant in Georgia, run by it 60 percent-owned Rollcast Energy unit. Power is already under a 20-year contract based on capacity. Atlantic gets paid even when it doesnt run. The other is the purchase of a biomass plant already in operation in Michigan, also under long-term contract.

These are classic Atlantic power deals: adding cash flow to pay dividends thats hedged from almost every possible angle. Thats the kind of thing I want my companies to raise money and invest in. Thats why I recommend dividend-paying equities instead of settling for the paltry returns now offered in bonds, annuities, savings accounts and other fixed income.