The Investor s Guide to Income Taxes

Post on: 25 Апрель, 2015 No Comment

Key Points

- Understanding what constitutes income can help you pay less in taxes. The amount of income you’re required to recognize for tax purposes depends on the extent to which the Internal Revenue Code allows special exclusions, adjustments, deductions and credits.

Your investment decisions always come first, but paying attention to taxes along the way can help you keep more of your hard-earned returns. Understanding what constitutes income and how different types of income are treated under the federal income tax rules is the first step in a sophisticated tax planning strategy. 1 While the rules change periodically, there are some important fundamentals that can help you better position your finances.

Everything is income

Income extends beyond wages, interest, dividends, annuities, royalties and alimony—it’s any form of realized income, and includes property or services you receive, or are entitled to receive. Debt that is cancelled or forgiven (from a mortgage or student loan) is also considered income for tax reporting purposes.

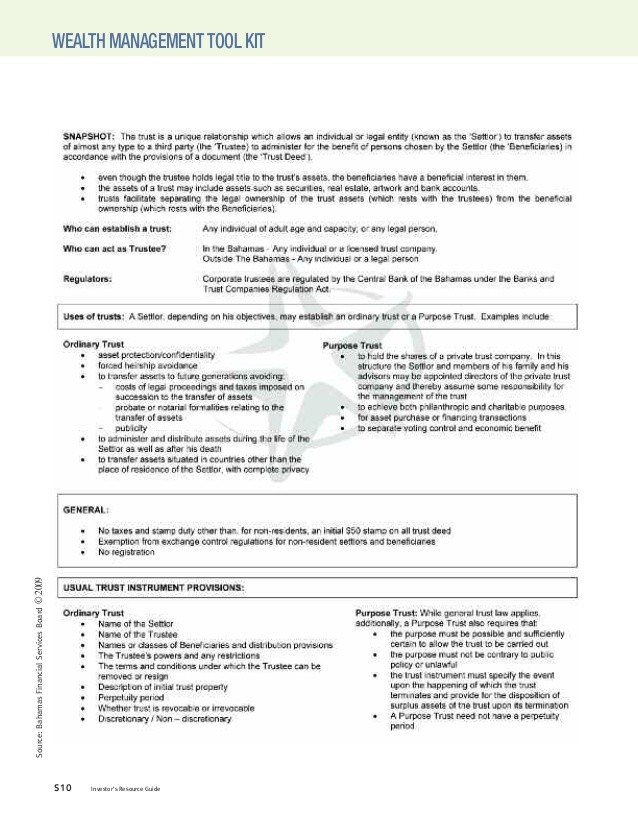

That said, your gross income isn’t fully taxable either. Internal Revenue Code (IRC) rules allow the following adjustments:

- Special exclusions. such as tax-free municipal bond (muni) income, gifts, inheritances and life insurance proceeds.

- Adjustments. such as above-the-line adjustments for retirement plan contributions, alimony and self-employed health insurance.

- Deductions. such as the standard deduction or itemized deductions for such things as qualified mortgage interest, state and local taxes, and charitable gifts.

- Personal and dependent exemptions.

- Credits. such as foreign tax credit .

- above-the-line deductions___________________

= Adjusted gross income (AGI)

- standard or itemized deductions

- exemptions_______________________________

= Taxable income

x tax rate (ordinary, capital gain, AMT)__________

- tax credits

- withholding and/or quarterly estimated payments_

= Tax owed (or refund due)

For more information and details on these categories, see IRS Publication 17, Your Federal Income Tax For Individuals. Publication 17 also provides a list of more specific resources, including one that investors will find particularly useful: IRS Publication 550, Investment Income and Expenses .

Types of income

For tax purposes, there are three main types of income:

- Ordinary: Income from wages, self-employment income, interest, dividends, etc.

- Capital: Income from the sale of property.

- Passive: Income from investments in real estate, limited partnerships or business activities where participation is immaterial.

There are further classifications within some of these categories. For example, some interest income is considered tax-exempt (for example, interest from state and local municipal bonds) and some dividends are deemed qualified and receive special long-term capital gain tax treatment.

Also, while capital gains can be either short-term (held for one year or less and taxed at the ordinary tax rate) or long-term (held for more than one year and taxed at a lower rate), there are further categories for such things as collectibles or recaptured depreciation (see IRS Publication 550 noted above).

Finally, special rules apply to the interaction between these categories. For example, passive losses can usually only offset other passive income, but generally not ordinary income.

The difference between effective and marginal tax rates

Our income tax system applies higher tax rates to higher levels of income and lower tax rates to lower levels of income. Currently, the rates range from 10% at the low end to 39.6% at the high end. The cutoff between the graduated tax rates is known as a tax bracket.

Your marginal tax rate is the tax you pay on your last dollar of income. If you’re single and you make over $406,750 a year, you’ll fall into the 39.6% tax bracket this year—and will pay $39.60 for every $100 you make over $406,750 in taxable income. 2 But for every dollar prior to that $406,750 threshold, you’ll have paid less.

Your effective tax rate is the total amount of tax you pay divided by your taxable income (or AGI, depending on the approach you use). This average is the actual overall rate you pay in taxes. For tax planning purposes, however, the marginal rate is more important because it tells you how much you will pay on the next dollar of income or how much benefit you will get for the next dollar of deductible expense.