The Ins and Outs of Master Limited Partnerships

Post on: 12 Июнь, 2015 No Comment

By Nilus Mattive | on April 5, 2011

While I’m hardly an expert on taxes, I do insist on doing my own return every year. And since I specialize in income investments, I also field tons of tax-related questions on dividend stocks and other investments.

Perhaps no area of the income world generates more confusion than the special class of investments known as Master Limited Partnerships, or MLPs. So today I want to give you a quick rundown on MLPs, and raise a few of the biggest tax considerations involved with these investments.

As always, the standard disclaimers apply, including the fact that this column is certainly no substitute for a personal consultation with a tax professional who is familiar with your circumstances.

But with that said, let’s get started …

How a Master Limited Partnership

Differs from a Regular Corporation

The typical company is a plain old corporation, a separate legal entity from its employees and investors. They’re treated as separate legal entities come tax time, too. Thus, any money the corporation has left over after paying its taxes can be used for a range of purposes — R&D, acquisitions, dividends, etc. And when shareholders receive those dividends, they’ll eventually pay taxes on the income, too.

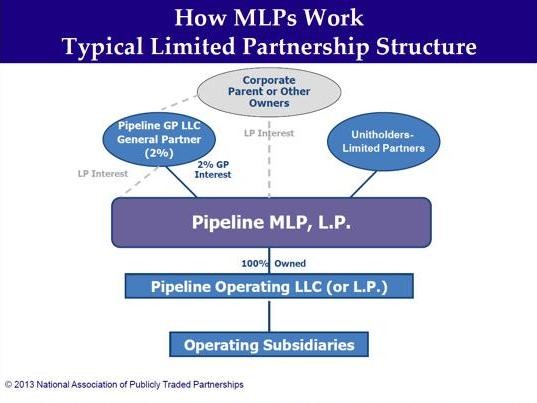

But as the name suggests, Master Limited Partnerships — also known as publicly traded partnerships — are organized as partnerships, which are not considered separate legal entities.

In other words, the partners are liable for the obligations of the partnership but also get all the direct benefits. (It’s worth noting here that your liability is generally limited, however.)

Only certain kinds of companies can qualify for this special status. At least 90 percent of the company’s income must come from certain sources such as interest, real estate rents, gains on commodities, and revenue from activities related to natural resources. This is why you’ll find a lot of MLPs that own timberland or oil pipelines.

And while they trade just like regular stocks on major exchanges, you’re technically buying “units” rather than “shares.”

Now, Here’s the Important Part Come Tax Time …

These Partnerships Are “Pass-Through” Entities!

As I said a moment ago, corporations pay taxes and then their shareholders who receive income pay taxes again.

Many MLPs operate oil and gas pipelines.

In contrast, a partnership’s income is treated as if it is earned by the partners and it is allocated to them based on their individual stake. The partners also share in any other events that typically affect taxable income such as deductions and credits.

By law, MLPs are also required to pay out most of their cash flow to partners in the form of regular quarterly distributions.

These payments may look like plain ol’ dividends. However, there’s an important difference at tax time — the bulk of the quarterly distributions are considered a return of capital and not taxable investment income.

What does this mean? That much of your distributions are tax deferred — just as if they were in a 401(k) or traditional IRA plan!

What happens is that the cost basis of your partnership units — the price you originally paid — gets adjusted up and down for distributions, income, and those passed-through tax items. Let’s go through an example:

Step 1. You buy a unit for $10 that yields 10 percent. In other words, you’re receiving $1 a year.

Step 2. At tax time, the partnership will send you a form (called a K-1) that breaks down all your income, tax credits, etc. You are required to pay tax on this allocation at your individual tax rate. As a rough guideline, it might amount to 20 percent of your total distribution. Thus, you’d pay tax on $0.20 of the $1 distribution. If the partnership records a loss, you will carry this loss forward to next year to offset future income from the same MLP. You cannot use it to offset income from other sources.

Step 3. What about the other $.80 of income? That’s deferred. Uncle Sam figures your $10 partnership unit was reduced by the $1 distribution. He also says your unit was increased by the $0.20 you just paid tax on. End result: Your unit is now worth $9.20 in the eyes of the Tax Man.

Step 4. This process repeats itself every year until one of two things happens: A. You sell your unit or B. The value of your unit hits zero.

Step 5. Realistically, you’re better off holding for longer time periods, but let’s say you sell your unit after one year for $11. You will owe ordinary income tax on the $.80 of deferred income. And the $1 gain on the unit itself will be taxed at the capital gains rate.

That’s basically how it works. And as you can imagine, the ability to defer taxes on this income can be very advantageous depending on your particular situation.

However, There Are Also Two

Tax Disadvantages to Note!

The first one is counterintuitive — but you generally do NOT want to hold MLPs in tax-sheltered accounts like IRAs.

[ic-ad]

It’s a long and boring story, but here’s the short version: Any amount of income that exceeds $1,000 will be taxable even if the MLP is held INSIDE a tax-sheltered account.

The reason is because it will be considered “unrelated business income.”

And importantly, the $1,000 limit is not applied to each individual holding but rather the income you might be receiving from all your MLPs.

Now, if you own just a small position in an MLP or two, this might not make a difference. Plus, you can also find certain MLP funds that will negate the risk of triggering the UBI tax.

But the safest route is simply holding your MLPs in taxable accounts.

Meanwhile, there is also a wrinkle when it comes to state taxes.

Reason: Many MLPs operate across a vast swath of the country and technically you could be earning income in many states each year.

Realistically, even if the individual states were looking at this you would have to own a substantial portion of units to come in above their income thresholds. Still, it is something else to be aware of.

Is it all a bit tricky? Yes.

But MLPs do their best to help investors wade through the process.

Plus, it is precisely these little hurdles that keep a lot people away from MLPs … leaving the juicy yields to those who are brave enough to sit down and get their hands a little dirty.

And considering the fact that some of my favorite MLPs are yielding 6 percent, 7 percent or even more right now … I certainly think the additional effort is worth it!

Best wishes,

Nilus

P.S. I’m currently recommending two MLPs to my Income Superstars subscribers right now. If you want to learn more about those companies — and all the other investments I like — just click here now.