The Income Buyer s Guide To REIT ETFs

Post on: 26 Июль, 2015 No Comment

Summary

- REITs offer an innovative way for income investors to access an alternative asset class with higher average yields.

- Many ETFs in this arena offer a unique approach to index construction that can include ultra-low fees as well.

- International and sector-specific offerings are another way for income investors to diversify their portfolios within several new opportunities.

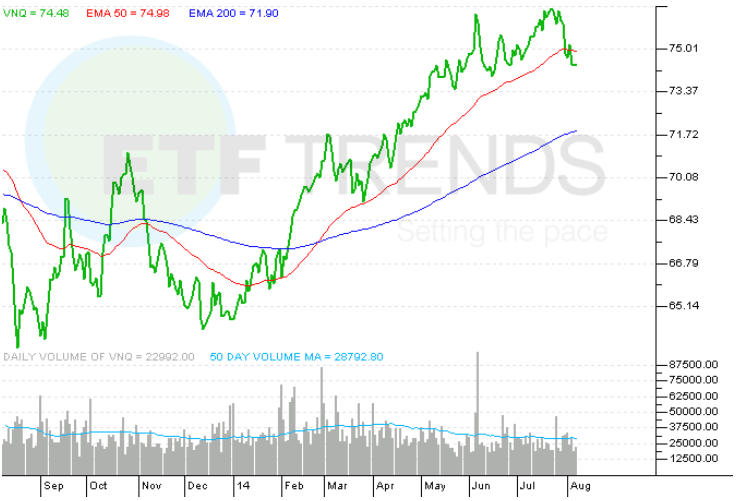

Real estate investment trusts, or REITs, have come a long way from the drubbing they experienced this time last year. The Fed-induced taper tantrum led to a significant sell-off in these income-generating vehicles that was primarily driven by rising interest rates and the fear of a slowing real estate market.

The majority of REIT ETFs fell between 15-20% in a two-month time frame that culminated in an excellent opportunity for value-seeking investors to purchase these funds at attractive price points and much higher yields. Since that sell-off, we have seen a complete price retracement back to the prior highs as yield-hungry buyers have stepped back into the real estate game.

One of the attractive attributes of REITs is they are considered an alternative asset class with different risks and growth drivers than traditional stocks and bonds. This makes them an excellent opportunity to diversify your portfolio in an unconventional asset class. in addition to adding a much higher yield than the average dividend-paying stock. In fact, REITs are generally required to pay out the majority of their taxable income as dividends to shareholders.

In terms of size, the largest and most heavily traded ETF in this space is the Vanguard REIT Index ETF (NYSEARCA:VNQ ). This fund is comprised of 137 publicly traded REITs with a total portfolio size of $23.1 billion. The top two holdings in the market cap-weighted VNQ include Simon Property Group (NYSE:SPG ) and Public Storage (NYSE:PSA ). However, the fund is widely diversified in a number of hotel, healthcare, office, retail, and residential REITs.

Probably the most attractive quality of VNQ over similar broad-based real estate competitors such as the iShares U.S. Real Estate ETF (NYSEARCA:IYR ) is its miniscule expense ratio. VNQ currently charges a tiny 0.10% management fee, compared to 0.46% for IYR. The only lower-cost vehicle in its class is the Schwab U.S. REIT ETF (NYSEARCA:SCHH ), which touts an expense ratio of just 0.07% annually.

VNQ has an effective yield of 3.70% based on the most recent distribution, and income is paid quarterly to shareholders. So far this year, VNQ has gained 17.01%, as the combination of favorable real estate data and falling interest rates have been a tailwind for higher prices.

REITs are often very sensitive to changes in interest rates, because their financing and acquisition costs are heavily reliant on a favorable yield environment. Investors typically shun REITs in a rising rate environment, because the additional risks you assume to own these companies versus other income opportunities become less attractive as bond yields rise.

While the majority of ETF assets in this space are focused on domestic REITs, there are also numerous international and sector-specific offerings that are intriguing as well.

The SPDR Dow Jones International Real Estate ETF (NYSEARCA:RWX ) is the largest fund by assets focused on overseas REIT holdings. RWX has over $4.7 billion allocated to 136 foreign REITs, with the largest country allocations being Japan, United Kingdom, and Australia. The dividend yield on RWX is listed at 4.43% as of the most recent distribution.

Another top international competitor is the Vanguard Global ex-U.S. Real Estate ETF (NASDAQ:VNQI ). This ETF represents REITs in over 30 countries, which include both developed and emerging market names. The VNQI portfolio is also much broader, with 551 holdings representing $1.4 billion in total assets.

International REITs can be an excellent way to diversify your exposure outside of the U.S. dollar and into burgeoning real estate opportunities abroad. However, both RWX and VNQI have lagged their domestic counterparts this year in total return. RWX has gained 8.98% and VNQI has increased 6.91% halfway through 2014.

BlackRock also offers targeted regional international REIT exposure via the iShares FTSE EPRA/NAREIT Asia Index ETF (NASDAQ:IFAS ) and iShares FTSE EPRS/NAREIT Europe Index ETF (NASDAQ:IFEU ). Because real estate trends can develop in independent geographical areas, these funds allow you to hone in on more specific foreign countries according to your investment thesis.

If you want more targeted domestic REITs, the answer might lie in sector-specific offerings. There are several ETFs that are focused on industrial, residential, and retail companies that allow you to access opportunities in these niche areas. Each particular sector may perform better or worse than an aggregate index, such as VNQ, depending on the fundamental drivers for each theme.

For example, the iShares Residential Real Estate Capped ETF (NYSEARCA:REZ ) is an ETF that invests in only residential, healthcare, and public storage companies. It is currently sitting on a 2014 unrealized gain of 19.84%, which bests nearly every fund in its class.

The Bottom Line

The ETF universe has never been so inviting to income investors that are looking for diversified ways to enhance their portfolio yield. The plethora of options available allows you to hone in on the type and style of REIT ETF that meets your unique needs. In addition, many brokerage companies have several of these ETFs listed on their transaction-free schedules, which may help you decide which fund is most appropriate.

No matter how you slice it, REIT ETFs can offer uncorrelated returns with excellent yields during a surging real estate or falling interest rate environment.

Disclosure: The author is long VNQ. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: David Fabian, FMD Capital Management, and/or clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell, or hold securities.