The Impact Of An Inverted Yield Curve Yahoo India Finance

Post on: 16 Апрель, 2015 No Comment

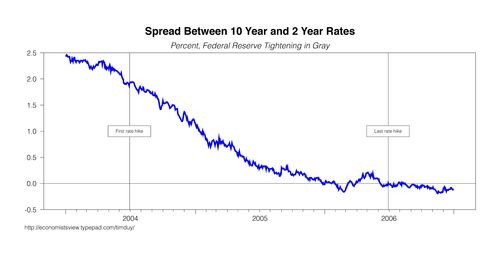

The term yield curve refers to the relationship between the short- and long-term interest rates of fixed-income securities issued by the U.S. Treasury. An inverted yield curve occurs when short-term interest rates exceed long-term rates. From an economic perspective, an inverted yield curve is a noteworthy event. Here we explain this rare phenomenon, discuss its impact on consumers and investors, and tell you how to adjust your portfolio to account for it.

Impact on Consumers

In addition to its impact on investors, an inverted yield curve also has an impact on consumers. For example, homebuyers financing their properties with adjustable-rate mortgages (ARMs) have interest-rate schedules that are periodically updated based on short-term interest rates. When short-term rates are higher than long-term rates, payments on ARMs tend to rise. When this occurs, fixed-rate loans may be more attractive than adjustable-rate loans.

Lines of credit are affected in a similar manner. In both cases, consumers must dedicate a larger portion of their incomes toward servicing existing debt. This reduces expendable income and has a negative effect on the economy as a whole.

Impact on Fixed-Income Investors

A yield curve inversion has the greatest impact on fixed-income investors. In normal circumstances, long-term investments have higher yields; because investors are risking their money for longer periods of time, they are rewarded with higher payouts. An inverted curve eliminates the risk premium for long-term investments, allowing investors to get better returns with short-term investments. When the spread between U.S. Treasuries (a risk-free investment) and higher-risk corporate alternatives is at historical lows, it is often an easy decision to invest in lower-risk vehicles. In such cases, purchasing a Treasury-backed security provides a yield similar to the yield on junk bonds, corporate bonds, real estate investment trusts and other debt instruments, but without the risk inherent in these vehicles. Money market funds and certificates of deposit (CDs) may also be attractive — particularly when a one-year CD is paying yields comparable to those on a 10-year Treasury bond.

Impact on Equity Investors

When the yield curve becomes inverted, profit margins fall for companies that borrow cash at short-term rates and lend at long-term rates, such as community banks. Likewise, hedge funds are often forced to take on increased risk in order to achieve their desired level of returns. In fact, a bad bet on Russian interest rates is largely credited for the demise of Long-Term Capital Management, a well-known hedge fund run by bond trader John Meriwether.

Despite their consequences for some parties, yield curve inversions tend to have less impact on consumer staples and healthcare firms, which are not interest-rate dependent. This relationship becomes clear when an inverted yield curve precedes a recession. When this occurs, investors tend to turn to defensive stocks, such as those in the food, oil and tobacco industries, which are often less affected by downturns in the economy.