The Highest Yielding Fixed Income Investments

Post on: 16 Апрель, 2015 No Comment

Please refer to our privacy policy for contact information.

Six Ways to Boost Your Portfolio’s Yield

In recent years, the extremely low rates on U.S. Treasuries and other lower-risk investments has fueled rising demand for high-yielding investments. Below are six ways that investors can boost their yields and overcome the low-rate environment. But beware: with higher yields also comes higher risk. Even if you need to boost your investment income, it isn’t worth excessive risks if you need to use the money soon, you’re depending on it for retirement. or you aren’t used to more volatile investments.

Two Ways to Find Yield

With that said, there are two ways to pick up higher yields in the bond market.

First, long-term bonds tend to offer higher yields than their short-term counterparts. The reason for this is simple: since more can go wrong with a bond issuer in a ten- to 30-year period than in a shorter interval, investors demand compensation for the added risk. Keep in mind, longer-term bonds tend to be much more volatile than shorter-term issues, so they aren’t appropriate for all investors.

In addition, there are times when long-term issues don’t offer much of an advantage over shorter-term bonds – a condition known as a flat yield curve. When this is the case, investors may not be getting appropriate compensation for the added risks of long-term bonds.

Investors can also find higher yields in the segments of the bond market that come with above-average credit risk. Five areas of the bond market that stand out for their ability to provide above-average yields:

Investment Grade Corporate Bonds

Corporate bonds are a lower-risk way for investors to pick up extra yield, especially if they focus on higher-quality and/or shorter-term issues. From 1997 through 2012, investment- grade corporate bonds averaged a yield advantage of 1.67 percentage points over U.S. Treasuries. The tradeoff for this higher yield is a higher level of risk than an investor would experience in Treasuries, since corporate are influenced by both interest rate risk (the impact of rate movements on prices) and credit risk (i.e. changes in the financial health of individual issuers).

Over time, however, investors have been paid for this risk: in the ten years ended on August 31, 2013, the Barclays Corporate Investment Grade Index produced an average annual return of 5.57%, outpacing the 4.77% return of the broader investment grade bond market, as gauged by the Barclays U.S. Aggregate Bond Index. Long-term corporate bonds performed even better, producing an average annual return of 6.82%. But always keep in mind that what the mutual fund companies tell us is correct: past performance truly is no guarantee of future results .

High Yield Bonds

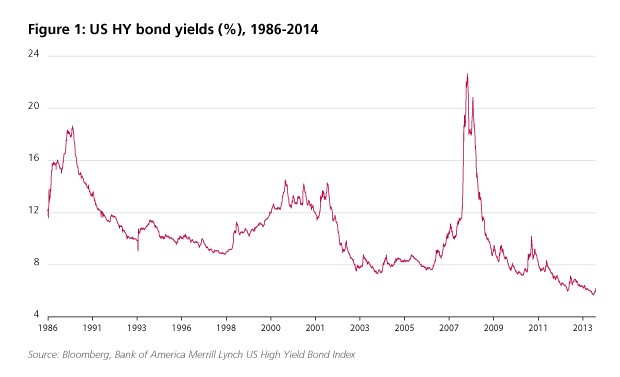

High yield bonds are one of the most risky areas of the bond market, and their volatility is often close to what an investor could expect from stocks. However, high yield bonds continue to be the one of the most sought-after investments among those who need to boost their investment income. From 1997 through 2012, high yield bonds have averaged a yield advantage of 6.01 percentage points over U.S. Treasuries. Their total returns have also been outstanding: in the ten years ended August 31, 2013 the Credit Suisse High Yield Index produced an average annual total return of 8.78%, over three percentage points better than the investment grade market and ahead of even the stock market, as gauged by the 7.11% average annual return of the S&P 500 Index. High yield bonds can therefore be one of the most important components of an income portfolio – as long as you’re comfortable with the risks.

Senior Bank Loans

Senior loans are a previously obscure asset class that is growing in prominence amid investors’ frantic search for higher-yielding alternatives. Senior loans, also referred to as leveraged loans or syndicated bank loans, are loans banks make to corporations and then package and sell to investors. Since the majority of these senior bank loans are made to companies rated below investment-grade, the securities tend to have higher yields than the typical investment-grade corporate bond. At the same time, senior loans typically offer a yield about 1-2% less than high yield bonds since the bonds themselves aren’t as vulnerable to default, and the funds that invest in this area tend to be less volatile than those that focus on high yield bonds. One of the most compelling aspects of bank loans is that they have floating rates. which provides an element of protection against rising rates. Funds that invest in senior loans can typically be expected to offer yields about two to three percentage points above broad-maturity U.S. Treasury funds.

Foreign Corporate and High Yield Bonds

Until just recently, there were very limited options to invest in corporate and high yield bonds issued by companies outside of the United States. Today, however, the demand for higher yielding investments has led to the birth of numerous mutual funds and exchange-traded funds dedicated to this space. The yields are high: funds this area will offer yields anywhere from three to six percentage points above U.S. government bond funds. But again, caution is necessary: the risks are high here, and when the markets are hit by broad economic concerns or major international news events, these funds will take it on the chin. Still, those who have a long-term time horizon and a higher tolerance for ris can take advantage of this relatively new and growing asset class to boost their income and augment their portfolio diversification.

High Yield Municipal Bonds

Investors in higher tax brackets have the option of investing in high-yield municipal bonds, which are the bonds issued by government entities with lower credit ratings. Funds that invest in this area will typically offer yields about 1.5 – 2.5 percentage points above funds that focus on investment grade munis (on a pre-tax basis). While volatility is higher in this area of the market, longer-term investors have been paid for the risks. Due in part to their yield advantage, high-yield munis have outperformed their investment-grade counterparts over the past decade. Learn more about whether this asset class is appropriate for your portfolio from my article, Are High Yield Municipal Bonds Right for You?

Finding Yield Outside of the Bond Market

There are also a number of high-yielding (and higher-risk) investments outside of the bond market, including:

- Convertible bonds

- Dividend-paying stocks

- Utility stocks

- Real estate investment trusts

- Master limited partnerships (MLPs)

- Preferred stocks

To learn more about these investment options, see my series of articles Investing for Income .

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Talk to an investment advisor and/or tax professional before you invest.