The High Cost of Low Interest Rates

Post on: 25 Июль, 2015 No Comment

by REIT Wrecks on October 4, 2011

T his is not my headline, but I wish I had written it. It comes from REBusinessOnline which recently published a story about Ethan Penner and his perspective on the commercial real estate market. Penners comments are consistent with my view that the stampede into primary markets and core assets is overdone. just like the stampede into the Sunbelt was overdone in 2007. To be sure, San Francisco (where I live) is seeing strong rent growth across the four major food groups, but some investors are paying up for Daly City and Santa Rosa as if they were Pacific Heights and Telegraph Hill.

The article, which you can read here. follows:

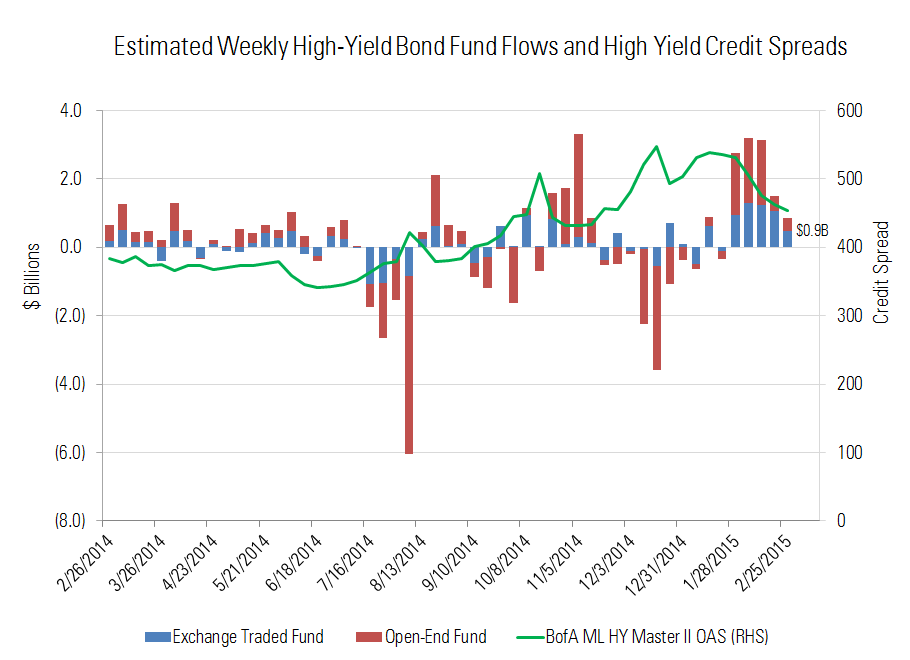

Today’s extremely low interest rates pose a danger to commercial real estate investors, particularly those with billions of dollars to deploy such as pension funds and sovereign wealth funds, warns Ethan Penner, founder and president of CBRE Capital Partners. In order to receive a reasonable rate of return, these investors are being “crowded out” of low-risk investments and forced into high-risk investments.

The 10-year Treasury yield, a benchmark for commercial real estate finance, currently is hovering around 2 percent, not far from its record low.

“There is almost no way to invest large amounts of money in today’s market — specifically in today’s real estate market — and not be set up for a major disappointment sometime soon,” remarked Penner during his keynote address at the Commercial Real Estate Investment & Finance 2012 conference. Law firm Morris, Manning & Martin along with France Media’s InterFace Conference Group hosted the day-long event at the Grand Hyatt in Atlanta.

“The major disappointment may take the form of economic non-recovery, it might take the form of very, very high interest rates, which will render your returns very, very inadequate,” explained Penner. “I don’t know what [factor] it is going to be, but I can tell you the byproduct of investing money today for most investors is going to be a lot of crying going forward.”

A disconnect among investors only compounds the problem. Some fund investors, for example, seek low-risk properties that generate double-digit returns. But those returns are more representative of value-add or opportunistic deals.

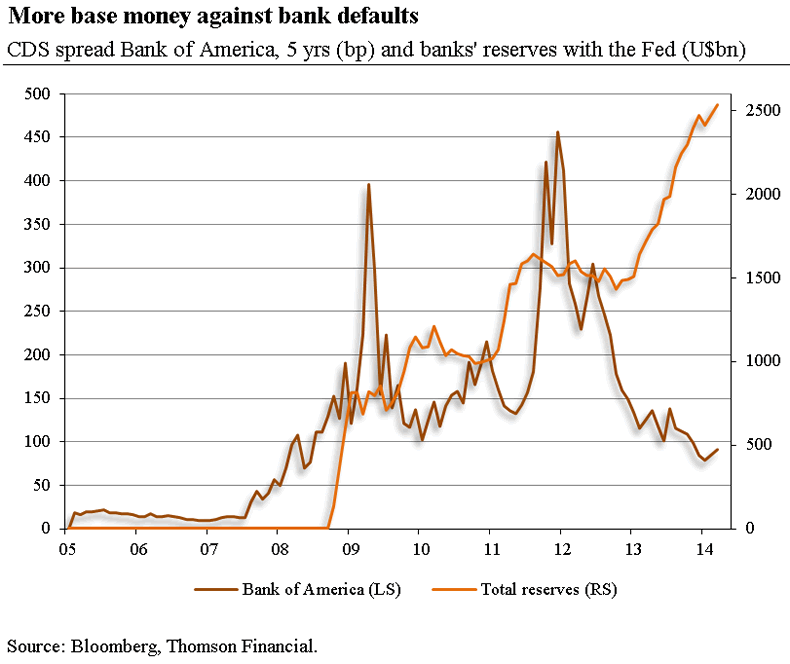

Penner, a pioneer in the commercial mortgage-backed securities industry who served as CEO of the Capital Company of America/Nomura Capital from 1993 to 1998, said the federal government has engaged in a misguided effort the last few years to bail out the banking system. In his view, government has acted on the belief that in an overleveraged world saving creditors is important.

“Obviously they are wrong. [The government] should have been saving the debtors, not the creditors,” argued Penner. “If we had taken the couple trillion dollars that we wasted trying to prop up the creditors and deleveraged the debtors, we’d already be in a recovery. It’s so obvious that it’s kind of amazing that nobody figured it out.”

Penner supports the idea of providing mortgage debt relief for homeowners. “That could be something that catalyzes a recovery because it’s obvious that it’s needed.”

Who is paying the bill for the efforts to prop up the banking system through low interest rates? The most obvious group is savers, explained Penner, “because people who are older, who are retired, and who were expecting to be able to invest their hard-saved money at a very low-risk investment at a certain rate of return to live a certain way of life are screwed beyond belief.”