The Future of Qualcomm s Stock (QCOM AAPL )

Post on: 16 Март, 2015 No Comment

New technologies tend to have long development spans. For Qualcomm, Inc. (QCOM ), the research and development (R&D) time horizon is eight-10 years. However, these technologies often have shorter adoption rates, and many analysts and consumers believe products become obsolete within a fraction of the R&D timeframe. These new development cycles spur the implementation and adoption of new technologies. They also drive earnings and stock prices. Let’s take a longer look at Qualcomm and how it is positioning itself against this backdrop.

Business Overview

QCOM is a technology provider for mobile voice and data applications and is a leader in Code Division Multiple Access (CDMA), which according to QCOM’s latest annual report with the Securities and Exchange Commission, “is one of the main technologies currently used in digital wireless communications networks.” The company is also in the middle of developing and marketing Orthogonal Frequency-Division Multiple Access (OFDMA) technology that, along with Long-Term Evolution (an OFDMA-based standard for cellular wireless communication applications), has seen significant growth in wireless devices. QCOM also licenses their intellectual property (IP) portfolio, which includes various patents related to wireless products.

How QCOM Makes Money

QCOM has three lines of business, although only two reporting segments: QCT (Qualcomm CDMA Technologies) and QTL (Qualcomm Technology Licensing). The third business line, QSI (Qualcomm Strategic Initiatives), makes strategic investments but does not generate revenues. Descriptions of the three segments below are taken directly from the company’s annual filing:

- QCT is a leading developer and supplier of integrated circuits and system software based on CDMA, OFDMA, and other technologies for use in voice and data communications, networking, application processing, multimedia, and global positioning system products. This segment’s revenues have increased as a percent of total revenues from 60 to 70% over past three years. Despite the high percentage of revenues, the earnings before taxes (EBT ) represent only 20% of revenues.

- QTL grants licenses or rights to use portions of the intellectual property portfolio. This segment has represented between 27-33% of revenues over the past three years and has been declining as a percent of revenue, but its EBT as a percent of revenues is in the high 80s. (This demonstrates that although it does not generate the largest percentage of sales, its profits are extremely high and represent most of the profits for the company.)

- QSI makes early-stage strategic investments focused on opening new or expanding opportunities for Qualcomm’s technologies and supporting the design and introduction of new products and services (or enhancing existing products or services) for voice and data communications. This segment has not generated any revenue.

Qualcomm’s revenues do experience some seasonality with a higher proportion recognized during the last calendar year quarter (during the holiday season) for QCT and during the first quarter of the calendar year for the QTL division. (This is important to note when comparing quarter-over-quarter revenue growth.) China, South Korea, and Taiwan historically have and continue to be the largest markets for this company (between 95-99% of revenues over the past the years) due in part to the location of global device makers such as Samsung Electronics Co. Ltd. (OTC:SSNLF), Hon Hai Precision Industry Co. Ltd. (OTC:HNHPF), and other Apple, Inc. (AAPL ) suppliers that contribute 10% of revenues. (This can be a big risk if a country or company experiences some difficult economic conditions.)

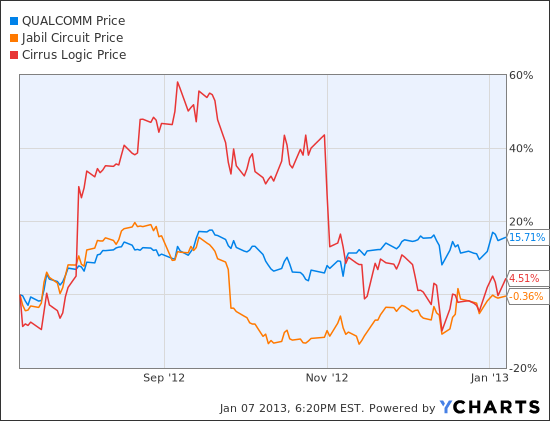

Stock Performance and Outlook for Growth

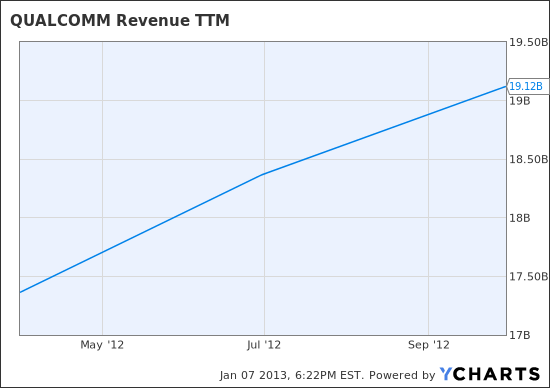

For Qualcomm’s stock to reach an expected five-year compounded annual revenue growth rate of 8-10%, it is dependent on opportunities in smartphones, growth in emerging markets, and future anticipated growth in new markets (tablets, as well as connected car and server data center markets).

Expected growth has been important in driving QCOM’s valuation and stock price. Historically, the stock trades at an average price-to-earnings (P/E) multiple of 17x. According to its annual filing, the company sees growth through 2018 due to the following:

- As of September 2014, 3G/4G connections globally (CDMA-based, OFDMA-based and CDMA/OFDMA multi-mode) represented nearly 40% of total mobile connections, and by 2018, 3G/4G connections are projected to surpass 5 billion globally. That is a 79% increase over the four years. Approximately three-quarters of this growth is expected in emerging markets.

- Smartphone shipments between 2014 and 2018 are projected to increase from 1 billion to 8 billion.

- QCOM has invested and will continue to invest heavily in the R&D of many cellular wireless communication technologies, including CDMA and OFDMA, to meet demand for data services and applications to improve user experience, enable new services, increase network capacity, make use of different frequency bands, and enable dense network deployments.

Coming off of a great performance in 2013 (during which there was a strong smartphone cycle), the company is resetting itself to a more normalized level through 2015. If the forecasted growth materializes, QCOM’s stock should see its valuation multiple either remain constant or expand. If the growth is less than expected, its multiple may contract, reducing its valuation and stock price. An additional stock driver may be on the cost side as the company expects EPS to outgrow revenues due to lower operating expenses.

Obviously there are risks that the stock may decline if earnings miss projections. These risks are centered on its three biggest markets (China, South Korea, and Taiwan) and its largest end clients (Samsung and Apple). Another risk is the expansion into new and developing technology markets. Lastly, it is important to bear in mind that the smartphone cycle is in the later stages.

Qualcomm is in a competitive market where new technology adoption cycles propel earnings and stock prices. There are numerous risks related to market expansion and new market opportunities over the next several years that need to be considered before investing in Qualcomm stock. The valuation (particularly the multiple like P/E) reflect these opportunities going forward. Whether the opportunities miss or meet expectations impact the multiple (expansion or contraction) and the stock price.

Disclosure: The author own shares of Apple.