The Foreign Tax Credit

Post on: 10 Май, 2015 No Comment

If you work in a state other than the one where you live, and if both states impose income taxes on earned income, then you should be familiar with the concept of a foreign state tax credit. The state where you live will give you a credit for the taxes paid to the state where you work. And, in most states that impose an income tax, any investment (or similar income) is only subject to tax in the state where you live. If you live in a state with higher tax rates than the one where you work, you will end up paying the higher tax on your earnings even though you get a credit for the taxes paid to the other state. And, if you live in a state where the taxes are lower than the state where you work, you will only get a credit for the taxes you would owe on that same income in the state where you live. In other words, the tax credit wont equal the amount paid to the other state. Either way, the credit will be less than the taxes imposed by the state with the highest tax rates.

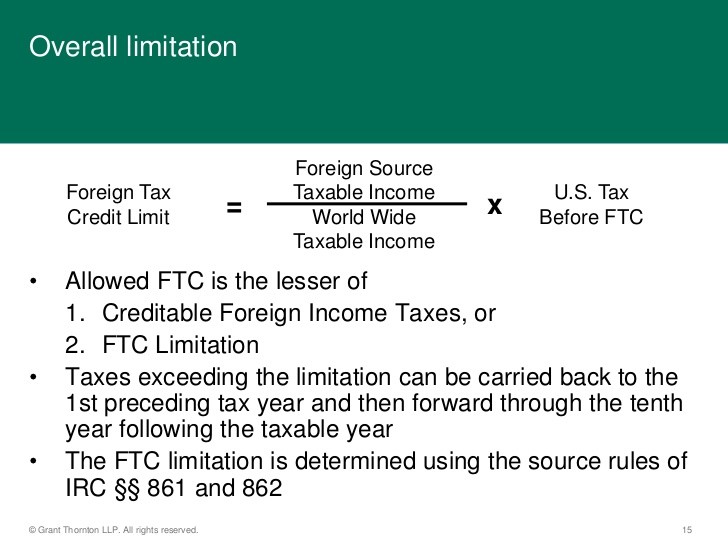

The major industrial countries of the world have adopted similar rules for citizens (and businesses) that work in multiple countries. The U.S. tax code provides for a tax credit for taxes paid to other countries — but only up to the amount of taxes that would have been paid to the U.S. on the same income. In countries that impose high rates of tax on earned income, the foreign tax credit may be a better option than the exclusion on foreign earned income.

For example, country X may impose an average tax rate of 40% on your earnings, but the U.S. might impose an average tax rate of 30%. The foreign country might therefore impose taxes of $40,000 on $100,000 of earnings. If the U.S. taxes those same earnings at an average rate of 30%, the tax would be $30,000. You can therefore offset your U.S. tax 100% by $30,000 of tax paid to country X, but your total taxes are still $40,000. Your other choice is to elect the $80,000 foreign earned income exclusion. and to pay U.S. taxes on the other $20,000. The foreign tax that would be imposed on the income that is excluded from tax in the U.S. is not allowed as a tax credit. But you would still get a credit for the foreign taxes paid on the $20,000 of other income.

Basically, you could still end up paying $40,000 to country X and zero taxes to the U.S. but other combinations of tax rates between the two countries could produce different results. Generally, if the U.S. tax rates are higher, the foreign earned income exclusion is better than the foreign tax credit.

The U.S. foreign tax credit is not limited to taxes on earned income. As an investor, you may be subject to taxes in various foreign countries on your investment income. real estate gains or other capital gains. You can claim a credit to offset your U.S. taxes for the taxes paid to foreign countries — but not in excess of the taxes you would pay on the same income in the U.S.

The 1997 tax law introduced a simplification provision for those with a small amount of foreign taxes. Sometimes, a U.S. mutual fund with foreign investments will pay taxes to foreign countries and those taxes are passed through to you as a shareholder so that you can claim a foreign tax credit on your tax return. The problem is that a small amount of foreign tax credit can increase your tax preparation fees by more than the total tax credit because of the long and complex formula used to compute the limitation on the credit. The 1997 tax law allows individual taxpayers to bypass the limitation formula if their foreign tax credit is not more than $300 — or $600 on a joint return and if the affected income is entirely from passive investments.

To the extent that you are doing business in a foreign country and find yourself having to pay a value added tax (VAT), the U.S. does not consider the VAT to be the equivalent of an income tax. The tax is deductible as an expense but a VAT can’t be used to claim a foreign tax credit.

U.S. persons who form foreign corporation to invest in foreign securities will not be able to claim a foreign tax credit paid by their foreign corporation, even though they may be required to pay U.S. income taxes on the income of their foreign corporation. This is just one of many nasty traps that lie in wait in the tax law for those who venture offshore without competent help to anticipate the tax problems and to find better ways to structure their foreign investments.

Extensive additional information about the foreign tax credit and related topics is included in the Offshore Tax Seminar Manual. co-authored by Richard Duke and myself.

Van Jacobs

(C) Copyright, 2004, Vernon K. Jacobs, All rights reserved.