The Effects of Quantitative Easing

Post on: 16 Март, 2015 No Comment

You have probably heard that the massive inflation of the money supply through Quantitative Easing is going to result in hyperinflation or at least massive inflation. But so far that hasnt happened. As a matter of fact since the end of QE2 in June of 2011 inflation rates have fallen from 3.63% in July 2011 to 1.41% in July 2012. How is that possible? The first reason is that the FED is playing a game with the banks. The FED loans money to the Banks at nearly Zero percent interest the Banks turn around and loan the money to the Government at 3% interest to finance the deficit. This gives the banks plenty of profit to shore up their sagging balance sheets.

But there is another reason that QE1 and QE2 didnt result in massive inflation .

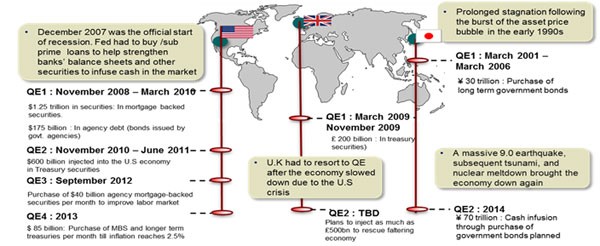

QE1 lasted from from November 25th 2008 through March 31, 2010 and the FED started by purchasing $500 Billion in Mortgage backed securities. Most of these securities were virtually worthless at this point. But just a few months earlier they were considered part of the larger money supply. The owners of this junk (when it was fully valued) assumed they had assets worth billions. But as the market realized that it was worth much less, so those billions in assets evaporated. So when the FED bought them they were simply taking assets that were worth billions a few months before and putting that money that had evaporated back into the economy. While putting worthless securities onto their balance sheets.

In March 2009, the FED announced that it will purchase another $750 Billion in junk mortgages (Mortgage Backed Securities) but the inflation rate is still heading down. So the FED buys another $100 Billion in Fannie Mae and Freddie Mac debt and then resorts to old fashioned money printing methods by buying $300 Billion in Treasury Securities.

So in effect the FED bailed out the owners of this junk debt and pumped up the money supply at the same time by converting worthless junk into valuable greenbacks. At that point the FED had purchased 1.25 Trillion in Mortgage Backed Securities and $175 Billion in Agency debt.

If we look at this chart of the inflation rate we can see the effect that this accounting magic had.

Click Chart for larger Image

See Current version of this Annual Inflation Chart

From the chart we can see that for the first half of QE1 the inflation rate continued downward as more money was being destroyed (through the stock market crash and other asset depreciation) than was being created by the FED. Finally, in July 2009, the asset destruction was over and the inflation rate bottomed at a deflationary -2.10%. From there the second half of QE1 pumped up the inflation rate to almost 3% for a net gain of almost 5% (from -2.10% in July 2009 to 2.72% in December 2009 = 4.82% ).

But as soon as the Quantitative Easing peters out the Deflationary forces take over again and the inflation rate falls once again to just over 1% where it stays from June through December of 2010. At that point the FED gets nervous again and starts QE 2.

This time rather than buying junk mortgages, the FED buys $600 Billion of longer term Treasury Notes. This pumps up the inflation rate to almost 4% but once again when the FED turns off the spigot deflationary forces take over once again and inflation falls to 1.41% in July of 2012. In August the FED announces that it will begin another round of Quantitative Easing (QE3).

Back in 2008 I said that QE1 might not actually be inflationary and I thought I would get Lynched for such heresy, but it turns out that is exactly what happened. See my 2008 article: Will the $800 Billion Bailout Cause Massive Inflation?

Sometimes the effects of an increased money supply take time to show up in the economy but in this case it appears pretty obvious what the effects of Quantitative Easing were.

Use our custom search to find more articles like this