The Economy s Worst Enemy Now Is Demographics (and It s About to Be Our Best Friend)

Post on: 16 Март, 2015 No Comment

Conor Sen Jan 15 2013, 1:13 PM ET

America is getting older, but in the next 15 years, we could hit a sweet spot, where Baby Boomers spend down their retirement savings and younger workers take on debt to buy homes and cars

20men%20snow%20father%20son%20parents%20demographics.jpg /%

Reuters

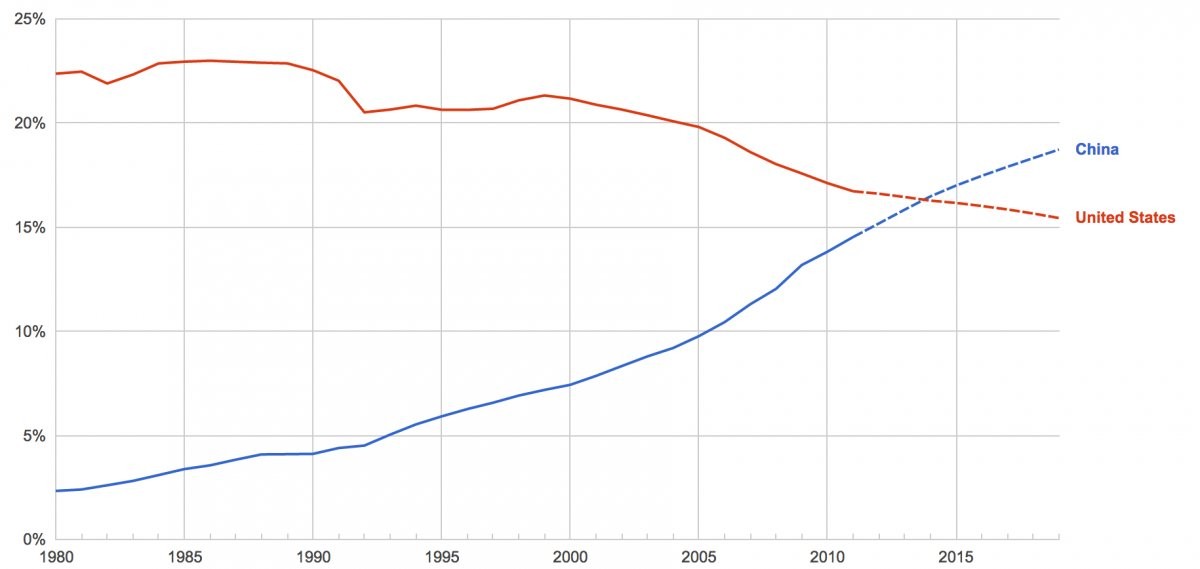

More than China or software, it’s demographics that poses the deepest threat to the U.S. economy today. But despite widespread fears that the economy will calcify under an aging population, there are good reasons to think that we’re in a unique and temporary demographic downturn. A grayer country could actually mean a stronger U.S. economy.

To understand why, you have to understand how one statistic has practically determined the course of the 20th century: The average age of the Baby Boomers. This was a huge, huge generation. This chart from the Census showing the U.S. population by age shows you just how much bigger they were than any generation before them — and how the youngest generation will barely replace them.

After World War II, some economists feared the U.S. would suffer a deep and protracted slump. Instead, the 1950s and 1960s witnessed historic growth. We needed houses to shelter young Boomers, and public infrastructure — roads and schools — to support them. The 1980s boom wasn’t Reagan Magic. It was the inevitable result of Boomers pouring into the labor force, settling down and starting families. Boomers entering their peak earning-, investing-, and home-buying years drove the stock market explosion in the 1990s and the housing boom in the 2000s.

But Boomers aren’t just big. They’re also getting old. Now in their late 50s and 60s, they’re rounding out their careers and saving for retirement. Fiftysomethings and sixtysomethings are the country’s champions of saving money, since they’re on the cusp of retirement. Boomer fifty- and sixtysometings are especially keen to save, given that they just lived through an asset bubble. For each near-retiree, saving lots of money and transitioning your assets to lower-risk investments makes sense. For the country, it’s a recipe for slower economic growth — the paradox of thrift writ large. And the generations behind the Boomers aren’t making up the difference. Millennial job prospects are still weak and Generation-Xers are freaked out by the example set by over-spending Boomers.

This all sounds like terrible news. And it is. For now. But it’s about to change for the better. After Boomers retire, they’ll become net spenders. Their savings rate will turn negative, and the government will be sending them a monthly check and paying for healthcare costs. Meanwhile, younger, more spend-happy workers will be taking their jobs and buying houses and cars with the income. This new era of retiring Boomers being replaced by Millennials will last for at least 15 years.

It could be a 15-year renaissance for the consumer economy.

There’s another catch. The Boomers’ retirement might represent a structural peak in the workforce. As the largest generation of its time rides into the sunset, the share of Americans who are working will decline. Most economists tend to think that a declining participation rate leads to less total income and slower growth. Perhaps they’re right.

But a stagnant labor pool could be good news for workers — especially workers who can’t be replaced by overseas labor and machines. In other words: local service workers, particularly in the health care sector. Rising health-care spending and a relatively small pool of labor should lead to rising wages for these workers, as they’ll be fought over like a Black Friday sale. It could even lead to companies investing more in training workers to fill much-needed positions, changes in attitudes towards immigration, and new protections for part-time workers.

If economics is the dismal science, demographics has been the dismal math for the United States recently. But we’re in a unique trough today. In the next 15 years, as Boomers spend their savings and Millennials borrow for their future, the American worker could get something that has been all too scarce in the last few years — an assist from Father Time.