The Diversified Portfolio Index

Post on: 14 Июнь, 2015 No Comment

Most Popular Commentaries

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

Investment rates of return that are average but consistent are the products of exceptional performance. Over longer time horizons, these returns become increasingly difficult to outperform. One such example is the Diversified Portfolio Index a buy-and-hold strategy deployed across all major asset classes.

After 40 years of working on Wall Street, absorbing all the data and information I could consume on the subject of investing, I found it did not provide me with the knowledge required to be a successful long-term investor. The anticipated wisdom from all this knowledge and data remained elusive. In time, the en vogue investment styles and asset classes eventually succumbed to mediocrity, or worse, total collapse.

Although many post highly successful trades for some time, almost all investors ultimately face a few bad trades, resulting in very mediocre overall performance. Even after picking a series of securities that work well, an active trader continues to make trades until reaching the point where doing nothing would be better.

Even hindsight could not provide me with a particular style that would have provided better-than-average performance for a portfolio invested in a particular asset class. While equities were favored for the long run up to 2000, an investor would yearn to have been in bonds during the poor stock performance since 2000.

The problems of where to be and how to invest going forward remained mysterious to me, no matter how long I was in the investment business.

The Diversified Portfolio Index

Then, I accidentally came up with something smart. Past performance and hindsight revealed the investment solution: a simple asset allocation methodology for an investment portfolio that can be used effectively by the common individual investor. The answer was the Diversified Portfolio IndexTM (DPI).

Own everything all asset classes. The average growth rate of the DPI, containing all the investment asset classes, provided a rate of return that I originally suspected would outperform most investment funds most of the time. After analyzing historical data, it became clear that there is enormous value to the DPI methodology. The average growth rate of the DPI produced returns that exceeded most investment funds all of the time.

I compared the results of the DPI to those of the mutual fund universe. The average annual performance of the DPI was typically over the 50th percentile (arithmetic mean is higher than the median), outperforming most of the individual funds in each year. By consistently achieving the average rate of return year after year, the DPI shows truly exceptional performance. This cumulative long-term result generates superior relative performance, doing better each year compared to competitors, as time goes on.

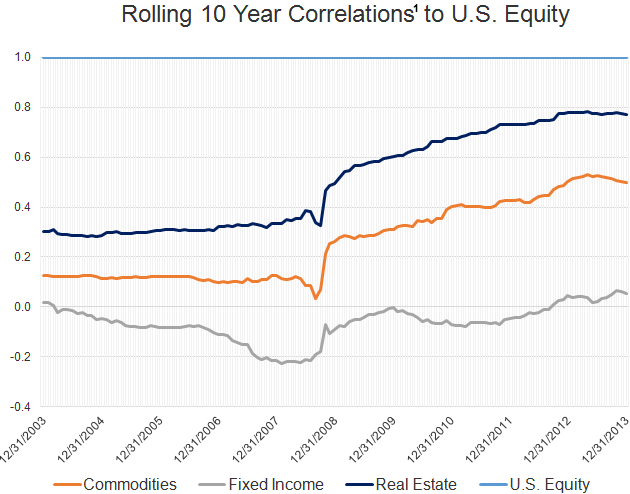

If it is to be believed that the investment markets are efficient and that no one can beat the markets in the long run, then one should simply own all the markets: U.S. stocks, international stocks, bonds, real estate, and precious metals and commodities. If all markets are represented by a haystack, and you are always trying to find the needles in that haystack to own in a portfolio, then you should buy the haystack to own all the needles.

This is accomplished by first defining an encompassing diversified asset class mix, which represents all investment markets, and then securitizing this with a spectrum of exchange-traded funds. The DPI achieves this. The asset allocation, which I determined based on my personal experience, is summarized here.

Asset Allocation of the