The deleveraging process is inevitable

Post on: 29 Июль, 2015 No Comment

blogs.ft.com/economistsforum/2009/07/the-cautious-approach-to-fix. ) — stimulated me to raise a fundamental issue that is preoccupying me as the crisis unfolds and to which I don’t have an answer. The standard orthodox prescription-suggested by Martin, Krugman and others- is to contain the systemic banking sector crisis with a set of comprehensive policy measures that include a rigorous assessment of major banks’ balance sheets, removal of non performing loans from banks’ balance sheets, and banks recapitalization. Virtually all the analysts point out the specter of the Japanese lost decade, and applicable lessons for the recent US crisis. Recently two papers address the Japanese crisis: Lessons from Japan’s Banking Crisis, 1991-2005 by Mariko Fujii Research Center for Advanced Science and Technology University of Tokyo and Masahiro Kawai, Asian Development Bank Institute (www.finance.group.cam.ac.uk/. /HartProgrammeConsolidatedDraft2009v4.pdf ), and Hoshi Takeo and Anil K Kashyap. 2008, “Will the U.S. Bank Recapitalization Succeed? Lessons from Japan”, NBER Working Paper 14401, Cambridge, Massachusetts: National Bureau of Economic Research (www.nber.org/papers/w14401 ). The Fujii-Kawai paper concludes with the following: “Acknowledging the extent and depth of the bank balance sheet problem—potential loan losses—is the first step toward resolving a banking crisis. In this regard, once the government determines a rough estimate of the size of the crisis, prompt action to recapitalize the banks that are viable, but are under-capitalized is an effective measure to restore market confidence and stabilize the banking system. Then removal of impaired assets from bank balance sheets is the next step..”

In reading the Fujii-Kawai paper I find some of the data striking. First, a chart that points out that the Urban Land Price dropped from an Index of 400 in 90′ to 100 now. Similarly, the concentration of bank lending in real estate was very high. In Japan’s lessons for a world of balance-sheet deflation Tuesday, February 17th, 2009 Martin cites an analysis of what happened to Japan is by Richard Koo of the Nomura Research Institute; The Holy Grail of Macroeconomics: Lessons from Japan’s Great Recession (Wiley, 2008) and discusses the deleveraging process of balance-sheet financed by debt. Following the unfolding of the US bubble in real estate, in makes me far more sympathetic and understanding of the Japanese authorities’ dilemma in the early 90′. Intervention — assessment of major banks’ balance sheets, removal of NPLs from bank balance sheets, and bank recapitalization— at any point in the early 90’s was equivalent trying to catch a falling knife. Not sure that no amount of intervention can stop the deleveraging process. My take from this data is fairly straightforward- the process of de leveraging and accrual of bad debt is dynamic, and creates a vicious cycle, and no amount of government intervention would have or should have tried to stop the market forces and de leveraging process.

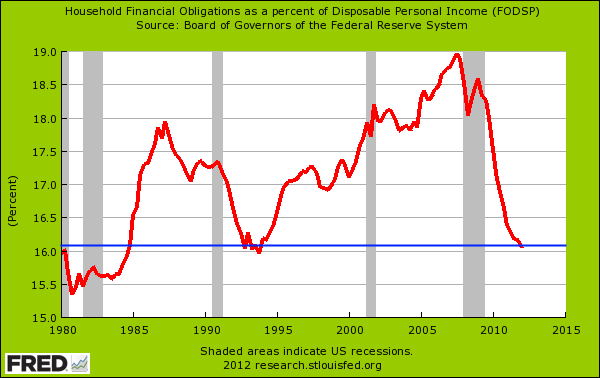

It leads to the following question- what does Japan’s “lost decade” teaches us? While the standard prescription to intervene promptly is very nice to present, maybe we need to turn things upside down, and look at them in a different light. In a recent talk on the mitworld.mit.edu/video/650 ). In the US, Zillow Real Estate estimates that the downturn in home prices has left about 20% of U.S. homeowners owing more on a mortgage than their homes are worth ( www.reuters.com/article/. /idUSTRE5450XN20090506 ). We are in a vicious cycle, with more houses getting foreclosed and coming on the market, leading to more price declines. A similar deleveraging process has to take place in commercial real estates, such as retail. Deutsche Bank has recently released sobering estimates regarding the prospective losses in commercial real estate. Equally, in light of the lost real estate and equities wealth, the household sector has to deleverage. Defaults in consumer credit are likely.

The evidence leads me to my counterfactual question- Can the deleveraging process be stopped through fiscal interventions? Admittedly, it will be interesting to quantify the losses and calculate the costs of intervention to assess if intervention is feasible by looking at the aggregate numbers before answering the question. I have not analyzed the aggregate numbers for the US, UK or Spain. But I doubt intervention is feasible. So maybe we need to drop the orthodox prescription to contain this systemic banking sector crisis, such as:

- Rigorous examinations of the credit quality of the major banks’ balance sheets, such as the US government’s stress tests, are a pointless exercise when credit quality continues to deteriorate;

- Removal of non performing loans from bank balance sheets is pointless because it addresses the present stock of non performing loans and not the flow; and

- Bank recapitalization is ineffective when the flow of non performing loans will lead to future losses.

My sense is that in the US, even if intervention on the order of magnitude required was feasible (and I doubt it), the political will, financial resources, and economic wisdom to intervene to offset the assets and wealth losses are simply not there. So as painful as it is, maybe the leveraging process has to proceed and the government should stand-by ensuring only the payment system, and facilitate the deleveraging process.

I realize that those conclusions are unconventional. Comments are welcomed.