The Causes and Consequences of the Subprime Mortgage Financial Crisis

Post on: 8 Июль, 2015 No Comment

by Silicon Valley Blogger on 2007-09-28 37

This is probably the umpteenth article Ive written about the subprime lending mess and for some reason, I still find something else to say about it. It seems that nary a day goes by without some mention of the doom and gloom hitting the property market.

In the past, I covered the causes of this crisis at the personal level with stories from people whove lost out. This time, I wanted to cover the causes at the macro level as well as the subsequent fall out from this situation.

Lets start with this question: Do any of these people look familiar?

- You have debt and want to borrow money.

- You are a house bubble sitter, one whos waiting for the chance to buy at lower home price levels.

- You need to refinance your mortgage.

- You are an investor in the stock market.

- You are an investor in the real estate market.

- You are a homeowner.

If you see yourself in any of these people, youre in good company. It looks like weve all taken a hit by subprime lending gone sour. Whether we like it or not, current real estate woes are actually affecting the lot of us more than any of us realize.

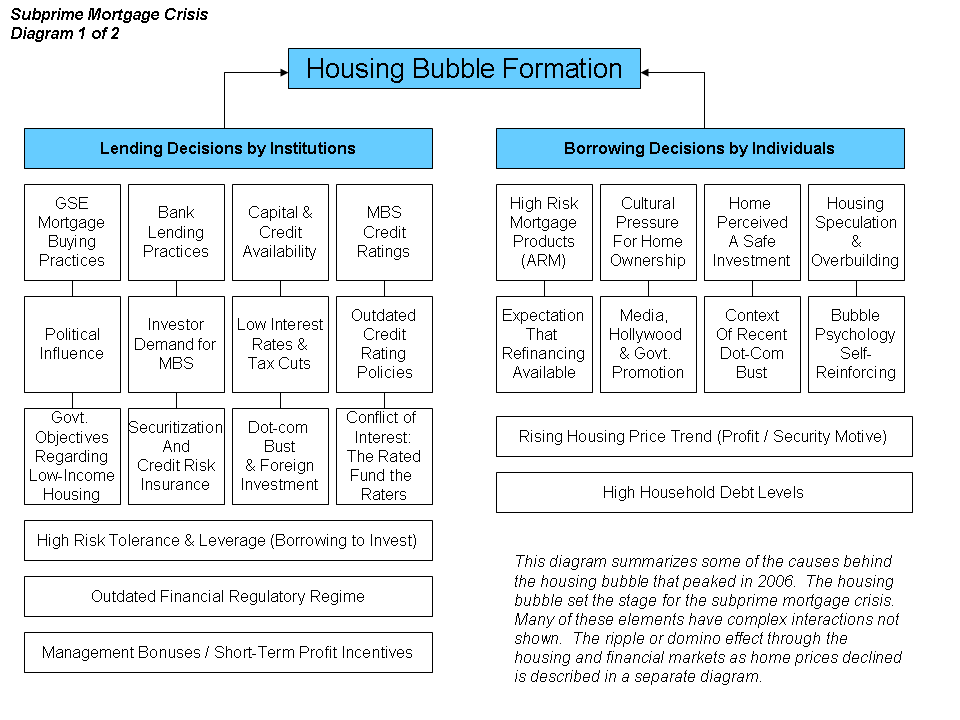

To understand the effects of the bust, lets see how this supposed financial contagion has transpired. Its all cyclical you see, since it starts right after the last bubble bursting episode in March 2000.

How The Housing Boom Unraveled

In short, this is what happened: the 2000 dot com bust led to a mild recession which subsequently led the Federal Reserve to cut rates low enough. These actions triggered borrowing and cheap money to fuel asset inflation and housing prices eventually heated up. After many years of this, the usual complacency and desire to keep the bubble going caused folks in the lending industry to resort to exotic loans and riskier practices. Credit got looser, enticing less qualified people to become heavily leveraged homeowners.

I remember how a few of my friends happily overextended themselves to own their half million-to-million dollar homes by cobbling together several loans to make it work. Things worked out for them since their homes are now valued at 50% higher than what they originally bought them for, so theyve been rewarded for taking the risk. They were the lucky ones even as the financial climate changed and the central bank reversed its course by raising rates. Those less lucky who were carrying risky loans started to feel the squeeze, causing them to default on their mortgages and eventually foreclose.

Without expert photoshop skills to aid me, heres my attempt at describing how the ugliness transpired:

risky loan products got eliminated > hedge funds were hit (as they held suddenly cheaper mortgage-backed securities) > home sales declined > people panicked and at the end of it all > the stock market did tank (though it has bounced back since, in reaction to the last rate cut).

This is yet another cycle of boom to bust. With history repeating itself, it shouldnt be a massive surprise. In fact, its said to be a good thing for its financial health restorative effects.

So whats next for us? Weve got to live with some changes now. And they appear to be across the board.

The Consequences of The Subprime Collapse

Credit got tighter.

With interest rates higher, money just got more expensive to borrow. There are also tighter restrictions for getting loans: you need a higher down payment to qualify for a loan plus you need to have very good credit to get a good mortgage deal these days. A friend of mine who is a real estate investor is not thrilled by these developments at all. He tells me stories of people with perfect credit who are now at the brink of foreclosure due to tighter rules or unlucky circumstance. These people have upside-down homes that are now cheaper than their purchase price and are therefore unable to find refinancing for their adjustable rate mortgages due to stricter refinancing terms. Since they are unable to refinance, they become stuck with existing mortgage payments that simply grow larger with interest rate hikes. When payments become prohibitive, they are forced to default.

Buying a house got tougher.