The Best Stock to Profit from the Income Inequality Market

Post on: 28 Май, 2015 No Comment

Bret Jensen August 7, 2014 Comments Off

“Wealth Inequality” has been one of the main topics of conversation among the media and political pundits throughout 2014. Unfortunately, given we have over three months to the mid-terms; this is likely to remain a core theme among both among political commentators and other talking heads throughout the rest of the year.

I do not want to get into the politics as the divergence between the income classes has been taking place slowly for over three decades now and even has accelerated over the past five years during a progressive administration. I do want to discuss one of the core causes of the angst caused by this wealth inequality and why this varies by income classes as I believe it is relevant to the markets and equities.

In my mind there is a little discussed chasm between socioeconomic classes and the differences between their perceptions and the reality of inflation. There are good reasons for these different views. It is also why many individuals dismiss the Federal Reserve metrics around inflation as woefully low.

If you occupy the lower or middle class, a greater portion of your income is very likely to go to items one uses every day. These include gas for your car, groceries, rent, education and even the cable bill. The very items that have seen much greater than the overall inflation rate over the past few years. In addition, as job growth has remained tepid since the recession ended in June 2009 wage growth has barely kept up with the headline inflation rate.

If one is fortunate enough to occupy the upper income or wealthy part of society, it is a completely different story. More disposable income here is spent on big ticket items likes computers and other consumer electronics; the very items that are experiencing deflation. In addition, thanks to historically low interest rates, those with good credit and a healthy income can finance other big ticket items like automobiles and homes at historically low levels.

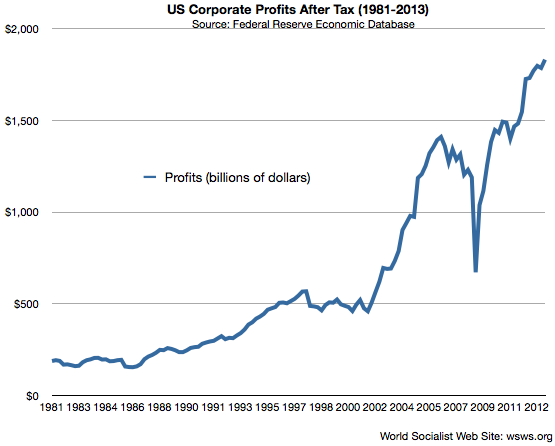

Furthermore, thanks partly to Federal Reserve policies the period of the last five years has seen significant rises in real estate and the equity markets; the vast majority of these gains have flowed to those in the top 10% of socioeconomic ladder. While the bottom two thirds of society are seeing significant every day price inflation, those at the top are benefiting from asset inflation as well as falling prices or easy financing of bigger ticket items.

This chasm is showing up in many aspects of our economy such as retail. At the low end Walmart (NYSE: WMT) has had five straight quarters of declining same store sales domestically. The second largest discounter, Target (NYSE:TGT), is also struggling mightily. Even the dollar stores that did so well in the recession are under such pressure that they have started to unleash consolidation in the sector as Dollar Tree (Nasdaq: DLTR) and Family Dollar (NYSE: FDO) are combining. Even McDonalds (NYSE: MCD) is struggling to produce any kind of domestic same store sales growth despite an extensive value menu.

On the other end of the spectrum are retailers that cater to higher end clientele like Michael Kors (Nasdaq: KORS) and Tiffany (NYSE: TIF) that are doing very well even in an economy that is mired in 2% annual GDP growth. (A few other companies and sectors are able to achieve this growth despite dwindling incomes like KORS and TIF. This entertainment company is one of them.) This divergence between different income stratum is not a new theme. This has been playing out for years and it is the primary driver of performance differences between the retailers serving upper income consumers versus those that serving the middle and lower end over the past two years (See Chart).

In the new economy those who can afford to spend more, do. And those who cant, dont. Companies catering to that second group are struggling mightily.

You can also see this divergence in the breakdown of auto sales. AutoNation (NYSE: AN) in its last reported sales month saw both domestic and import sales climb around 6% year-over-year. Luxury sales however were up a whopping 17% year-over-year.

This is one reason I have a significant investment in Ford (NYSE:F). Over the next 12 months the American manufacturing icon will have the busiest roll-out schedule in its history. Most of these models are geared to a higher end market including its new all-aluminum bodied F-150 truck series. This new truck series will have significantly higher price points than previous models – and have higher insurance rates due to the expense of repairing aluminum compared with other materials, will get much better gas mileage and should re-establish Ford’s market share lead in this high margin segment of the domestic vehicle market.

Ford is also benefiting from the growing income levels of lower and middle class consumers – in China. Sales through joint ventures in the Middle Kingdom are up more than 25% year-over-year and the company is now selling 100,000 vehicles a month in this increasingly important market. Ford shares are also selling at a deep discount to overall market multiple at roughly nine times forward earnings and the stock also pays a solid 3% dividend yield.

I would love to say I see something on the horizon that will reverse the divergence between the inflation perceptions and income growth discrepancies between the top strata of society and everyone else. Unfortunately I see nothing that looks likely to reverse this trend. In the meantime, investors should target their investments in the consumer discretionary sectors to those areas that are benefiting from this divergence because as John Dillinger once said when asked why he robbed banks “That is where the money is”.

Im positioning my own portfolio to take advantage of this new economy with different tiers of consumer spending. Recently I came across one company that is growing regardless of consumer spending levels, income inequality, or inflation. And with gross margins over 85% its like its printing money. Im looking for this one to double in months, not years. Click here to find out more .