The bear and bull cases for mortgage REITs in 2014

Post on: 16 Март, 2015 No Comment

RuthMantell

WASHINGTON (MarketWatch) — Shareholders of real estate investment trusts that invest in mortgage-backed securities had a rough 2013, and while rising rates continue to pose a risk, there could also be buying opportunities, analysts say.

Last year mortgage REITs saw their shares drop, with market speculation starting in May about the timing for the Federal Reserve’s tapering of its massive asset-purchase program. As rates rose on taper speculation, mortgage REITs saw book values fall, and investors traded down the stocks.

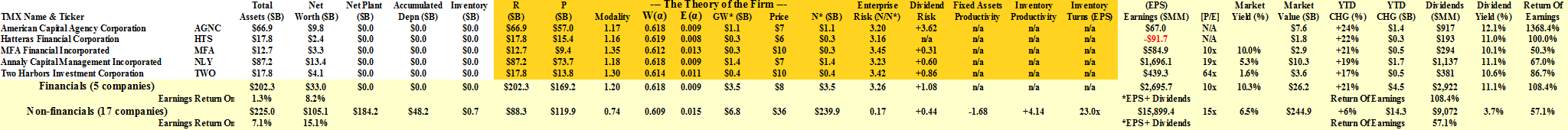

During 2013 shares of mortgage REIT giants Annaly Capital Management NLY, +0.00% and American Capital Agency AGNC, +0.40% for example, plunged 29% and 33%, respectively, far underperforming the S&P 500 Index SPX, -0.88% which had a stellar year .

Looking at 2014, the threat of rising rates continues to loom. Economists expect the central bank to further pare asset purchases as the economy strengthens.

“With the Fed’s tapering, they are buying fewer mortgage-backed securities,” said Christopher Donat, managing director in the research department of Sandler O’Neill + Partners, a New York-based investment bank. “And there could be other sellers of MBS out there.”

Rising rates have also led mortgage REITs to increase hedging, not a cost-free tactic. And mortgage REITs have cut leverage, which reduces risk, but also means they are seeing lower dividends. Annaly, for example, declared a fourth-quarter per-share dividend of 30 cents, down from a third-quarter dividend of 35 cents per share, and 45 cents per share in the fourth quarter of 2012.

“If your equity is declining, then your ability to continue to lever that will likely decline as well. Your ability to earn money is declining,” said Douglas Harter, an analyst at Credit Suisse.

Meanwhile, there’s also the glass-half-full view, which posits that investors oversold shares of mortgage REITs last year. The stocks are trading at a discount to their per-share book value. Investors sold off the group indiscriminately in 2013, and now there are buying opportunities, said Michael Widner, an analyst at Keefe, Bruyette & Woods.

Why REITs are missing the party

Real estate investment trusts missed out on the stock market’s stellar performance last year. Two experts in the industry explain why and provide their outlook for the sector in 2014. Photo: AP.

“There is a consensus view that the group is too cheap to short, but too out of favor and uncertain to buy,” he said. “What that’s done is left the group ignored.”

In December, Fed officials announced a gradual and careful first taper step. Now that markets have more information about the possible future shape of the Fed’s tapering, mortgage REITs may avoid another routing this year.

“The market won’t be grappling with the uncertainty of when the taper will start, but will be able to assimilate the taper as it happens in a moderate, gentle way,” said Merrill Ross, an analyst at Wunderlich Securities, a Memphis-based brokerage.

Still, the key question remains: To what extent has the market priced in the Fed and its impact on rates?

“If tapering is priced in and if the yield curve is going to stay reasonably stable, then that removes the biggest negative and the biggest overhang for the group,” Widner said.