The Basics of Interest Rate Parity (IRP) For Dummies

Post on: 16 Март, 2015 No Comment

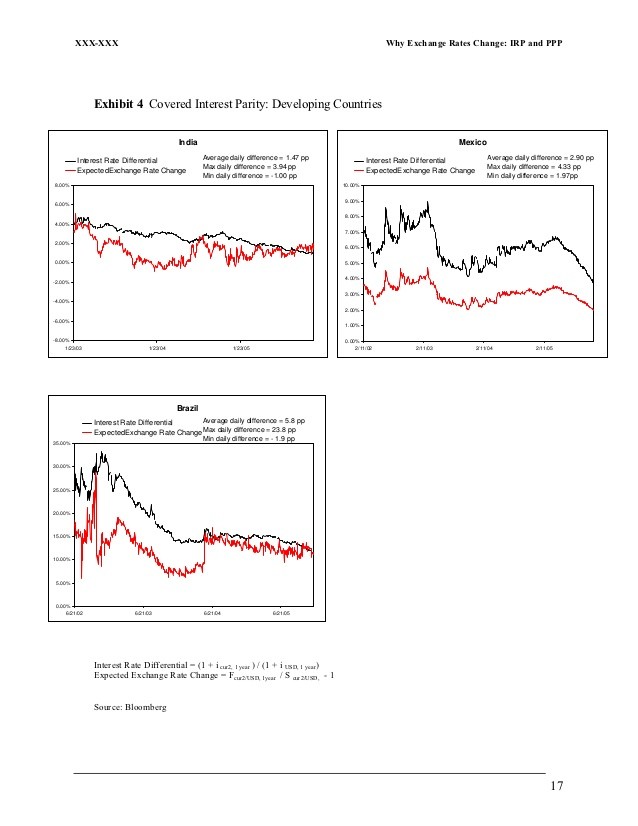

You need to be aware of three related subjects before you can understand the Interest Rate Parity (IRP) and work with it. The general concept of the IRP relates the expected change in the exchange rate to the interest rate differential between two countries.

Understanding the concept of the International Fisher Effect (IFE) is helpful for understanding the IRPMBOP relationship. The IRP includes the concept of a forward rate as it is observed on a forward contract.

Differences between IRP and MBOP

The IRP relates the interest rate differential to the change in the exchange rate. Whats the difference between the MBOP and the IRP.

Recall the parity condition in the MBOP:

and

denote the real interest rate on the dollar-denominated security, the real interest rate on the euro-denominated security, the expected dollareuro exchange rate, and the spot dollareuro exchange rate, respectively.

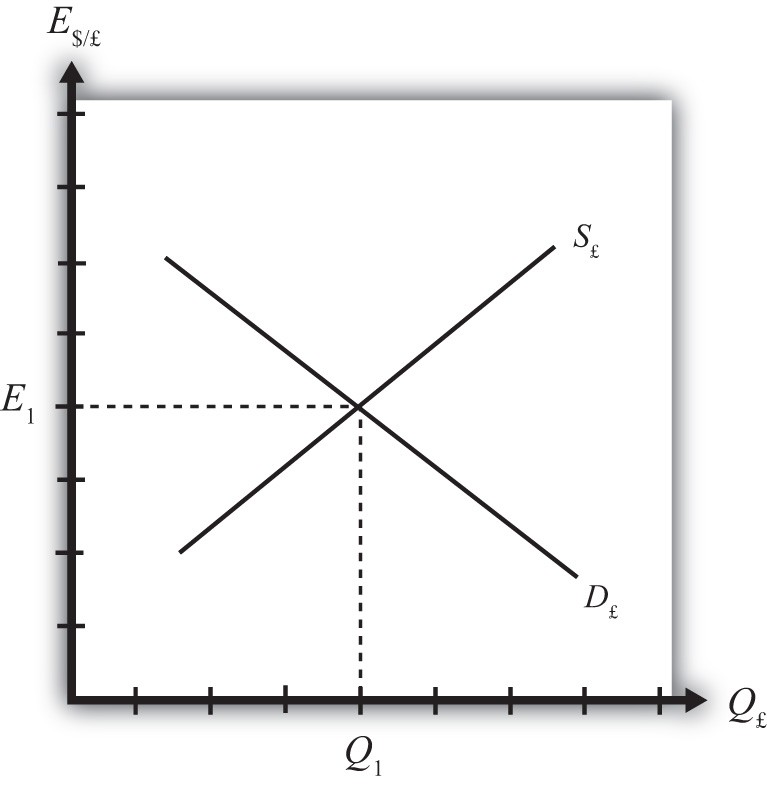

The equation implies that the real return on the dollar-denominated security equals the expected real return on the euro-denominated security in dollars. When this equality holds, the foreign exchange market is in equilibrium. In other words, investors are indifferent between the dollar- and euro-denominated securities.

After this quick reminder, you can reorganize the parity equation so that its left side is the difference between the real interest rates in two countries:

The IRP relates the interest rate differential to the expected change in the exchange rate, and this equation from the MBOP seems to do the same thing. At this point, the MBOP and the IRP sound similar. Whats the difference between them?

First, when the MBOP talks about the interest rate differential, it means the difference in two countries real interest rates. The IRP is also interested in the difference between interest rates as a predictor for changes in the exchange rate, but the IRP thinks in terms of nominal interest rates.

Second, whereas the MBOP uses the concept of an expected exchange rate, it doesnt specify how you can measure it. The IRP, on the other hand, uses the forward rate as indicated on a forward contract to get a numerical estimate for the expected change in the exchange rate.

Before introducing the IRP, the next two sections examine the International Fisher Effect (IFE) and forward contracts. The discussion of the IFE helps you understand the compatibility of real interest rates in the MBOP with nominal interest rates in the IRP. Having a basic knowledge of forward contracts is helpful for understanding the forward rate used by the IRP.

The International Fisher Effect (IFE)

The IFE is helpful in finding the relationship between the MBOP and its use of real interest rates, and the IRP and its use of nominal interest rates. Recall the Fisher equation:

r = R

Here, r, R, and imply the real interest rate, the nominal interest rate, and the inflation rate, respectively. According to the Fisher equation, the real interest rate equals the difference between the nominal interest rate and the inflation rate.

Therefore, if the MBOP and the IRP use the real and nominal interest rate differential in two countries, the difference between these two types of interest rates is the inflation rates in these countries.

The IFE suggests that investors expect the same real return in every country. To keep the real return the same in every country, nominal interest rates should adjust to the changes in the inflation rate. For example, as inflation rates increase, nominal interest rates increase as well, to keep real returns the same.

Suppose investors expect a 3 percent real return to domestic investment in all countries. Of course, the international comparison is based on a security of comparable risk and maturity. Suppose that the U.S. nominal interest rate and inflation rate are 5 percent and 2 percent, respectively.

If the U.K.s inflation rate is 1 percent and the exchange rate isnt expected to change, U.K. investors would look for a pound-denominated security whose nominal interest rate is 4 percent. (Theres an exchange rate dimension in this example. This exchange rate dimension implies that a real return of 3 percent to domestic investors does not necessarily imply a real return of 3 percent to foreigners in this example.)

Even though the MBOP and the IRP use the real and nominal interest rates, their approach to the interest rate differential between countries is related through the International Fisher Effect.

IRP and forward contracts

Another difference between the MBOP and the IRP is how they define the expected exchange rate. In the MBOP, the expected exchange rate is included in the parity equation. The expected exchange rate reflects investors expectations regarding the exchange rate some time from now. In fact, investors adjust their exchange rate expectations upward or downward. However, the MBOP does not explicitly provide any tools that can quantify the expected exchange rate.

The IRP quantifies the expected exchange rate using forward contracts. Forward contracts are an example of foreign exchange derivatives. You can think of foreign exchange derivatives as financial contracts where you lock in a specific exchange rate today for a future transaction in currencies (buying or selling of currencies).

A forward contract is an example of a foreign exchange derivative. It allows you to trade one currency for another at some date in the future at an exchange rate specified today. Typically, you get a forward contract from a bank that is engaged in foreign exchange transactions.

A forward contract includes the forward rate (the exchange rate on the forward contract), the amount of currency to be bought or sold, and the transaction date. Forward contracts are binding, in the sense that there is an obligation to buy or sell currency at the agreed price for the agreed quantity on the agreed transaction day.

The forward rate may be a good approximation of the expected exchange rate in the bracket of the parity equation in the MBOP. You might expect that a bank considers the current and expected values of the relevant variables for the exchange rate in both countries and quote a forward rate to you.

Therefore, in the MBOP and in terms of the dollareuro exchange rate, the percent change between the spot rate at time t and the expected exchange rate (or the i -period ahead future spot rate) at time t + i is:

If you use the forward rate instead of the expected exchange rate, the percent change in the exchange rate includes the forward rate and the spot rate:

- Add a Comment Print Share