The Basics of How to Analyze an Investment Portfolio of Individual Stocks or Other Securities

Post on: 2 Май, 2015 No Comment

I thought it might be useful to show you how Id analyze an investment portfolio and calculate a reasonable estimate of not only expected growth in capital but the overall economic characteristics of the holdings.

Tonight, a friend wanted to discuss investments. Well call her Alexis. We went over a list of stocks that interested her (note: I am not going to pass judgment, recommend, or otherwise endorse of any of the securities she listed; that isnt the purpose of this post it is to let you see how we do what we do). Alexis asked, If you were considering buying this list of stocks, where would you start? How would you manage the money? I have $50,000 I want to invest.

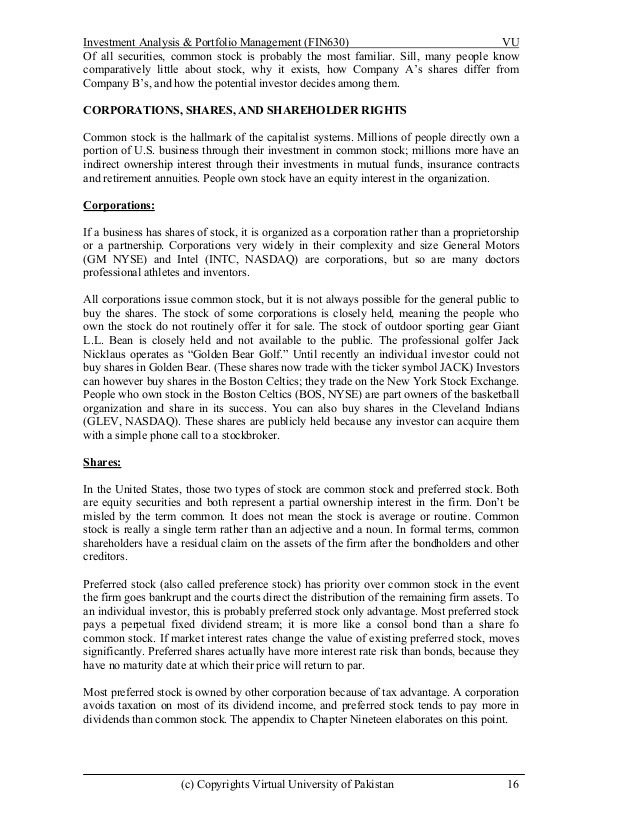

I went into my home study, opened Microsoft Excel on the iMac and loaded a template that I have used for some time (one of many spreadsheets that Ive built over the years). I entered her stocks into the spreadsheet and the program did the rest, propagating the information I needed with the following results:

This is how I would look at her portfolio

The investment column is where I entered the amount of money Alexis wanted to invest into each security. Since I was talking in abstract terms about capital allocation, I assumed she put $2,000 into each stock. Next came the company name and the industry in which it generates its earnings. The next column was the current market price of the stock. The next column, Position, is equal to the Investment column because I use it from time to time to run different calculation scenarios you can ignore it. The Look-Through column takes the earnings per share and multiplies it by total shares owned (it does not deduct taxes that would be owed on dividends if all of this money were paid out, as Buffett recommends, because Alexis wanted to hold the stock through a tax-free retirement account). The column thereafter is Earnings Per Share, followed by other metrics such as earnings yield, dividends per share, dividend income for the year based upon the total shares owned, dividend yield, total portfolio weight, and the p/e ratio.

Viewing the Portfolio as a Single Stock

This allows me to look at the entire portfolio as a single stock, or company. In essence, the portfolio is a $50,000 company that earns $3,636.72 after taxes each year, which is a 7.27% return on capital. Of this, $1,496.96 is paid out to me, as the owner, representing 2.99%. That means the remaining 4.28% of profit each year is retained by the companies to do all sorts of things like repurchase shares, pay down debt, expand, increase salaries, launch new products, etc.

Watch Your Valuation Multiple / Capitalization Rate Assumptions

Investing is the process of buying the most future profits for the lowest current price. — Joshua Kennon

If I assume that the look through earnings can grow by 3% per year, it might be reasonable to project that the portfolio would grow between 8% and 10% annually, over long periods of time (though the ride will be bumpy the stock market may be up or down 50% from year-to-year). Alternatively, you could always take Ben Grahams modified formula and use the 7.27% earnings yield + 3% growth = 10.27% long-term compounding. The key here is you are assuming constant valuation multiples! That is, you are assuming that $1 of earnings today will be valued at the same p/e as $1 of earnings 10 years from now, which is a function of the relationship of interest rates to the overall economy. That may or may not be the case and it is important for you to realize the implicit assumption in your forecast.

If interest rates rise, valuation multiples should fall. If interest rates fall, valuation multiples should rise. There are always exceptions but on a broad, macroeconomic basis, this is often the case. This is why dividend yields were much higher in the 1970s and 1980s inflation was higher and investors demanded the same real, after-inflation return for parting with their savings.

Likewise, this is the reason investor returns were flat between 2000 and 2010. You cannot pay 50x earnings, which represents a 2% earnings yield, for enormous companies like Wal-Mart and Home Depot and expect to do well. Even though these firms substantially expanded their profits during that decade, the valuation multiple collapsed at a faster rate, resulting in flat or declining stock prices. No rational investor was willing to pay those prices. Although there are always individual exceptions, broadly speaking, you cannot buy stocks with 2% earnings yields and expect to earn 20% on your money.

How Fast Can the Companies Grow Their Earnings Relative to Your Valuation Multiple?

The next question is, how fast can the companies you own grow their earnings relative to the capitalization rate applied to the stock?. A stock that is trading at a 5% earnings yield, or a 20 p/e ratio, growing at 20% is cheaper than a stock trading at a 10% earnings yield, or 10 p/e, growing at 2%. Graham came up with a rough valuation; he said the maximum p/e ratio an investor should be willing to pay for an exceptional company is 8.5 + growth rate. That is, if a company is growing at 12%, the maximum p/e should be 8.5 + 12 = 20.5.

The problem? Right now, that rule wouldnt work because companies reported enormous losses or impairment charges over the past few years, substantially lowering the level of reported profits. Going forward, those lower figures arent indicative of the earnings power of many firms. That is another way of saying that artificially depressed earnings are leading to artificially inflated p/e ratios. You have to understand the relationship between the numbers.

Much of this growth is going to be determined by the way management allocates that 4.28% retained look-through profit. As Warren Buffett pointed out in this years Berkshire Hathaway shareholder letter, a dollar put in Sam Waltons hands in the 1960s and 1970s was worth exponentially more than the same dollar of profit put in the hands of the CEO of K-Mart or Woolworth.

On a related note, you have to determine the stability of the earnings power. To use an oft-quoted example, a horse and buggy manufacturer a century ago might have shown good earnings but it was doomed as a long-term investment. I once made this mistake by buying Borders Group, which remains the single dumbest investment Ive ever made .

Projecting Ultimate Portfolio Value

For the list of 25 stocks Alexis selected, I would expect growth in the underlying earnings and dividends, taken as a group, to keep pace with inflation. That would mean the real rate of return would equal to current earnings yield, or 7.27%. If that turns out to be true, 25 years from now, the portfolio should be worth 5.78x the current value in real terms after inflation. or $289,000. At that point, she should be able to switch into higher yield investments with lower growth, earn 5% on the money, and collect $14,450 per year, or $1,204+ per month. Again, that is in todays money, after inflation, so you can estimate purchasing power.

Anything above that percentage return in real dollars and Id say she was delusional. The only way you could achieve something like that would be to enter another asset bubble and be lucky enough to sell out at the top. In the long-run, that is not a formula for winning.

If I wanted to make changes to the portfolio, every year or so, Id reevaluate the holdings and reallocate money to the companies with the highest earnings yield.

You Can Examine and Compare Individual Stocks Using the Same Approach

What if you wanted to decide between two individual securities in a specific industry, such as Coke and Pepsi in the soft drink category? You could use the same spreadsheet to create a quick comparison.

You could use the same approach to compare two stocks in the same, or even different, industries or sectors.

Your choice comes down to investing in Coca-Cola at an 8.21% earnings yield with a 3.05% cash dividend yield or Pepsi at a 6.29% earnings yield with a 3.08% dividend yield. Which company do you think will grow faster? If the growth rate is identical, Coke, at this price. is a better deal. Over 50 years, an additional 1.92% in earnings yield is an extra 259%.

Of course, it is not always that simple. Youd need to check the pension accounting for both firms what if one has a fully funded pension and the other is going to need to make up losses? Youd need to check stock option dilution. Youd need to research pricing power of both brands. This is known as ascertaining the earnings quality. How much of the reported figure is actually turned into cold, hard, liquid cash that is available to stockholders?

There is some subjective judgment, too. Management matters. Id rather pay a bit more money for a well-run company than a company where I seriously question the capital allocation and shareholder friendliness of the executives (case in point: Kraft Foods). I have so little confidence in the capital allocation decisions of the CEO of that firm that Id demand a much higher earnings yield and dividend yield to make the investment than I would if her track record were better. Some of you may disagree with me. You might be convinced that the Kraft CEO is an unsung genius that is going to make her stockholders rich. You might be right. I could be wrong. But that is why I said subjective judgment is involved on top of purely quantitative measures. You have to make your own decisions and back them up by risking your own money. This isnt kindergarten; you cannot rely on other people to do the thinking for you.

Other Adjustments Id Make to the Portfolio

I dont like to see more than 10% or 20% of my holdings have correlated risk. In fact, I wouldnt even want 100% of my net worth in the stock market — Id want real estate, private businesses, and other cash generators. To paraphrase Buffett, Build Fort Knox.

Once I had settled on the portfolio, Id pull the individual annual reports for each and look for:

- Excessive potential dilution. If the company might dilute shares by more than a few percentage points, I would adjust the earnings yield and dividend yield to account for this.

- Conservative capitalization structure. If the company has high operating leverage or a capitalization structure that matches long-term assets with short-term liabilities, I dont want to own it in most cases. The earnings might turn out to be illusionary and subject to a mass-wipeout in the event of a panic or meltdown.

- Pricing power and high returns on assets and equity to help combat inflation risk

- Look for correlated risk and remove it. I would go through each stock on the list and figure out which ones were connected. For example, if 20% of the portfolio consisted of companies located in California, a major earthquake or tsunami there would have a significant and material influence on the market value of my investments. If I owned a ton of oil refiners, power plants, and oil exploration companies, the price of crude is going to present a correlation risk that could expose me to major losses. If I owned all bank stocks, adding a company like Harley Davidson to the mix isnt diversification because it is essentially a bank or financing company in drag.

- Do some homework to uncover the existence of any more attractive senior issues. During the meltdown, you might have been able to buy convertible preferred stocks in some of these companies with a higher ranking in the capitalization structure, a larger dividend, but all of the upside potential of the common stock. In that case, you would have had the same profit potential with built-in loss mitigation. When returns are equal, consider moving up the capitalization structure! Your first goal is to avoid losing money. Worry about the profits after that.

- Look for individual modifications to the spreadsheet. From the list of stocks Alexis showed me, I would be incredibly surprised if the dividend rate for General Electric and U.S. Bancorp werent significantly higher five years from now than it is today. I think they are artificially depressed. Try to load the dice in your favor by collecting companies that are attractive in their own right but that you think have significant potential for upside surprises.