The 4 Tax Forms You Should Be Getting Soon

Post on: 16 Июнь, 2015 No Comment

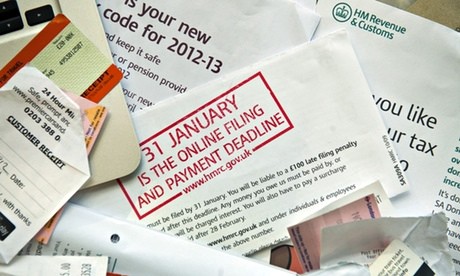

You may have already started receiving tax forms in the mail. You know what Im talking about — the envelopes are marked in big block letters, IMPORTANT TAX DOCUMENTS ENCLOSED.

If you havent received any yet, you should soon, and for some people, youll be getting many pieces of mail like that over the next few weeks. Getting your taxes done quickly and accurately requires you to organize your necessary documents and know when somethings missing, and looking at last years tax return is a good way to help you do that.

Unless things change dramatically, if it was on last year’s tax returns it will be on this years, said Howard Rosen, a CPA with Conner Ash Certified Public Accountants & Business Consultants in St. Louis. Rosen said that approach helps most people, but even if youve opened a new bank account or switched jobs, knowing how things changed from last year will help you put together a checklist of documents to expect.

When youre getting everything together you need to file your taxes. youll want to watch your mailbox (physical and electronic) for these items.

1. Your W-2

You can expect Form W-2, Wage and Tax Statement, from your employer by the end of January, Rosen said. He recommends reaching out to your employer if you havent received it by the of the month.

Paul Herman, who owns Herman & Co. CPAs in White Plains, N.Y. said to give employers a little more time.

Its not unusual for them to be received in early or mid-February, Herman said. Some people send them out later.

If youre trying to file your taxes as soon as possible and youre waiting on your W-2, ask about it in February, but know there may not be much you can do to speed up the process.

Free Credit Check & Monitoring Sign up for your Credit.com and get a FREE credit score plus personalized Action Plan to help you improve it. FREE and updated every 30 days.

2. Any 1099s

There are many kinds of 1099s, but some of the most common ones consumers get are 1099-MISC, for miscellaneous income; 1099-INT, for interest income; 1099-S, if you sold real estate in the past year; and 1099-R, if you received distributions from a retirement plan. There are dozens more, including the dreaded 1099-C. which means you have to pay taxes on canceled debt. Basically, youll get a 1099 if money considered untaxed income has been reported to the Internal Revenue Service.

1099s usually come out by the end of February, Rosen said.

See Where You Stand Sign up at Credit.com and get your FREE Credit Score plus personalized Action Plan to help you improve it. FREE and updated every 30 days.

3. 1098s

These are more welcome forms than 1099s, because 1098s usually means you get a tax credit. Common forms are 1098 for mortgage interest, 1098-E for student loan interest and 1098-T for tuition paid during the tax year. Banks and loan servicers tend to make these forms available quickly, particularly because many people manage paying these accounts online. If you havent received your form by the end of January, contact your loan servicer .

4. Charitable Receipts

You should receive letters from charitable organizations to which you donated in 2014 documenting how much you gave.

Those are just a few, typical examples of the many forms you might receive. As you get these things, either in an envelope or to your email inbox, gather them in a common place. Perhaps thats a folder on your computer and a physical folder in your filing cabinet, including a checklist of what youre waiting on before you can file your taxes. Mark your calendar for when you anticipate receiving tax documents so you can inquire about them if they havent arrived as expected.

I do think people struggle with it if they have more than just a couple of forms because it’s tough to keep track of all these things, Herman said. He gives his clients tax organizers (folders, really) to help them manage the paperwork, and he repeatedly emphasized the importance of looking at the previous years return to help plan for this years.

Rosen said the same.

I think most people worry than they need to, to be honest with you. Theyre thinking, Do I have everything? Do I have everything?’ Rosen said, mimicking a stressed consumer. For most folks, just using last year as your guideline is a great way to start.

More Money-Saving Reads:

Image: iStock

Sign up for our weekly newsletter.

Get the latest tips & advice from our team of 30+ credit & money experts, delivered to you via email each week. Sign up now .

Please note that our comments are moderated, so it may take a little time before you see them on the page. Thanks for your patience.