Technical Analysis Made Simple Introduction to Pattern Analysis

Post on: 16 Март, 2015 No Comment

Technical analysis is an investment approach, with a focus on price patterns to make investment decisions, as opposed to fundamental analysis. What, then, is pattern analysis? Pattern analysis is the interpretation of charts and the interpretation of patterns from those charts. This will be discussed in this article about a basic introduction to pattern analysis in technical analysis. Chart reading and concomitant pattern analyses are not simply mere memorisation of patterns and recalling of their interpretations. It is not that simple and there is more to pattern analysis than that. Any chart is a combination of differing diverse patterns and, hence, an accurate evaluation relies on chart reading skills and techniques, consistent pattern study of charts, experience in technical analysis, and personal knowledge both technical and fundamental analysis-wise, and the ability to evaluate differing and sometimes opposing indicators, to analyse and evaluate patterns in view of diverse, composite, and sometimes differing details as well as recognising patterns in charts using, in some cases, fixed and memorized formulae.

Knowing the reasons for market participant behaviours might help us in pattern analysis. There are tens of thousands, even hundreds of thousands, of diverse, differing and individual market participants in the stock market at any point, and these people are selling and buying securities for differing, diverse reasons, possessing various motives and from various financial positions. It is all very complex and not simple at all. Trying to figure out why participants are buying and selling can be daunting and very challenging. Chart patterns are therefore useful, because they place buying and selling into a kind of limited perspective by consolidating supply and demand into a single consolidated picture. As a complete, consolidated visual record of trading, the patterns in stock charts thus provide a framework to analyse stock market movements and can have data that can be extrapolated: simply, chart patterns can help us analyse the big picture, so pattern analysis is indeed a key skill of technical analysis.

Pattern analysis can be used to make short or long term forecasts. Yet, it should be noted, technical analysis can be science and also art. For instance, what is the long term as opposed to the short term? Interpretation plays a role, so experience is key. In addition, pattern recognition can be open to personal and biased interpretation and is subject to bias. To defend ourselves against bias and to confirm actual, proper interpretations, other fields from technical analysis should be used to verify (or refute) conclusions based on pattern analysis. While patterns may seem similar, in reality, no two patterns are exactly the same. False breakouts and exceptions are all par for the course. Hence, consistent and constant study of various charts and the concomitant experience is required for successful pattern analysis.

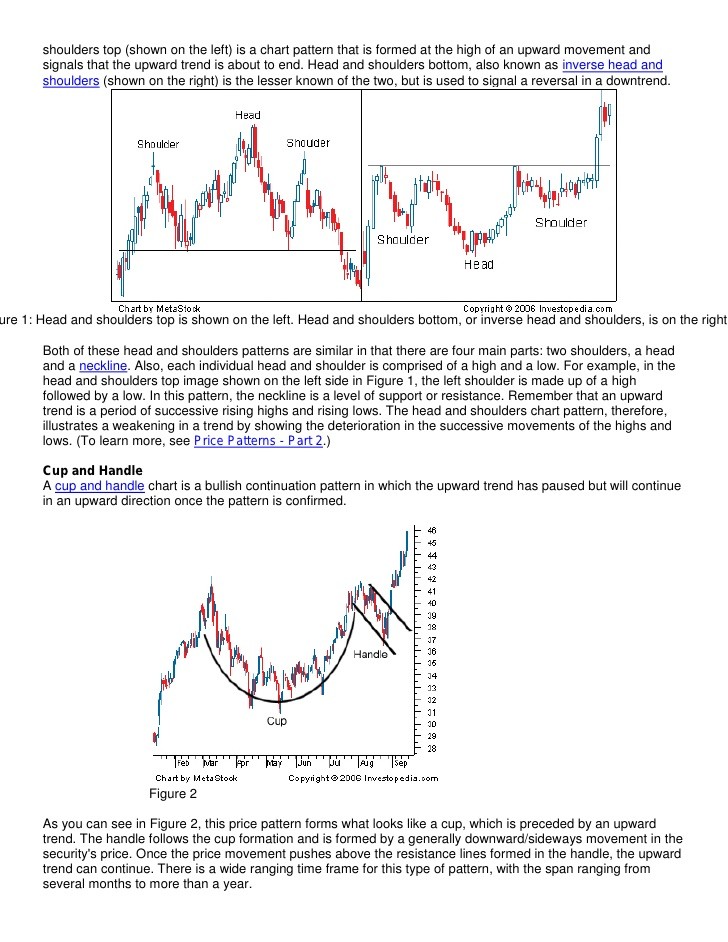

In addition, there is more to pattern analysis than all that. It is also important to acknowledge that prices trend, and that pattern history repeats itself often. An uptrend indicates that demand is in control, and, on the other hand, a downtrend indicates that supply is in control. These uptrends and downtrends are all reflected in the price movements and pattern analysis must take them into account. Also, and furthermore, the vast majority of patterns in charts fall into two main groups: either a reversal or continuation. (These terms are all key to understanding technical analysis since technical analysis is technical, there are many technical terms.) Reversal patterns in charts indicate a change of trend. Continuation patterns in charts indicate a pause, and indicate that the previous direction before that will resume after a while. However, just because a pattern forms after an advance or decline does not mean simply or simplistically that it is a reversal pattern. Much actually relies here on prior price actions, volume, and other indicators, as the price pattern evolves. This is where technical analysis stops being a science, but really and definitely becomes an art form.

To conclude the introduction to pattern analysis: pattern analysis is the reading of charts and their patterns, but that is not all. Sometimes, discerning charts and patterns requires insight into market behaviour by the many and diverse market participants. Yet, pattern recognition is not a science, but an art sometimes; analysis is hard to do. Hence, the keys to successful pattern analysis are dedication to learning and technical analysis education, a focus by limiting charts and chart reading methods to those known well, and consistency in ones work ethic, which means that one should maintain charts regularly and study key and recurring patterns often to gain both knowledge and experience. Good luck with your introduction and foray into technical analysis and pattern analysis!

Shawn Seah is a blogger who writes on diverse topics, primarily investment, finance and education. He has a website on ideas on how to become rich and many other blogs on diverse topics such as How to Learn German Fast, University Degrees Online. and English Language Resources Online.

%img src=http://media.avapartner.com/banners/p369485172.gif?tag=33247&tag2=