Taxes and REIT Investment

Post on: 16 Март, 2015 No Comment

How Do Shareholders Treat REIT Dividends for Tax Purposes?

For REITs, dividend distributions for tax purposes are allocated to ordinary income, capital gains and return of capital, each of which may be taxed at a different rate. All public companies, including REITs, are required early in the year to provide their shareholders with information clarifying how the prior year’s dividends should be allocated for tax purposes. This information is distributed by each company to its list of shareholders on IRS Form 1099-DIV. An historical record of the allocation of REIT distributions between ordinary income, return of capital and capital gains can be found in the Industry Data section of REIT.com.

A return of capital distribution is defined as that part of the dividend that exceeds the REIT’s taxable income. A return of capital distribution is not taxed as ordinary income. Rather, the investor’s cost basis in the stock is reduced by the amount of the distribution. When shares are sold, the excess of the net sales price over the reduced tax basis is treated as a capital gain for tax purposes. So long as the appropriate capital gains rate is less than the investor’s marginal ordinary income tax rate, a high return of capital distribution may be attractive.

How Does the So-Called “Fiscal Cliff” Legislation Signed by President Obama in 2013 Affect Taxation of REIT Dividends? What About the So-Called “ObamaCare” 3.8% Surtax on Investment Income?

Background

By way of background, on May 28, 2003, then-President George W. Bush signed the Jobs and Growth Tax Relief Reconciliation Act, which cut income tax rates on most dividends (called “Qualified Dividends”) and capital gains to a 15% maximum through 2010. On December 17, 2010, President Barack Obama signed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, which extended this 15% maximum rate for two years, through December 31, 2012.

Fiscal Cliff Legislation

On January 2, 2013, President Obama signed the American Taxpayer Relief Act of 2012 (the Fiscal Cliff Legislation) to avert the so-called “fiscal cliff” of automatic tax rate increases and spending cuts that would have occurred on January 1, 2013 absent legislation. Effective January 1, 2013, the Fiscal Cliff Legislation permanently extends the 15% maximum rate for Qualified Dividends and capital gains for individual taxpayers earning $400,000 or less and couples earning $450,000 or less. For taxpayers earning in excess of those income thresholds, the maximum tax rate on Qualified Dividends and Capital Gains is 20%. For tax years beginning in 2013, dividends that are not “Qualified Dividends” are taxed at the highest applicable tax rate for ordinary income. For individual taxpayers with income in excess of $400,000, and couples with income in excess of $450,000, that rate is 39.6%.

ObamaCare 3.8% Surtax

Also beginning in 2013, a 3.8% surtax (enacted pursuant to the Patient Protection and Affordable Care Act, commonly known as “ObamaCare”) on investment income (such as dividends and capital gains) applies to individuals with adjusted gross income in excess of $200,000 and couples with adjusted gross income in excess of $250,000. Thus, Qualified Dividends and capital gains of individuals with adjusted gross income in excess of $200,000 and below $400,000, and couples with adjusted gross income in excess of $250,000 and below $450,000, are taxed at a maximum rate of 18.8% (15% maximum rate, plus 3.8% surtax on investment income). Qualified Dividends and capital gains of individuals and couples in excess of these thresholds are taxed at a maximum rate of 23.8% (20% maximum rate, plus 3.8% surtax).

Because REITs do not generally pay corporate taxes to the extent they distribute dividends, the majority of REIT dividends are not Qualified Dividends, and continue to be taxed as ordinary income up to the maximum rate, which is 43.4% in 2013 (the maximum rate of 39.6%, plus the 3.8% surtax on investment income). However, REIT dividends continue to qualify for a lower tax rate in the following instances:

- When the individual taxpayer is subject to a lower scheduled income tax rate (with the Fiscal Cliff Legislation maintaining the low rates of prior law for individual taxpayers earning $400,000 or less and couples earning $450,000 or less);

- When a REIT makes a capital gains distribution (23.8% maximum tax rate, consisting of 20% maximum rate on Qualified Dividends, plus 3.8% surtax on investment income), or a return of capital distribution, as described above;

- When a REIT distributes dividends received from a taxable REIT subsidiary or other corporation (23.8% maximum tax rate: 20% maximum rate on Qualified Dividends, plus 3.8% surtax on investment income); and,

- When permitted, a REIT pays corporate taxes and retains earnings (23.8% maximum tax rate: 20% maximum rate on Qualified Dividends, plus 3.8% surtax on investment income).

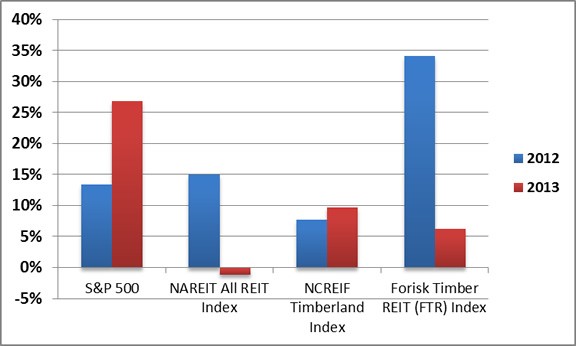

Top Dividend Tax Rate in 2012 and 2013