Taxation of limited liability company

Post on: 17 Июль, 2015 No Comment

If you’re a business owner, serious investor or new entrepreneur, you absolutely must understand how limited liability company taxes work. Why? Because LLCs both make your accounting easier and provide you with some wonderful tax planning opportunities.

Furthermore, LLC taxes aren’t that complicated if you approach the subject with an open mind and a willingness to learn a thing or two about tax law. In fact, you really only need to understand a handful of things to make sense of LLC taxation:

One related comment seems in order here.

If you’re operating a single-member LLC that’s treated as a sole proprietorship or an LLC that owns rental properties, you can often do your tax return yourself. All you need to do is add a Schedule C (for a business) or a Schedule E (for rental property) to your regular 1040 tax return.

If you’ve elected to have an LLC treated as an S corporation or as a C corporation, you probably should have a knowledgeable tax practitioner (a CPA, an enrolled agent or an attorney) prepare your tax return. Note that my CPA firm specializes in preparing federal and state S corporation tax returns.

Default Rules for LLC Taxation

Because a limited liability company may elect how it will handle its tax accounting, the Internal Revenue Service provides default rules.

You use the default rules until you make an election to use one of the other tax accounting approaches available.

Rule for One-owner Limited Liability Company

By default, a single member LLC is disregarded. In other words, you just ignore the one owner LLC. (The owners of an LLC are called members)

This sounds tricky, but the disregarding or ignoring just means that the income or deductions of the LLC go on the owner’s regular tax return.

For example, if an individual owns an LLC that operates an active trade or business, the LLC’s income and deductions go on the Schedule C Profit or Loss From Sole Proprietorship page of the person’s tax return.

And if an individual owns an LLC that holds rental property, the LLC’s income and deductions go on the Schedule E Supplemental Income and Loss page of the person’s tax return.

In other words, the fact that the business or real estate is operated or owned by an LLC is irrelevant for tax accounting. The LLC is, in the language of tax law, disregarded.

Husband and Wife LLCs

And another interesting little wrinkle here: An LLC owned by a husband and wife who reside in a community property state can be treated a as a single-member, or one owner, LLC, meaning that such an LLC can also be disregarded.

LLCs Owned by a Corporation or Partnership

If the owner of the LLC is a corporation or partnership, the LLC is a single member, or one-owner, LLC.

In this case, the LLC’s income and deductions just get combined with the corporation’s or partnership’s other income and deductions and appears on the corporation’s or partnership’s tax return.

Rule for Multiple Owner Limited Liability Company

A multiple member LLC by default is treated as a partnership. This means that the LLC’s income and deductions get reported on a partnership tax return. And then that tax return allocates the income and deductions among the partners, or LLC members.

Each partner, or LLC member, receives a K-1 from the partnership. The K-1 shows that partner’s share of the income and deductions flowing out of the partnership.

LLC Tax Accounting Options

Many people would find LLC taxation pretty easy if only the default rules were used. However, you don’t have to use the default tax treatment for an LLC. You can elect to opt out of the default tax treatment and choose to be taxed as a corporation.

How to Elect a Different Tax Treatment

Getting treated as a corporation occurs after the LLC and its owner(s) proactively elect to be treated as a corporation.

To elect to be treated as a corporation, the LLC and its owner(s) file an 8832 form. To elect to be treated as an S corporation, the LLC and its owner(s) file a 2553 form.

Both forms are available from the www.irs.gov website.

An important point: if an LLC elects to be taxed as a corporation or S corporation, the LLC is still an LLC. (This is confusing, I know.) But for income tax purposes only the LLC is treated as a corporation or S corporation.

S Corporation vs. C Corporation Election

Let me briefly delve into something already mentioned on this page. There are actually two sets of rules for how the tax accounting works for a corporation.

The usual set of rules appear in a chunk of the tax law called Subchapter C. Large publicly-held corporations and many other smaller corporations use the Subchapter C rules.

Many small corporations and small LLCs electing to be taxed as corporations, however, use an alternative set of tax accounting rules that come out of another chunk of the tax law called Subchapter S. If you’ve talked to many experienced small business owners, you’ll have undoubtedly heard them talk about Subchapter S. Businesses that use the Subchapter S rules, often called S corporations, pay no corporate income tax and often save their owners a lot of self-employment tax.

Note: I provide tons of information about S corporations and S corporation taxation at a sister web site, S Corporations Explained. If you’re thinking about making an election to opt out of the default tax treatment for an LLC, you may also want to read this website’s FAQ article: How S corporations save taxes

Tax Effects of Incorporating an LLC

Normally, you don’t need to worry very much about the tax effects of forming an LLC. By default, an LLC is either a disregarded entity or a partnership. And forming a disregarded entity (like a sole proprietorship) or a partnership should only rarely in and of itself trigger taxes.

If you plan on treating an LLC as a corporation for tax accounting purposes, however, you sometimes need to be a bit more careful.

Incorporating a Brand New LLC

If you form an LLC, immediately elect C or S corporation status, and then begin doing business, the formation of the LLC and then the subsequent incorporation election should not trigger any income taxes.

You will need to use a different form to report your taxable income to the federal and state government. And you will need to process payroll for the LLC’s working owners. But you won’t simply by incorporating trigger taxes at the point of incorporation.

Incorporating an Existing LLC

If you’re forming an LLC and planning to elect corporation tax treatment at some point in the future, you need to be careful.

In some situations—specifically, when you transfer personal debts to the LLC and then elect corporation tax treatment or when you transfer more liabilities than the book value of the assets you transfer—you can inadvertently trigger taxes by incorporating the LLC.

For detailed information about how, why and when this taxation occurs, you can read the S Corporations Explained website’s FAQ article Incorporating an existing business: what you must know

Do You Need Advice About Incorporating?

If after reading the above article you don’t feel like you understand the issues of incorporating an existing business with debt, you may not want to use do-it-yourself LLC formation kits (like we sell at this website) or online incorporation services. Instead, you may want to work with a local attorney or tax accountant who can review the specifics of your situation.

In this setting, you are not really upgrading to a local professional for the work of preparing the documents. the paperwork is pretty straightforward. Rather, what you’re upgrading for is the opportunity get some tax planning help.

LLC Owners and Payroll Taxes

Limited liability companies often make their LLC owners subject to payroll taxes.

In many cases, in fact, LLC owners pay as much in payroll and self-employment taxes as they pay in income taxes. Payroll taxes run roughly 15.3% on the first $115,000 of earned income and then between 2.9% and 3.8% thereafter!

Fortunately, the limited liability partner self employment tax treatment is usually pretty straightforward as long as you know how an LLC is treated for income tax accounting purposes. Here are the basic rules:

Single-member LLCs treated as disregarded entities:

If a single-member LLC (or one-owner LLC) engages in an active trade or business, the LLC pays self-employment tax on its profit. Note that in this case, the single-member LLC reports in business income on a Schedule C tax form and calculates its self-employment tax on a Schedule SE tax form.

If a single-member LLC doesn’t engage in an active trade or business—say, the LLC engages in a passive activity such as real estate investing—the LLC doesn’t pay self-employment tax on its profit. Note that in this case, the single member LLC reports its passive income on a Schedule E.

Multiple-member LLCs treated as partnerships:

If a multiple-member LLC (or multiple-owner LLC) engages in an active trade or business, the LLC owners, or partners, pay self-employment tax on their shares of the profit. Note that in this case, the multiple-member LLC reports its business income on a separate 1065 partnership tax return and the individual partners calculate their self-employment tax bills on their shares of the partnership profit on Schedule SE tax forms which accompany their 1040 individual tax returns.

If a multiple-member LLC doesn’t engage in an active trade or business, however, then the LLC owners don’t pay self-employment tax on their shares of the profit. And in this case, the LLC owners report their shares of the partnership’s profit on their respective Schedule Es.

LLCs treated as C corporations:

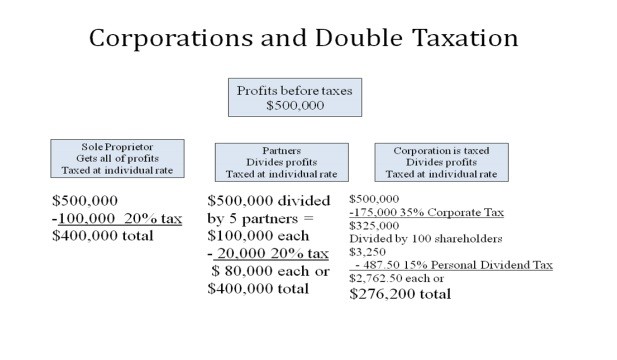

If an LLC makes an election to be treated as a regular C corporation, the LLC’s profits are not subject to self-employment tax. The profits are, however, subject to corporate income tax as reported on the LLC’s 1120 corporate tax return. Furthermore, if the corporate profits are distributed to LLC owners in the form of dividends, the dividends are taxed again at the 15% qualifying dividend rate.

Note that a LLC treated as a C corporation would pay payroll taxes (which are equivalent to self-employment taxes) on any wages paid to llc members working in the business.

LLCs treated as S corporations:

If an LLC makes an election to be treated as an S corporation, the LLC’s profits are subject neither to self-employment taxes nor to corporate income tax. The S corporation does need to file an 1120S tax return, however, and through this tax return the LLC’s owners get taxed on their respective shares of the corporation’s profit.

Note that if an LLC owner works in the business, the LLC-treated-as-an-S corporation must pay a reasonable wage to the LLC owner. The LLC absolutely does owe payroll taxes on these wages.

Additional Limited Liability Company Tax Resources

If you’re interested not just in how LLC taxation works but also in how to reduce the amounts you have to pay, note that we sell three downloadable e-books with additional, more specialized information (see descriptions that follow). Each book, by the way, covers tricks and techniques that can easily save an LLC’s owners thousands of dollars in taxes annually.

Real estate investment in this economy can produce good returns. But clever tax planning can bump cash profits by thousands each year. Read More

Using an LLC for your business? The best tax trick available is maximizing deductions. But finding legitimate deductions can be tricky. Read More

Operating your LLC as an S corporation? If you set the right salary, you can save $5K to $10K per partner per year in self-employment taxes. Read More