Taxable Possessory Interests

Post on: 29 Апрель, 2015 No Comment

Taxable Possessory Interests

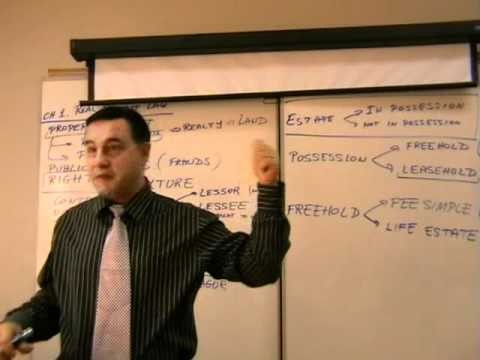

A taxable possessory interest is created when a private party is granted the exclusive use for private benefit of real property owned by a non-taxable entity. An expanded definition may be found in Revenue and Taxation Code Section 107.

The key criteria that must exist to have a taxable possessory interest are the possession or right to possession of real property owned by a non-taxable entity. The possession must be independent, durable, and exclusive of the rights held by others, and provide a private benefit to the possessor above that which is granted to the general public.

Taxable possessory interests can be created in virtually any use of government owned real property. Common examples would be campgrounds, government employee housing, forest cabins, golf courses, ski resorts, airplane hangers and terminals, anchorages, restaurants, grazing rights, stores, homes, apartments, cable television rights-of-way, easements and boat slips.

Property Tax Law covering possessory interest can be found in Revenue and Taxation Code Sections 61, 107 — 107.9, 480.6, and property tax rules 20-28.

When valuing a taxable possessory interest there are two key factors that differentiate the value from real property unencumbered fee values:

- We must value only the legally permitted use under the agreement, which may not be the highest and best use of the property.

- We must not include the value of the lessor’s retained rights in the property. The government’s interest is exempt.

When it has been concluded that a new base year value is necessary, one or more of the traditional value approaches, comparative sales, income, or cost, are used with certain modifications. These are more fully explained in Property Tax Rule 25.

Comparative Sales Approach — In this method the sale of the subject property or sales of other similar possessory interests reasonably close to the effective date of value are used to determine the value. Contract rent paid on the property is treated as another assumed obligation of the buyer and must be valued at its present worth and added to the sale price. Any other obligations assumed by the buyer under the agreement would also be valued and added to the sale price. Any benefits to the buyer, such as salvage value at the end of the lease, would also be given a present value, but be deducted from the sales price.

It is also possible to value the taxable possessory interest indirectly by comparing the subject to sales of similar fee property. As a final adjustment, the present worth of the right of the government to take back the property at the end of the term of possession must be deducted from the value.

Income Approach — The possessory interest is valued either directly by capitalizing all future net income that the possessory interest is capable of generating under typical management during the estimated term of possession, or indirectly by first capitalizing the net income to estimate the fee value and then deducting the present worth of the government’s rights subsequent to the anticipated term of possession.

The most common income method is to value the possessory interest directly by capitalizing the economic income stream for the reasonably anticipated term of possession. In this method we are measuring only those rights possessed by the tenant and are excluding any non-taxable rights retained by the governmental landlord. The critical estimates in this approach are:

Economic Rent — estimated from rental rates recently negotiated in a competitive market, less any anticipated expenses by the landlord.

The reasonably anticipated term of possession — the term estimate based on the intent of the public owner and the possessor, as indicated by such evidence as the history of the property’s use, the policy of the public agency administering the lands, and the actions of the possessor.

Capitalization rate — a rate that expresses the relationship between income and value.

Possessory Interest Value = Economic Rent X Present Worth Factor (@ the Capitalization Rate for the Reasonable Term)

Cost Approach — In the cost approach the land value is estimated using the comparative sales or income methods and the reproducible property value is estimated by replacement cost new less accrued depreciation and less the present worth of the estimated value, if any, of such property at the termination of possession. The two components are added together to arrive at a total value for the possessory interest.

The valuation approach used will vary depending on the type of interest being valued and the estimated reasonable term of possession.

For specific information on a possessory interest assessment please contact the Assessor’s office.

The lien date for real property taxes is January 1 each year. The person in possession of the possessory interest on the lien date is liable for the entire subsequent fiscal year’s taxes. Unfortunately, no provision is made for the Assessor to prorate the taxes if the possessory interest is terminated after the lien date.

Delinquent taxes are immediately transferred to the unsecured roll and become an immediate lien on the lessee, not the property. This lien may be reflected on credit reports and may impede other real estate transactions of the lessee in California.