Tax Sale Property Primer for Idiots Tax Lien Certificates FAQ

Post on: 9 Апрель, 2015 No Comment

Click for Details about our Complete Tax Lien Course

Frequently Asked Questions

What is Tax Lien Certificates Network?

The Tax Lien Certificates Network is an online community of Investors and financial institutions that buy, sell, and trade property Tax Lien. We also offer a very affordable home-study course for individuals who want to quickly learn how to invest in tax lien and tax deeds.

How much interest does a tax lien pay?

When you purchase property Tax Certificates. you are guaranteed a fixed return on your investment. In fact, if you choose to purchase your tax-defaulted paper from a particular state, your return may be as high as 50%. Although most states pay less than 50%, your investment is always secured with real property. So, as long as due diligence is a major part of your process, your investment is never at risk.

Are there any risks associated with tax lien investing?

It is important to remember the element of risk involved in the purchase of tax liens. If you purchase lien properties under the control of the Federal Deposit Insurance Corporation (FDIC) and those affected by the Drug Enforcement Administration (DEA) could possibly result in the loss of your investment. That’s why our training course was designed to teach you how to conduct your own investigation and reduce the possibility of loss.

Will the Government allow me to deduct the travel cost if I go out of state to purchase tax lien certificates?

If you start a Tax Lien Investing business, the U.S. Government will allowed to write off a number of home office business expenses. We recently wrote the Home Business Tax Benefits Guide to explain all the details.

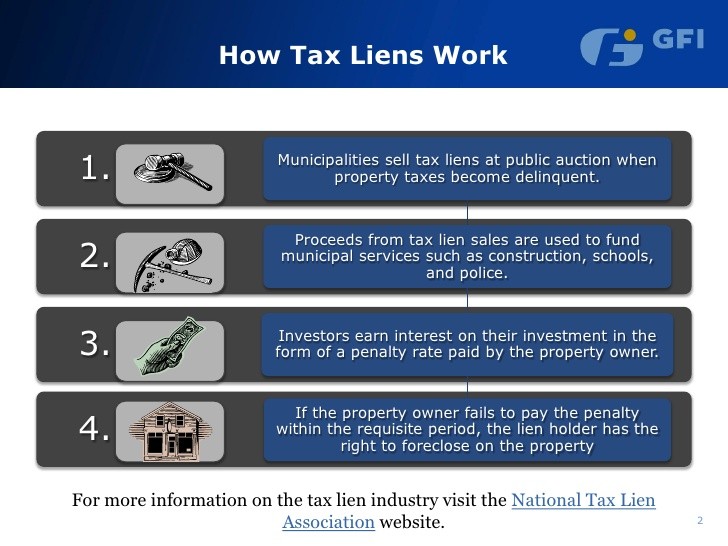

What is a Tax Sale?

The legal process of selling property for the unpaid taxes is commonly called Tax Sale or Tax Auction. Regardless to the name given, the sale is held at a time, place and location ordered by the Court and it is a public auction.

How can I learn about public tax lien auctions?

We sell an e-book with a free video tape that completely covers tax lien auction process. If you would like to get a better idea of what to expect at a tax lien auction, you should consider this material. For new investors who need additional help, we also provide a FREE Tax Sales Investors White Paper.

Will I get my money back if the property is redeemed?

If property is redeemed, the purchaser will receive his or her purchase money back (ie: amount paid at tax sale) plus interest on the tax lien certificate based on the price paid at the tax sale.

Which county sells the most tax liens ?

Arizona’s Maricopa county is the largest U.S. county that sell Tax Certificates. The Maricopa county recorder, county assessor, and county treasurer have excellent online resources for researching tax lien properties.

If I purchase a Tax Lien Certificate, do I own the property?

No. You own a note on the property, for a specified redemption period, and earn interest for each month the note remains outstanding. At the end of the redemption period you may request the deed to the property. The buyer has no legal claim or obligations during the redemption period.

How do I collect my interest payments?

If the property owner pays the government the outstanding taxes due before the certificate reaches maturity, the government will send to you your initial investment along with all outstanding interest due.

What happens if the property owner does not pay?

If you find yourself in that situation, you will have hit the lottery. The government will give you the deed to the underlying property, Free-and-clear. Tax Certificates are senior to all other mortgages and liens (including Federal tax liens ). This means you could realize a ROI of 10,000% or higher.

Once it is determined that I own the property, how do I take possession of it?

To insure that everything is in proper order, you should contact a Real Estate Attorney in the state where the property is locate and get his/her assistance. The Attorney will insure that the title is cleared and all required notifications are sent to interested parties.

Are the Tax Lien Certificate profits considered taxable income?

One of the biggest challenges facing all investors is keeping the profits generated by their investments. The publisher teamed up with securities expert Jeff Desich of Mid Ohio securities to bring you a step-by-step guide to realizing tax deferred even tax free returns.

I am a housewife, and my husband is desparate for us to have more income. Would investing in Tax Lein Certificates help us?

Yes, it would. Over twelve percent of our students are housewives and they are contributing significantly to the families’ financial security.

What if my question was not answered on this page?

If you purchase our Tax Lein Certificates investment course, you will also recieve a complimentary telephone consultation. This service is very popular with our customers.