Tax Credits Deductions Loopholes Breaks – Cutting Your Tax Bill

Post on: 24 Апрель, 2015 No Comment

Theyre called credits, deductions, exclusions, exemptions, subsidies or loopholes, but the official tax code syntax is income tax expenditures. Its a complicated way to refer to the legal reduction of money against which you are taxed. If you have $10,000 worth of deductions, thats $10,000 less that the government can tax.

Although most of the money saved from these breaks and subsidies comes from ones used by businesses – especially those given away by local and state governments – the ones that apply to individuals draw the most interest. Such credits and loopholes are grass-roots savings for single taxpayers and families every year.

The Congressional Research Service estimates there are more than 200 of them in the Internal Revenue Service (IRS) code and that they account for about $1.2 trillion in uncollected federal revenue each year. Had these deductions not existed at all in 2012, the U.S. Treasury would have doubled the amount of taxes it collected.

Tax Expenditures Have Supporters and Critics

For both individuals and businesses, governments use tax breaks and credits to support certain policies, such as supporting the creation of jobs by giving new businesses a tax break. Municipalities often employ them in place of taxing and direct spending but without the need to raise existing taxes or levy new ones. And because tax expenditures are excluded from the budget process, and give the appearance of a tax cut rather than a government expense, they tend to have strong political appeal.

For instance, the increased emphasis on green living often leads the federal government and state governments to award tax credits for homeowners who install solar-powered systems and for homeowners who spend money on energy-saving windows, insulation and appliances. Supporters of various corporate tax expenditures laud them as vehicles that encourage investment, help start new companies and create more jobs. Supporters of individual tax expenditures say they lower tax bills. thus allowing people to pay down their debts. save for the future, and invest in their homes and families.

But while tax expenditures have their champions, especially when they benefit a certain group or industry, they also have detractors. Some critics say that subsidizing a particular sector of the economy – or, in some case, even a specific company – by granting a targeted subsidy or credit is an unfair use of the tax code because it distorts the free market and props up uncompetitive businesses.

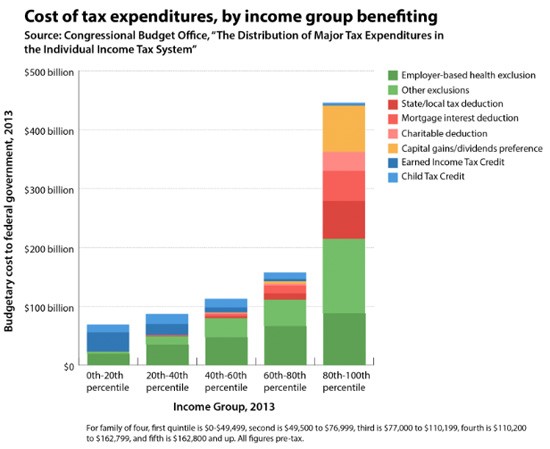

Others object because they say tax breaks and loopholes grant bigger subsidies to Americas wealthier individuals:

- Tax expenditures are the equivalent of giving $686 a year to the lowest 20 percent of the countrys income groups;

- $3,175 to those in the middle fifth;

- $30,714 to those in the upper fifth;

- And nearly $250,000 to families in the top 1 percent.

Not surprisingly, these breaks and credits are politically popular. And because each one represents a monetary savings for some group or special interest, once authorized, they are difficult to repeal.

For instance:

- If Congress tries to remove tax incentives for oil and gas exploration, the energy companies raise a ruckus;

- If lawmakers consider removing the home mortgage interest deduction, the real estate industry bears its teeth;

- If there’s a hint that Medicare benefits may lose their tax-exempt status, the AARP gets aggressive;

- And if there’s an attempt to reduce or cap the Earned Income Tax Credit, advocates for the poor accuse Congress of making war on children.

Individual Tax Expenditures

Individual taxpayers use a variety of tax expenditures to lower their tax bills. They are mostly classified as adjustments, deductions, exemptions and credits. The first ones a taxpayer a filer will see on the standard IRS 1040 form are the adjustments that can be made to total income.

Those include:

- Educator expenses for classroom teachers – up to $250

- Certain business expenses of reservists, performing artists, and fee-based government officials

- Contributions to a Health Savings Account (HSA)

- Moving expenses

- Mileage

- The deductible part of any self-employment taxes paid

- Contributions to a self-employment retirement plan

- Contributions to a self-employment health insurance plan

- Any penalty paid for an early withdrawal of savings

- Alimony paid

- Contributions to an Individual Retirement Account (IRA) – the maximum contribution is $5,000 ($6,000 for individuals over 50) subject to certain restrictions

- Interest paid on a student loan

- Tuition and fees paid for a dependent

- Certain domestic production activities

Each of these comes with a special set of requirements. Some are much easier to apply than others. But all of them help a taxpayer reduce reduce his adjusted gross income. Filers need to refer to instructions and specific IRS publications for details.

The next savings available is the standard deduction. Single taxpayers can claim $5,950; married and filing jointly or qualifying widow(er) filers can claim $11,900; head of household filers can claim $8,700.

Taxpayers eligible to itemize their deductions have more choices and can reduce their tax bills even further. The most popular tax expenditure for individuals who itemize is the mortgage interest deduction claimed by about one-third of all homeowners. In 2012, it saved them approximately $87 billion. Homeowners who itemize can also deduct the amount of property taxes they pay each year to local governments.

Itemizers also saved about $33 billion last year by deducting their state and local income taxes, and another $33 billion was saved by deducting their charitable contributions.

Once all of the deductions and exemptions are added up, they can be subtracted from the adjusted gross income to create a filers taxable income. This is the amount on which federal income taxes are paid.

However, the tax bill, itself, can then be further reduced by applying certain credits which include those for adopting a child, paying for child care services, being elderly or disabled, purchasing energy-efficient equipment for the home, buying an electric car, and paying any foreign taxes, among others.

Tax Expenditures for the Rich and the Poor

Even more tax subsidies exist for individuals at either end of the income spectrum. The Earned Income Tax Credit (EITC) was created in 1975 to help low to moderate working families and individuals. When the credit exceeds the amount of taxes owed, it can result in a tax refund or credit of up to $5,891 for those who qualify. In 2010, the EITC helped lift 3 million children out of poverty. Its a tax expenditure worth $58.4 billion per year.

The countrys richest citizens benefit greatly from the special low tax rate on capital gains, which is money earned on investments. For the past several years, it has been set at 15 percent considerably lower than the tax rates on income earned from employment. The rate increases to 20 percent in 2013, but is still considered a tax expenditure because it saves money for those whose income comes primarily from investments rather than paychecks.

Another tax savings for certain wealthy individuals is the low rate applied to what is known as carried interest, which is compensation paid to managers of private equity funds. In addition to any profits made from their funds investments, their management fees, instead of being taxed as ordinary income, qualify for the capital gains rate.

Corporate Tax Expenditures

One of the largest tax expenditures for corporate America is the exclusion of employer-sponsored health insurance. More than 60 percent of Americans get their insurance through their jobs, making this exclusion both widespread and expensive. In 2012, it cost the U.S. Treasury $171 billion in lost revenue, as companies were entitled to deduct the amount they spent on their employees health plans. The exclusion of employer pension benefits, such as contributions to 401(k)s and other retirement plans, is another annual corporate tax expenditure, worth about $138 billion.

A third large tax expenditure for businesses is the bonus depreciation credit that allows for the accelerated depreciation of certain types of machinery and equipment. Closing this loophole would bring in an estimated $582.7 billion by 2021, according to Congress Joint Committee on Taxation. Taxing overseas profits of multinational corporations would bring in a similar amount over the next decade, while ending the domestic production credit would net the Treasury an estimated $154.3 billion over 10 years.