Taking a look at IncomeGenerating Investments in a Rising Interest Rate Environment Fiscal

Post on: 25 Июль, 2015 No Comment

Taking a look at Income-Generating Investments in a Rising Interest Rate Environment

By The Money Management Editor

Money Management Newsletter — January 2005

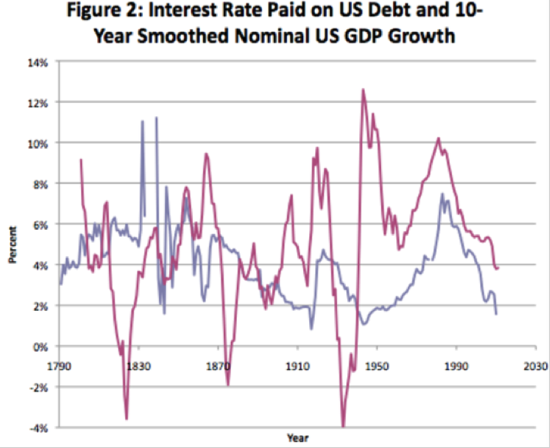

Income-generating investments are used to provide exposure to a variety of securities, as well as deliver income. In other words, an alternative to using only traditional GICs or bond funds to receive income. With interest rates at low levels many investors and some experts seem to agree that a period of moderately rising interest rates is not far off the horizon. Often the belief held is that income-generating investments such as bonds will be negatively impacted when interest rates start to rise. Here is something to consider.

The primary role of income-generating securities in most diversified portfolios is to reduce volatility through a low correlation to other investments. They also help generate an additional income stream, through frequent distributions, for investors wishing to supplement their current household income. However for investors who only want a portfolio of income producing investments, emphasis should be placed on diversifying the portfolio risk and broadening the income mandate by allocating funds to asset classes, such as dividend-paying equities, income trusts, preferred shares, high yield bonds and convertible debentures. The diversification benefits within these portfolios help reduce the impact of rising interest rates by adding securities that will react differently to interest rate movement. We examine some of them below.

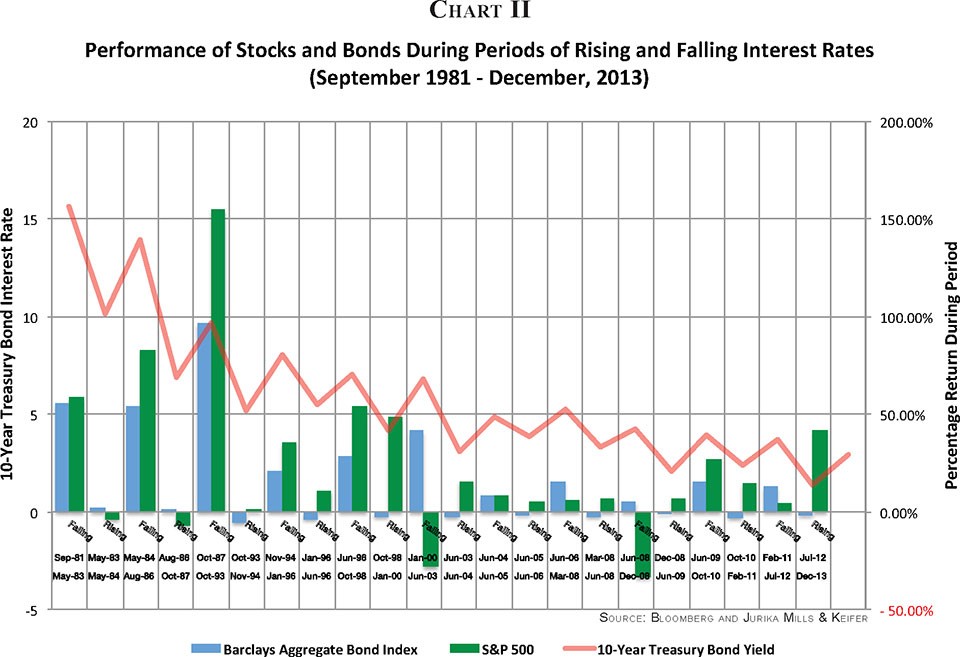

The role of bonds in a well-diversified portfolio is clear — they reduce the volatility of a portfolio. The inverse relationship between bonds and interest rates can be simplified to say that the value of a bond will increase when rates fall and decrease when rates rise. However, one must always remember that bonds pay out coupon income, which means that the loss on the value of a bond during rising interest rates is always cushioned by its coupon. Interest rate increases must be substantive in a short period of time to diminish the marginal effect of the coupon on the actual bond valuation. As well most portfolio managers will actively manage the bond terms within their portfolios, increasing or decreasing the average term to adjust to expected changes in interest rates.

While high-yield bonds may be categorized as bonds, these investments can play a significant role in an investor’s portfolio, not just because of their higher coupon but also as a strategic element of diversification. For example, in the U.S. market, investment grade, corporate bonds have had a high correlation to U.S. Treasuries while lower grade, high-yield bonds, have been much more closely correlated to U.S. Equities. This is because the higher yield on the bond is related to the less desirable financial characteristics of the issuing company as well as the prevailing interest rate environment. Therefore investors who purchase these higher risk bonds are much more attuned to any changes in the direction of the stock market that will impact the financial outlook of the bond issuer. As such the bond prices will fluctuate with stock market changes as well as prevailing interest rate movements.

Convertible Debentures express no correlation with investment grade bonds, preferred shares and/or income trusts and have a very low correlation with high yield bonds. This is due to the debenture’s lack of sensitivity to interest rates. A convertible bond is made up of two components, a straight bond plus a call option. If interest rates rise, it impacts the straight bond, but helps the call option because higher rates means higher option valuations. And if rates rise in response to a positive economy and higher stock markets, this further helps the call option. So this would be the only fixed income sub asset class that is the most sensitive to stock markets, but at less risk.

Dividend-paying securities and income trusts add additional layers of diversification to the portfolios. The valuations of these asset classes are dependent on the types of businesses represented. Income trusts are high yield equities whose underlying businesses flow through distributable cash-flow in a tax-efficient manner. Their sensitivity to interest rates will vary depending on the type of trust with utility and real estate trusts more sensitive than business and resource trusts. Dividend-paying securities are appealing because of the dependable income stream they can provide. In a rising rate environment, often coupled with favourable economic conditions, many industries and in turn individual companies will benefit and thus the share value will rise. Similar to bond coupons, dividends act as a cushion against stock market losses.

Preferred shares are hybrid securities that provide some of the attributes of bonds and common equities. Like bonds, preferred shares commit to a regular fixed payment but their market value will fluctuate with the performance of the company and the stock market in general. The higher fixed dividend offered by preferred shares helps to offset market downturns.

To learn more about this or similar investment products, consult a professional investment advisor. Mutual funds are sold by prospectus only. The information within this website is subject to our Mutual Fund Investments and Statutory Sales Disclosure Information .

With files from Dynamic Mutual Funds